Tim Hoyle, CFA, Co-Chief Investment Officer

thoyle@haverfordquality.com

Do the Strong Jobs Numbers Mean the Recession is Over?

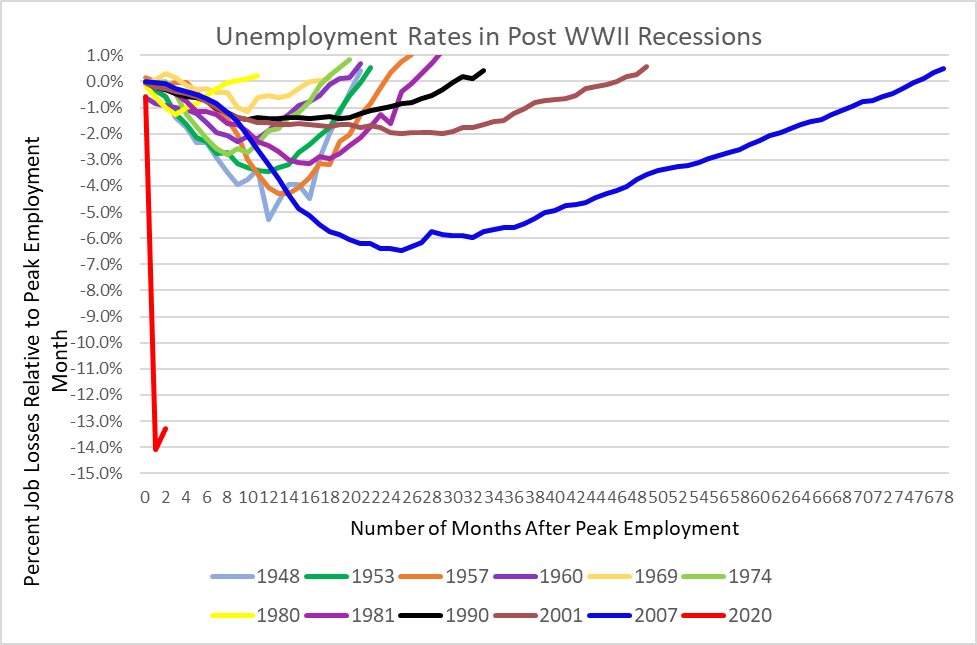

On Friday, June 5th, the Bureau of Labor Statistics (BLS) released the May 2020 Employment Situation. The report massively exceeded expectations, showing employment rose by 2.5 million jobs in May versus an expected loss of over 8 million jobs. The unemployment rate also fell. The BLS acknowledged that these figures are overly optimistic (i.e. wrong) due to errors in the data gathering, but the market cares less about specificity and more about direction. The directional trend of the May jobs report hinted that the worst of the Great Lockdown is now behind us.

Last week, Mark Zandi of Moody’s Analytics predicted that the COVID-19 recession is now over. This statement was made before Friday’s jobs report and based on preliminary employment data reported by payroll provider ADP. Mr. Zandi’s prediction could very well prove to be correct. Historically, employment figures have tended to be a trailing indicator of economic performance, as employment gains often only return months following the economic inflection point.

Source: FactSet Research Systems, Haverford Trust

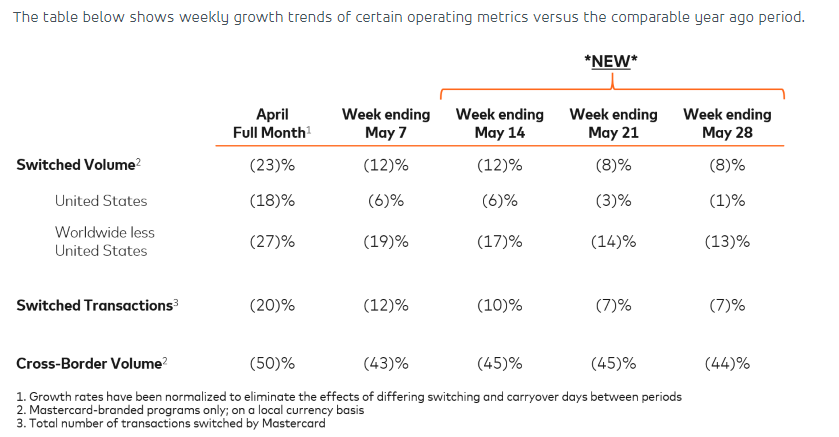

The pandemic-nature and almost immediate decline in unemployment has no historical precedent, so we are hesitant to draw conclusions from one data point. But we are seeing empirical evidence that leads us to believe we have experienced the worst of the economic numbers. We devoted last week’s Havercast to just this issue. Yesterday, June 8th, Mastercard posted additional data supporting the view that economic activity is showing almost incremental weekly improvement following the lockdown.

Source: MasterCard

At Haverford, we expect the initial economic numbers following the Great Lockdown will be as outstanding on the upside as they were depressing on the downside. But following the initial rebound, we believe the economy, employment, and earnings will still be operating below 2019 levels well into 2021.