Last Week:

- U.S. equities finished positive for the week: Last week, the Dow Jones Industrial Average (Dow) gained 185 points, or rose 0.76%, to 24,456. The Standard & Poor’s (S&P500) index increased 41 points, or gained 1.5%, to 2,760. The Nasdaq closed 2.37% higher at 7,688, while the 10-year Treasury ended the week at 2.83%.

- June Jobs Report: On Friday, the Labor Department reported nonfarm payrolls rose a seasonally adjusted 213,000 in June, above expectations. The unemployment rate rose to 4%, in line with expectations as the labor force participation rose to 63%. Average hourly earnings remain contained at +0.2% in June and +2.7% y/y. More than half of the S&P 500’s rally this week (+1.5%) came after the jobs report on Friday, signaling investor confidence in the continued strength of the American economy.

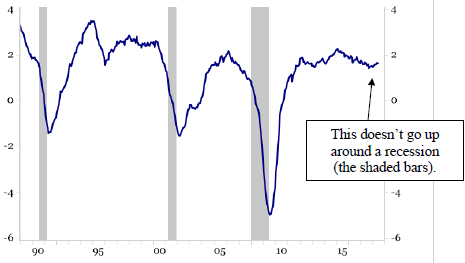

All Employees: Total Nonfarm Payrolls (% Change Year-over-Year)

Source: Bureau of Labor Statistics, Strategas Research Partners

Look Ahead:

- Second quarter earnings season will begin as banks start to report on Friday. Notable reporters include J.P. Morgan, Citigroup, Wells Fargo, PNC, and First Republic Bank.

- On the economic calendar, we will see Consumer Credit on Monday, Producer Price Index (PPI) and Consumer Price Index (CPI) out on Wednesday and Thursday, and ending the week with Import / Export Price Index on Friday. Abroad, China will report currency reserves and CPI / PPI on Monday and trade balance on Friday. In Europe, we will see the German trade balance on Thursday, ZEW Economic sentiment on Tuesday, and Euro-zone Industrial Production on Thursday.