Tim Hoyle, CFA, Co-Chief Investment Officer

thoyle@haverfordquality.com

The Fed Can’t Reopen Factories, But They Can Help Facilitate a Comeback

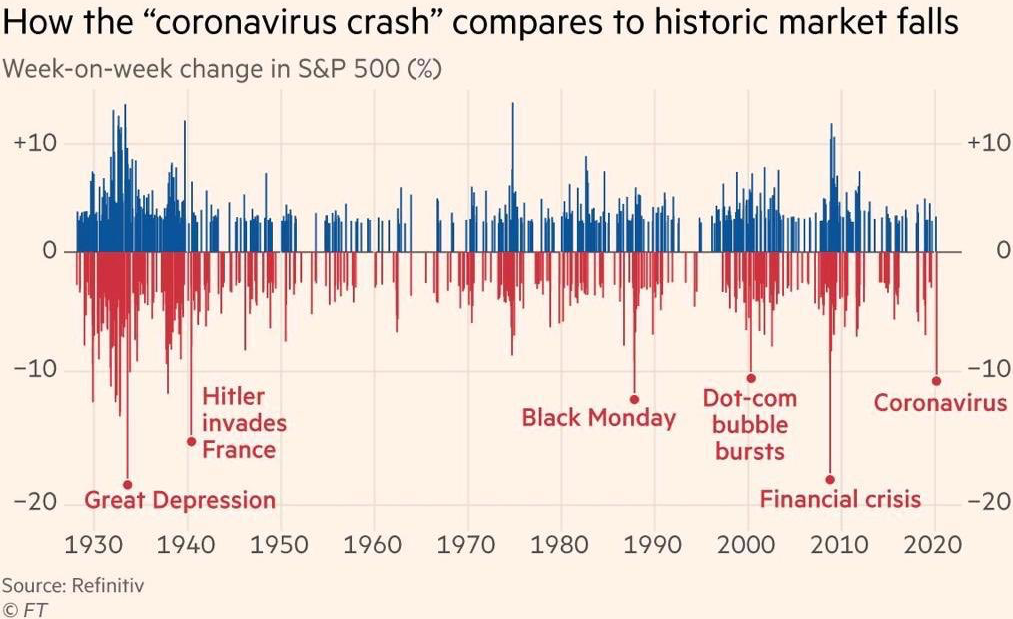

Last week’s decline in the markets was historic. The one-week change was on par with events such as Black Monday in 1987 and the bursting of the dot-com bubble in 2000. Markets reacted violently to the realization that there is still so much we don’t know about COVID-19. We don’t know how many are infected and just have mild symptoms. We don’t know its true mortality rate. We do know the “cure” is putting a major dent in economic activity. Stock and bond prices are telling us that all our economic assumptions for 2020 are now irrelevant. Earnings will be much lighter than expected on a global GDP number that could turn negative during the first half of 2020 before rebounding.

The Coronavirus Crash Rivals Historic Market Falls

Source: Refinitiv, Financial Times

But at this point, following that market’s reaction, much of the negative news and fear of the unknown is backward looking. The market will not bottom on good news; it will likely have rebounded significantly by the time the good news is disseminated. Our base case remains that six months from now the fears of this virus will be in the rearview mirror. We are the first to admit that we are not epidemiologists, but we are students of history. We are confident that human ingenuity will develop a vaccine and our health system is robust and adaptive.

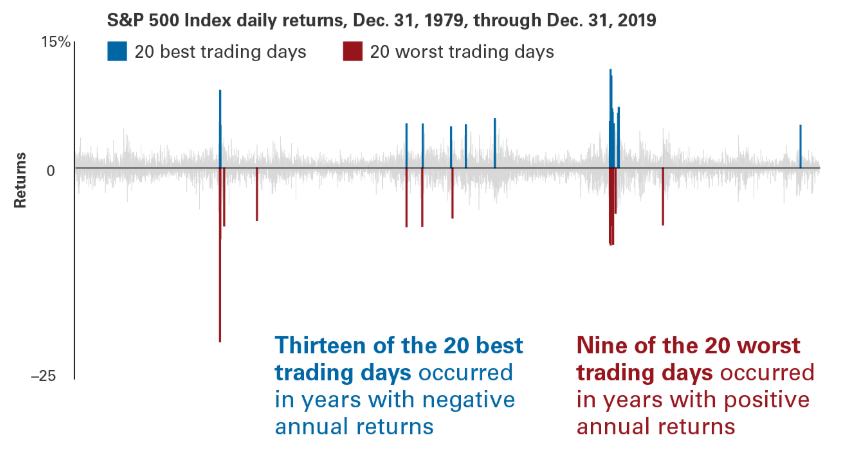

We expect a heightened level of volatility as we learn more about the virus’ spread. We just experienced the negative side of volatility. There is also a positive side to volatility during which markets experience dramatic increases. Often, steep declines and dramatic rises are clustered, which is one reason why it is so difficult to time the market.

The S&P 500’s Best and Worst Days Historically Happened Close Together

Source: Vanguard

We speculate that both monetary and fiscal moves could provide the catalyst for a market rebound. The Federal Open Market Committee (FOMC) is scheduled to meet on March 18th. As of now, the markets are telling the Fed that monetary policy is too tight. We expect the FOMC to cut rates by 50 basis points, exceeding the consensus outlook for a 25-basis point cut. We also believe there is a high likelihood it occurs before their regularly scheduled meeting later this month. A rate cut won’t cure COVID-19, but it will let the business community know that while the FOMC can’t reopen factories, they will act decisively to facilitate a comeback. We also expect that the White House will seriously consider rescinding some tariffs on Chinese goods. Again, this will not cure the virus, but will grease the skids for an economic rebound as virus fears wane.

The Bond Market is Telling the Fed that Monetary Policy is Too Tight