On Friday, The Standard & Poor’s (S&P 500) index closed in negative territory for the fourth straight week thanks to the hither and thither China trade negotiations. This morning, President Trump indicated the Chinese called not once, but twice, offering to come back to the negotiating table. Chinese representatives have denied the calls occurred. Both sides are attempting to frame the public perception in their favor in order to save face. The markets reacted favorably this morning, although at some point we would expect the market to stop reacting to talk and start demanding results. The Chinese Yuan is trading at 7.14 relative to the U.S. dollar this morning, well below the level that spooked markets just three weeks ago

At Jackson Hole Wyoming on Friday, the Federal Reserve Chairman Powell spoke with a dovish tone: “The three weeks since our July FOMC meeting have been eventful, beginning with the announcement of new tariffs on imports from China. We have seen further evidence of a global slowdown, notably in Germany and China. Geopolitical events have been much in the news, including the growing possibility of a hard Brexit, rising tensions in Hong Kong, and the dissolution of the Italian government. Financial markets have reacted strongly to this complex, turbulent picture. Equity markets have been volatile. Long-term bond rates around the world have moved down sharply to near post-crisis lows. Meanwhile, the U.S. economy has continued to perform well overall, driven by consumer spending.”

Another rate cut is very likely in September. The Fed Funds rate is too tight relative to long-term rates, too tight relative to global yields, and too tight for a trade war. Economic fundamentals are weaker versus when rates were increased last year. Will the Federal Reserve surprise the market with a 50 basis points cut? We don’t think so. The Federal Reserve still views the outlook for the U.S. economy as favorable despite business investment and manufacturing weakening. Solid job growth and rising wages have been driving robust consumption and supporting moderate growth overall.

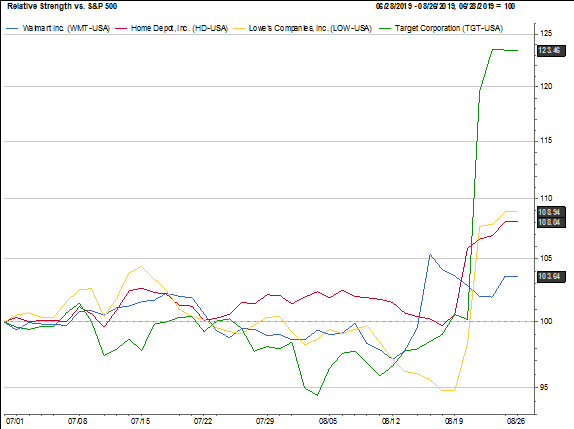

The consumer’s strength was evident in the numerous earnings reports provided by retailers last week. The July-end retail earnings season was a solid one and produced huge post-earnings rallies in Home Depot (HD), Lowes (LOW), Target (TGT), and Walmart (WMT). These companies are increasingly dominating general-purpose retail while mall-based and department stores suffer from a lack of consumer traffic.