Last Week:

- U.S. equities finished negative for the week: Last week was another volatile week for equity markets as fears of a potential trade war between the U.S. and China continued to plague equity markets. On the week, the Dow Jones Industrial Average (Dow) lost 170 points, or fell 0.71%, to 23,933. The Standard & Poor’s (S&P500) index lost 36 points, or fell 1.38%, to 2,604. The Nasdaq closed 2.10% lower at 6,915, while the 10-year Treasury ended the week at 2.78%.

- March Job’s Report: On Friday, the Labor Department reported nonfarm payrolls rose a seasonally adjusted 103,000 in March, below expectations of 180,000 jobs. Although below February’s 326,000 job additions, this was the 90th consecutive month of job additions extending the longest job expansion streak on record and bringing the average payroll additions for Q1 to 202,000. The unemployment rate remained at 4.1%, while average hourly earnings rose 2.7% year over year in line with recent annual gains. Although economists continue to expect inflation to edge up (driven by fiscal spending & bigger deficits, low unemployment, higher oil prices, etc), reaccelerating inflation does not mean “run-away” inflation.

Source: Bureau of Economic Analysis

Look Ahead:

- Earnings releases will pick up in the back half of the week with Q1 reporting season kicking off with Blackrock, JP Morgan Chase, Wells Fargo, and PNC Bank among others.

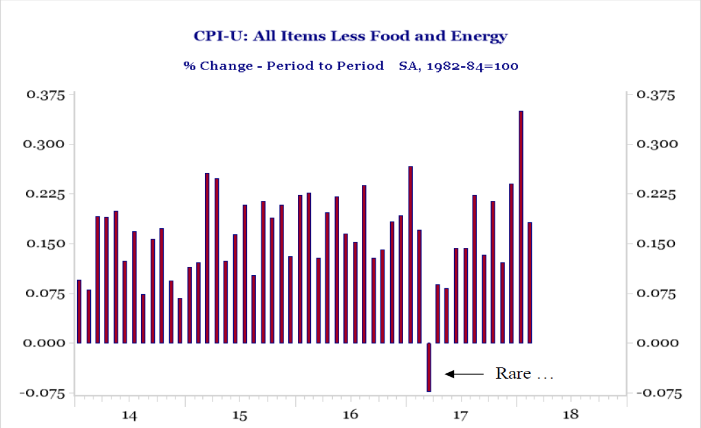

- The economic calendar should be relatively slow. Domestically we will see Producer Price Index (PPI) data on Tuesday and Consumer Price Index (CPI) data on Wednesday. The U.S. CPI number this week should see easy year over year comps as March 2017 saw a headline number decline of -0.2% m/m and a rare core CPI (ex-food and energy) decline of -0.1% m/m.

- The Federal Open Market Committee (FOMC) meeting minutes will be published on Wednesday.

- Internationally, we will see German trade balance on Monday, China CPI and PPI on Tuesday night/Wednesday morning, Euro-zone Industrial production on Thursday and China Trade balance on Friday.