Last Week:

- U.S. equities finished mixed for the week: Last week, the Dow Jones Industrial Average (Dow) lost 149 points, or fell 0.6%, to 25,313. The Standard & Poor’s (S&P500) index decreased 7 points, to 2,833. The Nasdaq closed 0.4% higher at 7,839, while the 10-year Treasury ended the week at 2.86%.

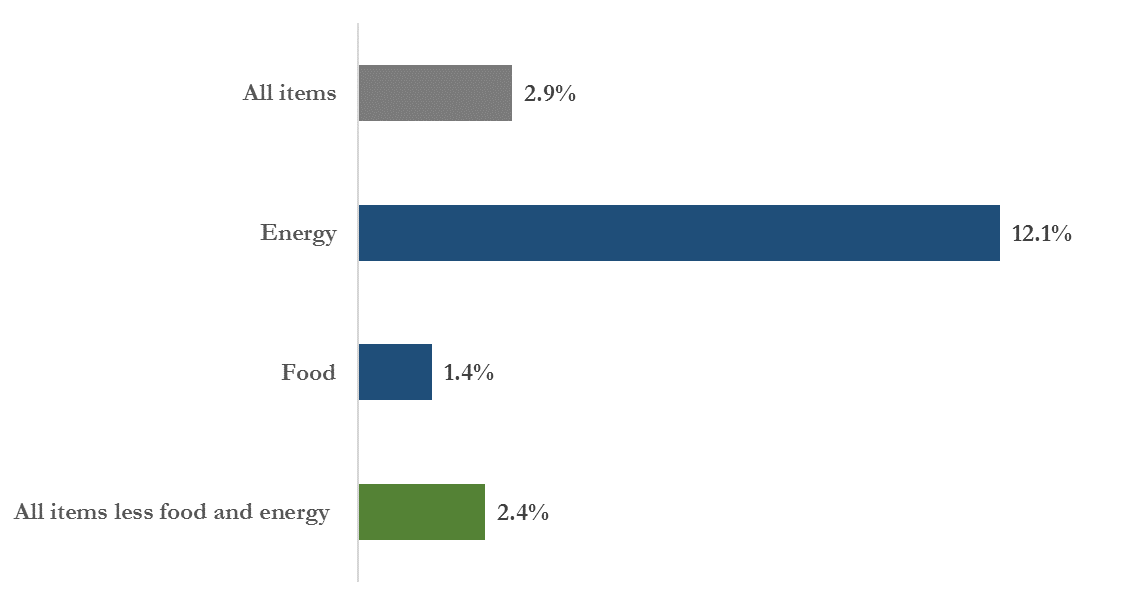

- U.S. Inflation: Last week, The Bureau of Labor Statistics reported U.S. inflation as measured by the Consumer Price Index (CPI) increased +0.2% in July and +2.9% year over year. Core CPI (CPI ex food and energy) increased +0.2% in July, and +2.4% in the last 12 months, marking the largest 12-month increase since September 2008. The underlying trend remains a steady buildup in inflationary pressure (although not runaway inflation), pointing to the Fed continuing on its gradual rate hike path. Although the Fed’s formal guidance is calling for two rate hikes for the remainder of 2018, investor expectations are for one hike at the September meeting and a 50% chance of a hike in December.

12-Month % Change, Consumer Price Index, Selected Categories*

*Source: Bureau of Labor Statistics; Not Seasonally Adjusted; As of July 2018

Look Ahead:

- Second quarter earnings will continue to wind down this week, with earnings releases expected from Advance Auto Parts, Home Depot, Tapestry, Wal-Mart, and Cisco among others.

- On the economic calendar, important data releases include Small Business Optimism Index, July Retail Sales, Second Quarter Labor Productivity and Costs, August Housing Market Index, July Housing Starts, and the Leading Economic Index for July. Outside the U.S, we will see China Retail Sales, Industrial Output, Foreign Direct Investment, as well as Eurozone Industrial Production and GDP Data.