Last Week:

- U.S. equities finished mixed for the week: The Dow Jones Industrial Average (Dow) lost 285 points, or fell 1.07%, to 26,458. The Standard & Poor’s (S&P500) index decreased 16 points, to 2,914. Meanwhile, the Nasdaq closed 0.74% higher at 8,046, while the 10-year Treasury ended the week at 3.06%.

- NAFTA Update: Last night, after several months of negotiations, the three countries (Canada, Mexico, and the United States) finally came to an agreement on the terms of the revised North American Free Trade Agreement. Key changes include updates to account for technological changes, such as the internet and the digital economy, as well as changes to bring more automobile production back to North America. In line with the initial bilateral deal with Mexico, to qualify for zero tariffs under the new pact, car companies would be required to manufacture at least 75% of an automobile’s content in North America (vs. the current 62.5% requirement). In addition, companies will be required to use more local steel, aluminum, and auto parts and have at least 40-45% of auto content made by workers earning at least $16 per hour. The new trilateral pact will be known as United States-Mexico-Canada Agreement (USMCA) and will proceed through the approval process for the three countries.

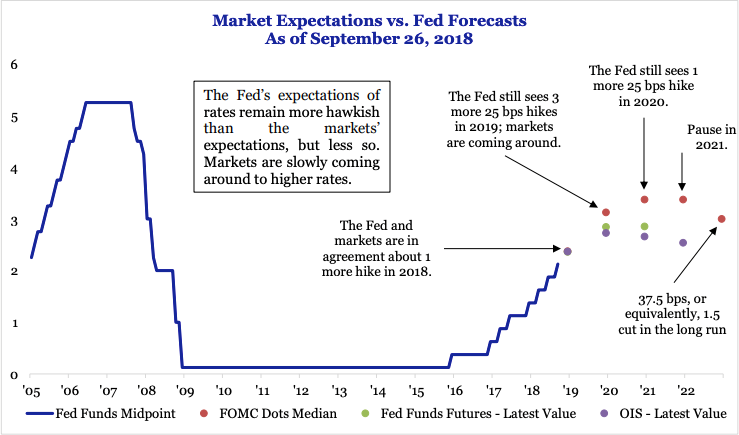

- Fed Decision: Last week, the Federal Open Market Committee (FOMC) decided to raise the Federal Funds Rate by 25bps to 2.00-2.25% in a widely anticipated move. Although the Fed removed the language describing U.S. monetary policy as “accommodative” from the press release, this was widely anticipated, and Fed Chair Jerome Powell emphasized the change reflected the reality that rates were approaching normal levels. The median Fed dot forecasts through 2020 didn’t change, leaving one rate hike for the remainder of the year, three for 2019, and one for 2020. There was a new forecast for 2021, which showed a pause in rates.

Source: Strategas Research Partners, FOMC, Bloomberg

Look Ahead:

- The week ahead will be relatively quiet on the corporate calendar with some notable earnings releases from Pepsi, Paychex, Constellation Brands, and Costco Wholesale, among others. In addition, there will be a number of investor/analyst meetings and conferences during the week.

- On the economic calendar, we will see Purchasing Managers Index (PMI) data in the U.S. and Europe, with U.S. trade balance and the September U.S. Jobs report at the end of the week. Chinese markets will be closed all week for a local holiday.