Last Week:

- U.S. equities finished mixed for the week: Last week, the Dow Jones Industrial Average (Dow) gained 39 points, or rose 0.2%, to 25,058. The Standard & Poor’s (S&P500) index was essentially unchanged, increasing 1 point, to 2,802. The Nasdaq closed 0.1% lower at 7,820, while the 10-year Treasury ended the week at 2.89%.

- Fed Chairman Jerome Powell’s Testimony: Last Tuesday, Chairman Powell reaffirmed previous Fed communications in his testimony, commenting, “With a strong job market, inflation close to our objective, and the risks to the outlook roughly balanced, the FOMC believes that—for now—the best way forward is to keep gradually raising the federal funds rate.” On the balance sheet, Powell estimates three to four years to reach their long-term target. With that said, so far the Fed is meeting their goal of gradually reducing the balance sheet without disrupting financial markets.

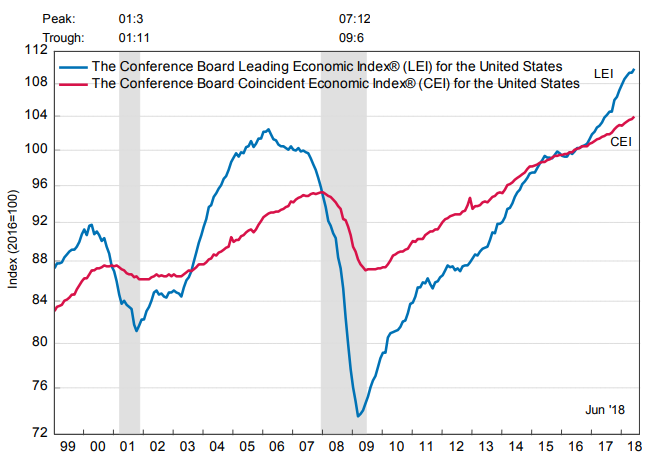

- U.S. Leading Economic Indicators: The Conference Board’s Leading Economic Indicators Index for the U.S. rose 0.5% during the month of June, following no change in May, and April’s 0.4% increase. The June numbers support the narrative of a strong U.S. economy experiencing solid continuing growth. According to the Conference Board, the widespread growth in leading indicators with the exception of housing permits, which declined once again, does not suggest any considerable growth slowdown in the short term. The Board’s Coincident Economic Index (CEI), a measure of current economic activity, increased 0.3%, with the Lagging Economic Index also increasing 0.3% during the month..

U.S. Composite Leading Economic Indicators Index (2016 = 100)

Source: The Conference Board

Look Ahead:

- This week will be largely dominated by second quarter earnings releases, especially on Thursday. Notable reporters include United Technologies, Verizon, Kimberly-Clark, Coca-Cola, UPS, Baxter, Comcast, MasterCard, Starbucks, Chevron, and Exxon among others.

- On the economic calendar, we will see existing home sales, Federal Housing Finance Agency home price index, flash Purchasing Managers Index (PMIs), durable goods orders, and preliminary second quarter U.S. Gross Domestic Product (GDP). Abroad we will see Euro-zone PMI and M3 money supply, Germany IFO Business Climate Index, the European Central Bank Refinance rate, Japan’s trade balance, and Tokyo’s Consumer Price Index.