Last Week:

- U.S. equities finished positive for the week: Last week, the Dow Jones Industrial Average (Dow) gained 426 points, or rose 1.67%, to 25,929. The Standard & Poor’s (S&P500) index increased 34 points, or rose 1.20% to 2,834. The Nasdaq closed 1.13% higher at 7,729 while the 10-year Treasury ended the week at 2.41%. Last week also marked the end of the first quarter, with equity markets making a strong rebound fueled by the sharp “dovish” turn from the Fed, better than expected earnings, and optimism around a China-U.S. trade resolution. During the quarter, the S&P 500 rose 13%, the Dow rose 12%, and the Nasdaq rose 16%.

- Economic Summary: Last week, the Commerce Department revised down real Gross Domestic Product (GDP) growth for the fourth quarter down to 2.2%, from the +2.6% estimate released earlier. Although the growth rate during the fourth quarter is still strong, it is at a much slower pace compared to the +3.4% during the third quarter and +4.2% during the second quarter. The final GDP reading is now in line with expectations and leaves the full year growth rate at +2.9%. The downward revision was driven by weaker consumer spending and nonresidential fixed investment than previously estimated during the quarter. Corporate profits were effectively flat sequentially after two quarters of robust growth and six quarters of positive growth. Consumer spending which accounts for two-thirds of U.S. economic activity was revised down to +2.5% from the +2.8% estimate–a relatively robust number nonetheless. For 2019, many economists continue to expect economic growth, although a moderation from 2018 levels with the Federal Reserve predicting +2.1% GDP growth for the year.

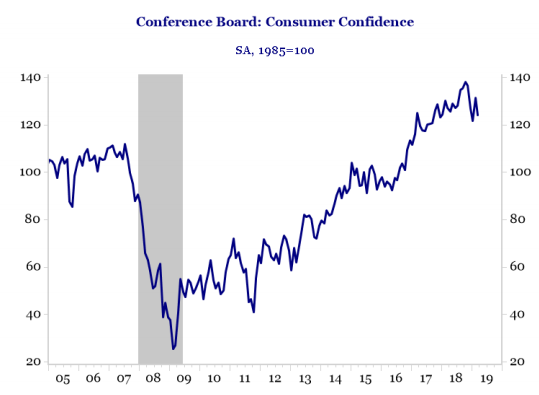

- During the week, we also saw the Conference Board’s measure of U.S. Consumer Confidence post a decline in March mainly driven by pessimistic views of the current business and labor market conditions. With the index currently at 124.1, consumer confidence is definitely down from the post-recession peak in October of 137.9, signaling that optimism may be waning, but still remains at elevated levels.

Source: The Conference Board, Strategas Research Partners

Look Ahead:

- The corporate calendar will be relatively quiet this week, with a handful of companies reporting earnings. Notable reporters include GameStop, Walgreens Boots Alliance, Acuity Brands, and Constellation Brands, among others. There will also be a number of broker conferences and investor meetings during the week.

- On the economic calendar, we will see Purchasing Managers Index (PMI) data for March, Retail Sales data for February, Construction Spending data, Durable Goods data, ADP’s National Employment Report for March, and the March Jobs Report. Outside the U.S., it will be a relatively quiet week with Chinese and Euro-zone PMI data out during the week.