LAST WEEK:

- U.S. equities finished negative for the week: The Dow Jones Industrial Average (Dow) lost 576 points, or fell 2.22%, to 25,413. The Standard & Poor’s (S&P500) index decreased 45 points, to 2,736. The Nasdaq closed 2.15% lower at 7,248, while the 10-year Treasury ended the week at 3.07%.

- Economic Data Recap: Last week, The Bureau of Labor Statistics reported U.S. inflation as measured by the Consumer Price Index (CPI) increased +0.3% in October and +2.5% over the past 12 months, a slight uptick from the +2.3% annualized number we saw last month. The gasoline index was responsible for over one-third of the seasonally adjusted increase during the month, with advances in the shelter, used car and trucks, and electricity indexes also contributing. Core CPI (CPI ex-food and energy) increased +0.2% during the month, and +2.1% over the past 12 months, slightly below September’s 2.2% reading. Although inflation appears to have picked up slightly from the last reading, the underlying trend remains a steady buildup in inflationary pressure (although not runaway inflation), pointing to the Fed continuing on its gradual rate hike path.

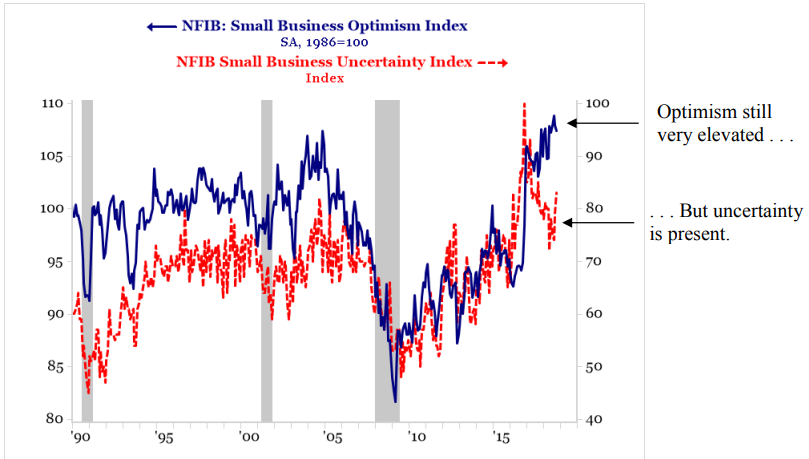

During the week, we also saw the National Federation of Independent Business (NFIB) Small Business Optimism Index remain near historical highs (107.4) despite all the cyclical headwinds including larger US tariffs, higher interest rates, dwindling labor supply, and higher inflation among others.

Source: Strategas Research Partners, National Federation of Independent Business

Look Ahead

- Third quarter earnings season will continue to wrap up this week. Some notable reporters include L Brands, Best Buy, Campbell Soup, Medtronic, Foot Locker, Lowe’s, Ross Stores, Target, TJX Companies, and Gap Inc. among others.

- On the economic calendar, we will see National Association of Home Builders (NAHB) Housing Market Index for November on Monday, The Census Bureau’s October New Residential Construction data on Tuesday, Durable goods orders (Wed), Existing Home sales (Wed), October Leading Economic Index (Wed), Jobless Claims (Wed) and Flash Purchasing Managers’ Index (PMIs) on Friday. Outside the U.S., on Monday we will see Japan trade balance data, UK Confederation of British Industry (CBI) industrial trends, with Euro-zone consumer confidence on Thursday and Flash PMI for the Euro-zone and Germany on Friday

- U.S. markets are closed for Thanksgiving on Thursday, while Friday will see a shortened Trading day with stock markets closing at 1 p.m. while bond markets close at 2 p.m.