Last Week:

- U.S. equities finished positive for the week: The Dow Jones Industrial Average (Dow) gained 583 points, or rose 2.36%, to 25,271. The Standard & Poor’s (S&P500) index increased 64 points, to 2,723. The Nasdaq closed 2.65% higher at 7,357, while the 10-year Treasury ended the week at 3.23%.

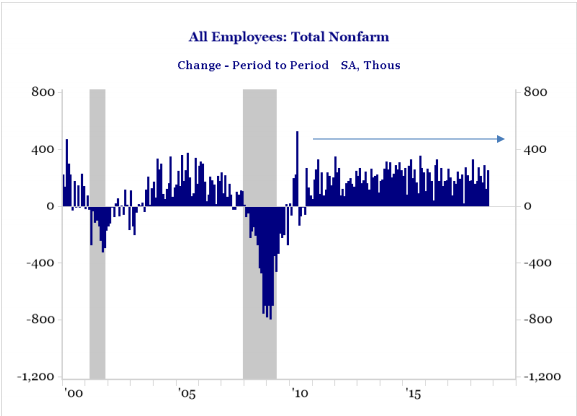

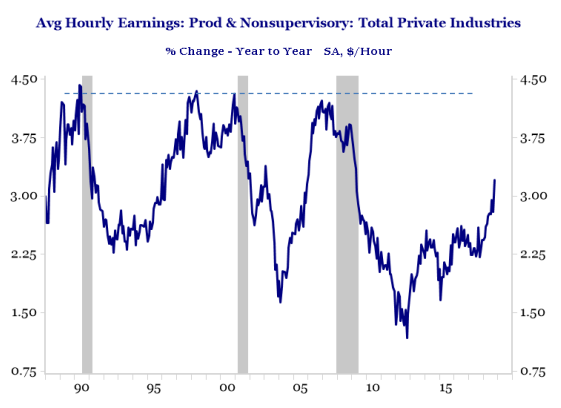

- October Jobs Report: Last week, the Bureau of Labor Statistics reported that the U.S. economy added 250,000 jobs in October, well ahead of expectations of 190,000 jobs. The unemployment rate remained unchanged at 3.7% (~50-year low), with broad based job gains led by healthcare, highlighting the continued strength of the U.S. labor market. The highlight of the report was the wage growth of +3.1% year over year, the best rate since 2009. Overall, the strong jobs report provides support for the Fed to continue on its tightening path, albeit cautiously.

Source: Strategas Research Partners, Bureau of Labor Statistics

Source: Strategas Research Partners, Bureau of Labor Statistics

Look Ahead:

- Third quarter earnings season will continue this week with notable reporters including Becton, Dickinson and Company, CVS Health, Air Products and Chemicals, Emerson Electric, QUALCOMM Inc., Johnson Controls, and Walt Disney, among others.

- On the economic calendar, we will see Markit PMIs reported early in the week with eyes on the Federal Open Market Committee (FOMC) meeting on Thursday—consensus expectations are for the federal-funds rate to remain at the current 2-2.25%. We will also see the Job Openings and Labor Turnover Survey for September, Producer Price Index (PPI) for October, and the University of Michigan Consumer Sentiment Survey during the week. Internationally, we will see trade balance data from China Wednesday night/Thursday morning.

- U.S. Mid-term elections will take place on Tuesday, November 6, 2018