Last Week:

U.S. equities tread water for the week: On the week, the Dow Jones Industrial Average (Dow) rose 0.4%, to 26,090. The Standard & Poor’s (S&P500) index rose 0.5% to 2,887. The Nasdaq closed 0.7% higher at 7,797 while the 10-year Treasury ended the week at 2.09%.

The several key economic data points released last week, in aggregate, painted a picture of a still growing U.S. economy. Retail sales are up 3.2% year-over-year and industrial production advanced 0.4% in May, up 2.0% versus the prior year. The Producer Price Index (PPI), which measures price changes from a producers’ perspective, increased 1.8% annually, slightly short of expectations. Benign measures of inflation could allow the FOMC to implement an “insurance cut” later this year designed to extend the domestic economic expansion, keep the yield curve normal, and respond to weakening global conditions.

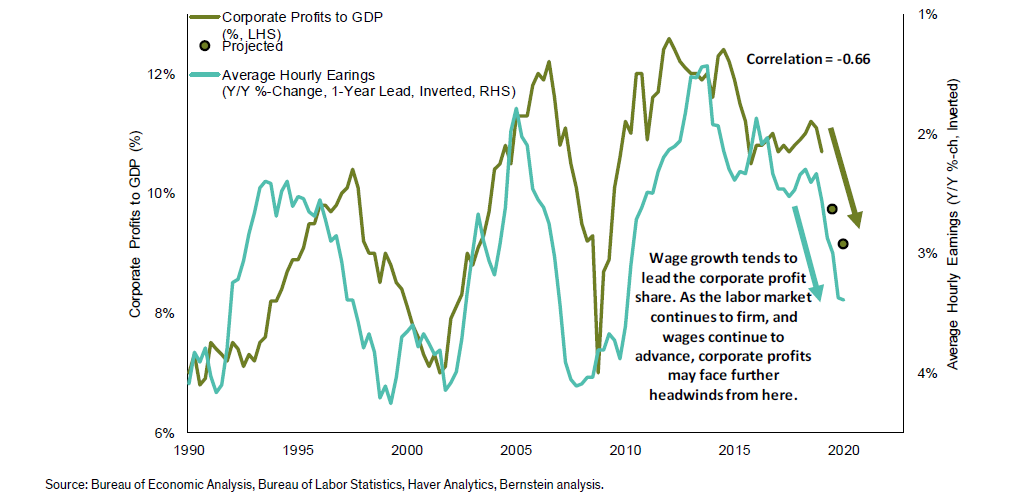

We often write about the seemingly unstoppable American consumer. Strong job growth, increased labor participation, low credit costs, and improving asset prices all yield increased consumer spending. Consumer spending represents over 70% of GDP. As the consumers’ share of the economy increases it has the added benefit of dampening the economic cycle. The only missing ingredient had been wage growth. That too has become more positive over the past two years. Wage growth above 3% is a welcome development for American workers. An analysis completed by Bernstein research shows that rising wages will be a headwind to corporate profits in the coming year. We believe moderating profits is a price worth paying for a healthy consumer.

Bernstein estimates that current wage growth in the 3.3% range suggests that corporate profits as a percent of GDP could fall 150 basis points over the next year, to 9.2%.

Source: Bernstein Research

Look Ahead:

The FOMC meets this week. It is widely expected that the committee will set the stage for a possible “insurance” rate cut in July or September.