Despite paying close attention to the stock market, most investors don’t have a detailed plan for growing and managing their money.

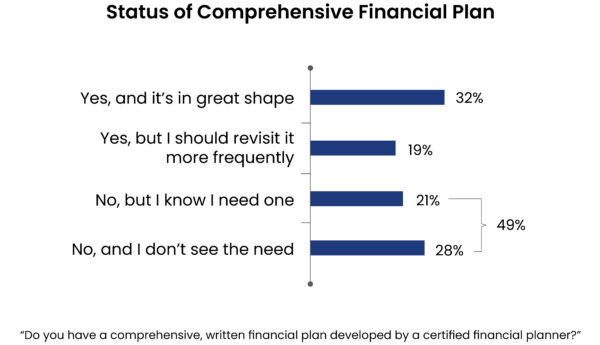

Just three in 10 investors said they have a comprehensive wealth strategy or financial plan developed by a professional that is in great shape, according to a recent Philadelphia Business Journal survey, commissioned by The Haverford Trust Company. Another two in 10 have a plan but say they need to revisit it more frequently.

“People are often reluctant to find out how much they need to have saved for retirement and other life events,” said Joseph McLaughlin, CEO of Radnor-based investment management and wealth strategies firm The Haverford Trust Company. “They’re concerned they don’t have enough.”

A total of 216 people participated in the survey and the research took place in the first quarter of 2022. The respondents represented a variety of ages, but skewed over 50, with 2% younger than 30, 9% ages 31 to 40, 8% ages 41 to 50, 24% ages 51 to 60, 35% ages 61 to 70 and 22% over 70. Approximately three out of four were men.

Knowledge is power, McLaughlin said. By creating a comprehensive plan, investors can make better decisions about how to reach their goals, such as saving for their children’s or grandchildren’s college education, traveling in retirement and other more fundamental needs.

“Creating a really good financial plan is like weighing in at your doctor’s office,” McLaughlin said. “You don’t want to lie to your doctor about your health. The same thing is true with your wealth management advisor. You want to come clean and reveal as much as possible because that assures you that you’ll be able to reach your goal.”

Lack of a comprehensive financial plan does not mean investors aren’t active in managing their money. The majority said they are highly involved in their household finances, and nearly three out of four consider themselves knowledgeable about finances.

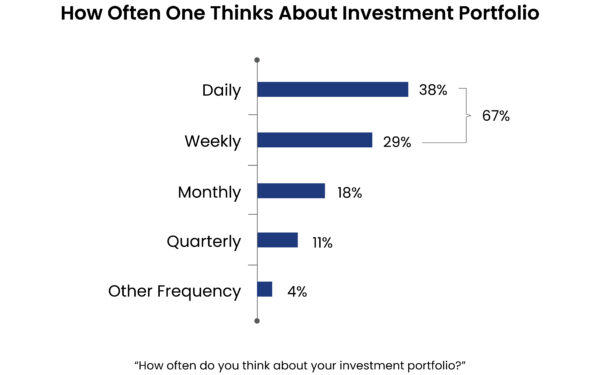

They also think about their investments often. Two-thirds reported thinking about their portfolio at least weekly, with 38% thinking about it daily. However, that may be more often than necessary, McLaughlin said.

“When you turn on the television, most of the commentators are selling the volatility and creating angst,” he said. “That’s not a good formula for success. It might cause an investor to look at their portfolio more frequently, which can result in making an emotional decision. But if you look at it monthly, that’s probably enough. If you meet with your advisor a couple of times a year to check in on how you’re doing with your goals and how your portfolio is positioned, it can give you peace of mind.”

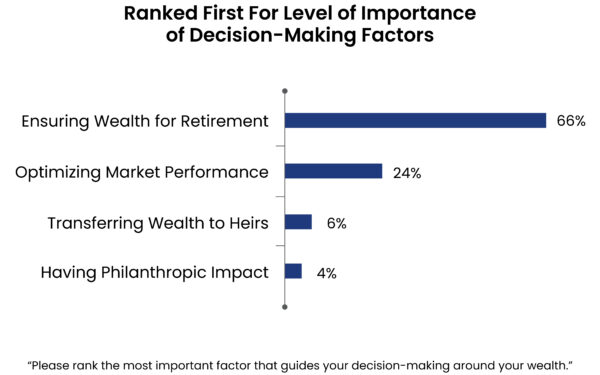

Most investors polled say they make decisions they believe will ensure wealth for retirement. Others do so to optimize market performance, transfer wealth to their heirs or make a philanthropic impact.

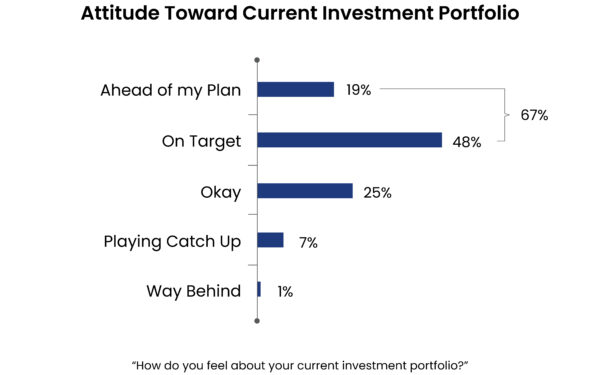

Most investors surveyed seem satisfied with where they stand today. Two-thirds said their portfolio is on target or ahead of plan. For the other third, McLaughlin recommends creating or updating their financial plan with a professional partner who can help ensure proper asset allocation.

“When we mention asset allocation, we’re talking about how much you have in stocks, bonds and, importantly, cash in a money market account or other highly liquid vehicle,” McLaughlin said. “The cash component is really important. You don’t want to be selling your longer-term assets, such as bonds and stocks, in a downturn like we experienced in the second quarter of 2022.”

Stocks, bonds and money market accounts aren’t the only places investors are putting their money. More than half of the survey participants have invested in real estate, and 20% plan to do so in the next three years. When it comes to popular investment categories, real estate far outpaces other types of alternative investments, such as private markets, infrastructure, hedge funds, commodities and cryptocurrencies.

The key for investors is to find the right mix of assets to best support the goals in their financial plans and adjust as needed over time without getting too concerned over short-term volatility, McLaughlin said. It’s actually not unusual for the S&P 500 to drop by 5 to 10% at some point in a given year.

“In our planning, we make conservative assumptions about future growth,” he said. “You have to incorporate what the market has historically done with how volatility is affecting the portfolio today.

“You shouldn’t be invested in stocks unless you understand that there may be a bear market every few years. While all investments carry some degree of risk, historically investors have been rewarded for accepting volatility risk,” McLaughlin said.

This content was published in partnership with Philadelphia Business Journal. To see the original article, click here.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value