U.S. equities continue to rally, with the Dow Jones Industrial Average (Dow) hitting new highs last week, crossing the 27,000 mark, and the S&P 500 crossing 3,000 for the first time, as investors reacted positively to Fed Chair Jerome Powell’s testimony to Congress. On the week, the Dow rose 1.5%, to 27,332 and the S&P500 rose 0.8% to 3,014. The Nasdaq closed 1.0% higher at 8,244, while the 10-year Treasury ended the week at 2.10%.

During the Federal Reserve Board’s (Fed) semi-annual testimony to Congress, Fed Chair Jerome Powell signaled a July interest rate cut despite the recent “positive” developments surrounding the U.S./China trade tensions and the strong June Jobs Report. According to Powell, “Many FOMC participants saw that the case for a somewhat more accommodative monetary policy had strengthened,” which translates to potentially lower rates. He went on to say that “uncertainties around trade tensions and concerns about the strength of the global economy continue to weigh on the U.S. economic outlook.” The markets continue to price in very aggressive rate cuts, with over 50% odds for 100bps cut by mid-2020 priced in to the futures markets. Although Powell didn’t fully tackle this during his testimony, a critique of a rate cut is the Fed potentially using valuable ammunition for managing a downturn and also what a rate cut means for asset price inflation.

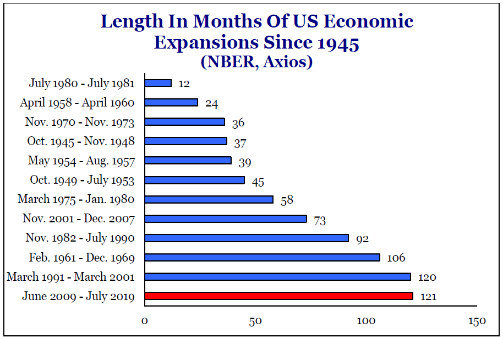

Although July marks the longest economic expansion since 1945— clocking 121 months since the last recession—economists believe it hasn’t been the most robust, with Gross Domestic Product (GDP) growing at a modest 2%-2.5% pace over the last decade. The American consumer remains strong and continues to drive 70% of economic growth, unemployment is at multi-decade lows, and wage growth remains steady, above 3%. All these factors bode well for inflation, which has remained in the “not too hot, not too cold” territory, between 1.5% to 2%. During his testimony, Powell acknowledged the U.S. economy is “in a good place,” with the baseline outlook for GDP growth to remain “solid,” the labor market to remain “strong,” and inflation to hit the 2% target. He pushed back against the characterization of the labor market as too hot. “While we hear lots of reports of companies having a hard time finding qualified labor, nonetheless we don’t see wages really responding,” he said.

Although July marks the longest economic expansion since 1945— clocking 121 months since the last recession—economists believe it hasn’t been the most robust, with Gross Domestic Product (GDP) growing at a modest 2%-2.5% pace over the last decade. The American consumer remains strong and continues to drive 70% of economic growth, unemployment is at multi-decade lows, and wage growth remains steady, above 3%. All these factors bode well for inflation, which has remained in the “not too hot, not too cold” territory, between 1.5% to 2%. During his testimony, Powell acknowledged the U.S. economy is “in a good place,” with the baseline outlook for GDP growth to remain “solid,” the labor market to remain “strong,” and inflation to hit the 2% target. He pushed back against the characterization of the labor market as too hot. “While we hear lots of reports of companies having a hard time finding qualified labor, nonetheless we don’t see wages really responding,” he said.

As second quarter earnings season kicks off this week, the expectation is for S&P500 Q2 earnings to modestly decline. The big banks will get earnings season going with Citigroup already reporting mixed earnings this morning. 56 S&P 500 companies will report this week, with 122 companies reporting next week and another 121 reporting the following week. We will also see China’s second quarter GDP, along with retail sales and some industrial production metrics. In the United States, we will see retail sales and Michigan Consumer Confidence numbers, among others.