Quality Growth

Large-cap, dividend paying, blue-chip companies with financial strength, high profitability, earnings predictability and low debt-to-equity ratios.

Overview

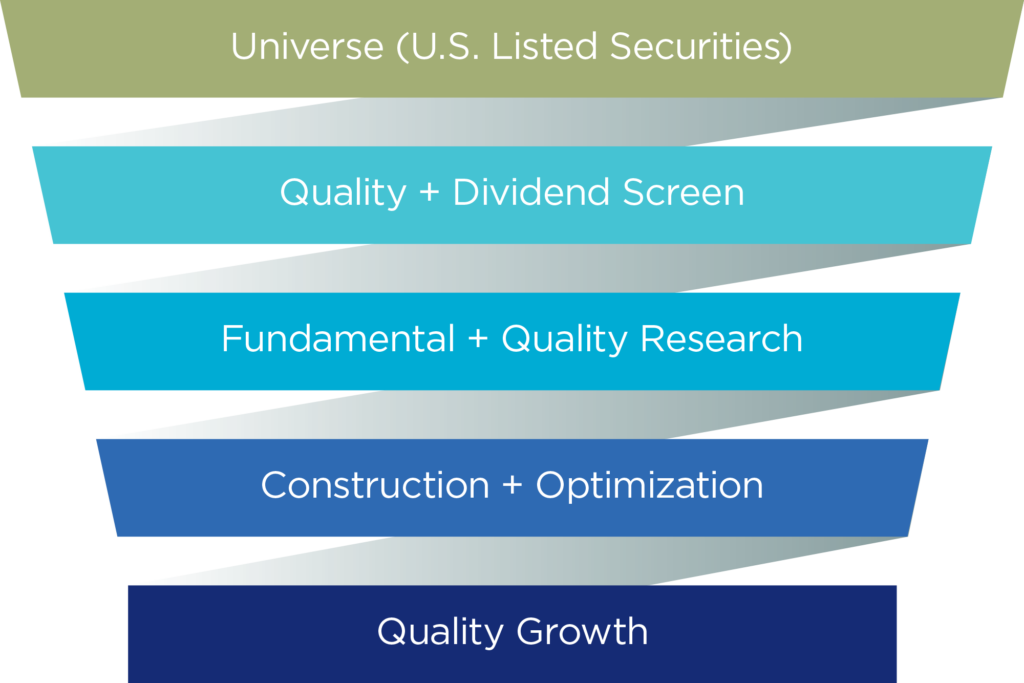

The Quality Growth Portfolio consists of 25-35 stocks selected through a rigorous quality screening process from among a universe of over 300 stocks. We choose companies for the portfolio based on superior financial strength, above-average and consistent earnings growth, regular and growing dividend payments and a strong competitive position.

Investment Philosophy

Investment Process

Portfolio Characteristics*

Characteristic |

Haverford |

S&P 500 |

|---|---|---|

| Financial Strength | A+ | B |

| Earnings Predictability | 82 | 65 |

| Average Market Cap ($Billion) | 551 | 882 |

| Projected EPS Growth (5 Years) | 9.9% | 14.1% |

| Historical EPS Growth (5 Years) | 10.6% | 7.1% |

| Hist. Dividend Growth (5 Years) | 9.2% | 5.5% |

| Dividend Yield | 1.7% | 1.3% |

| Price to 2024 Earnings | 21.7 | 20.6 |

Sector Allocation*

Characteristic |

Haverford |

S&P 500 |

|---|---|---|

| Communication Services | 0.0 | 8.91 |

| Consumer Discretionary | 11.49 | 10.46 |

| Consumer Staples | 9.75 | 6.06 |

| Energy | 2.52 | 3.80 |

| Financials | 19.99 | 12.98 |

| Health Care | 18.59 | 12.68 |

| Industrials | 12.00 | 8.68 |

| Information Technology | 24.01 | 29.58 |

| Materials | 1.59 | 2.31 |

| Real Estate | 0.0 | 2.35 |

| Utilities | 0.07 | 2.20 |

Top-Ten Holdings*

| Microsoft |

| Apple |

| Mastercard |

| BlackRock |

| Accenture |

| Costco |

| JPMorgan |

| Lowe’s |

| Oracle |

| RTX Corporation |

Notes

* Based on recommended portfolio weights. Portfolio Characteristics, Sector Allocation and Holdings are subject to change at any time based on market or other conditions.

The S&P 500 is for comparative purposes only. The S&P 500 is a capitalization-weighted index, calculated on a total return basis with dividends reinvested. The S&P 500 is an unmanaged index with no expenses, which covers 500 industrial, utility, transportation, and financial companies of U.S. markets. It is not possible to invest directly in an index.

Disclosure

All Data as of March 31, 2024. The information presented should not be construed as investment advice or recommendations with respect to specific securities presented and may not represent the holdings or weighting of any particular portfolio.