Last Week:

- U.S. equities finished mixed for the week: Worries of financial and currency turmoil in Turkey took the Turkish lira down 22% last Monday, struggling to recover and ending the week down 5.9%. In the U.S., the Dow Jones Industrial Average (Dow) gained 356 points, or rose 1.4%, to 25,669. The Standard & Poor’s (S&P500) index increased 17 points, to 2,850. The Nasdaq closed 0.3% lower at 7,816, while the 10-year Treasury ended the week at 2.87%.

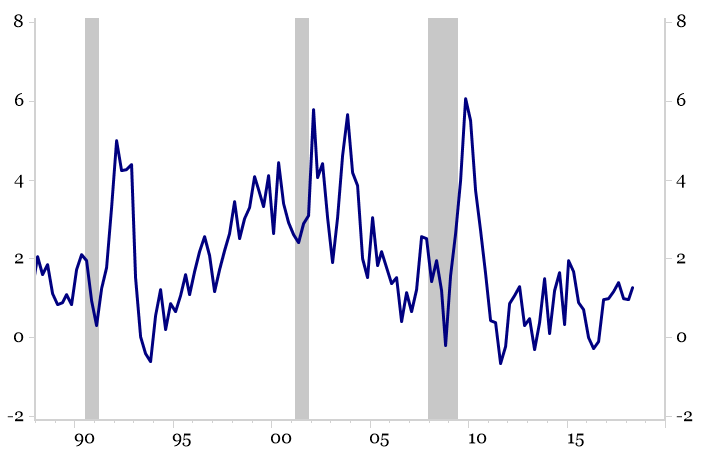

- U.S. Productivity Improving: Last week, the Bureau of Economic Analysis reported U.S. productivity rose a solid +2.9% annualized rate sequentially during the second quarter, although that only brought the last 12-month growth rate to +1.3% annualized. After revisions, U.S. productivity has been +2.2% at an annualized rate on average since 1947 and could continue to increase as U.S. capex continues to recover. This is important because, in theory, stronger productivity keeps a lid on unit labor costs, helping support corporate profits even in an environment where wages are rising.

Non-Farm Business Sector: Real Output Per Hour of All Persons, % Change (Y/Y), Seasonally Adjusted, 2012=100

Source: Bureau of Economic Analysis

Look Ahead:

- Second quarter earnings will continue to wind down this week, with earnings releases expected from Lowe’s, TJX Companies, Target, Medtronic, and Gap, Inc. among others.

- On the economic calendar, it will be a relatively slow week. Notable data releases include Housing data, Federal Open Market Committee (FOMC) meeting minutes (Wed), and U.S. Purchasing Managers’ Index (PMIs – Thurs). U.S.-China trade negotiations will take place (Wed & Thurs). Finally, the Kansas City Fed Symposium will take place starting Thursday through Saturday in Jackson, WY.