Last Week:

A significant amount of news supported the markets’ move to all-time highs on Friday. The Dow Jones industrials finished the week up 1.33%, with the Standard & Poor’s 500 and Nasdaq advancing 0.9% and 1.41%, respectively. Passage of the tax bill became more certain and is expected to be passed by the House on Tuesday and Senate on Wednesday. We believe the tax plan will provide a significant boost to corporate profits in 2018 and fuel increased economic growth. How much real economic growth is the only question. The economy has never suffered a recession with corporate profits rising.

As widely anticipated, the Federal Open Market Committee raised short-term interest rates a ¼ point to 1.5% at Janet Yellen’s last meeting as chair. We continue to anticipate the Fed will raise rates three times in 2018. Despite turnover at the FOMC, we expect Jerome Powell to maintain the course set by Janet Yellen.

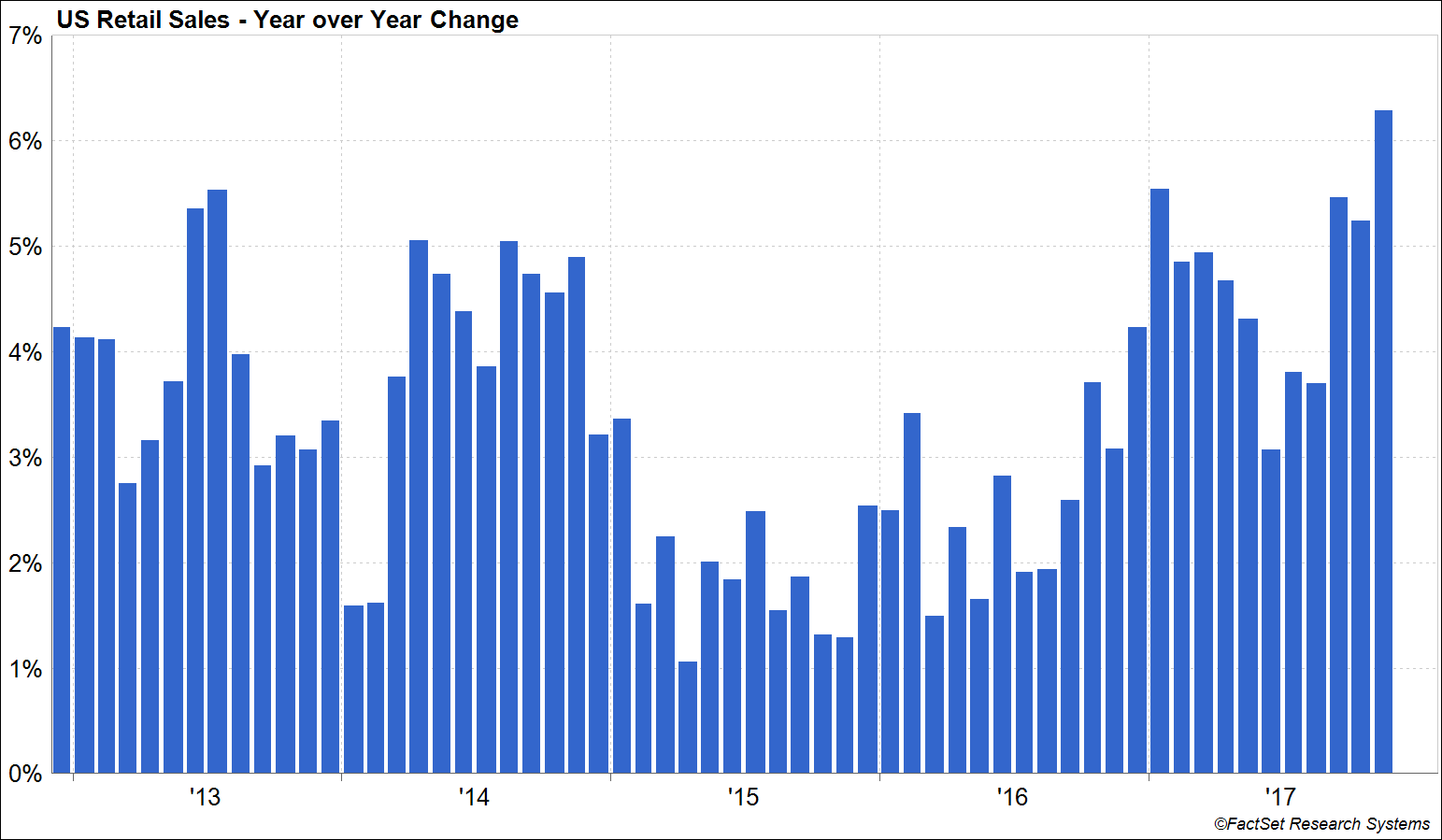

The economy is strong and getting stronger. U.S. retail sales increased in November, rising +0.8% month over month. October sales were also revised higher. Retail sales are up 6.3% year-over-year, and up 3.5% after adjusting for inflation. The Purchasing Managers Index, a measure of manufacturing rose from 53.8 to an 11-month high of 55, while the Services Index fell to a 15-month low of 52.4. The National Federation of Independent Businesses small business optimism index also surged again in November.

After a protracted and contentious proxy battle, Procter & Gamble has agreed to add Trian’s Nelson Peltz to their board of directors. We believe Peltz will be a positive agent for continued change at the company as they navigate changing consumer preferences.

Look Ahead:

Congress must take action to avert a government shutdown.