A few years ago, Binney Wietlisbach was sitting in a meeting when her assistant knocked on the door and delivered an urgent message. A long-time client had called and said they needed to speak with her about a family emergency.

The president of The Haverford Trust Company stepped out of the meeting and answered the phone. The couple was having a disagreement over whether they should sell their house. Wietlisbach talked them through the financial plan they had been working toward for the past 10 years and helped diffuse their tension and fear to reach a decision.

“And that’s what we try to do for all of our clients,” she said. “We want to be that trusted advisor. We want to be that first call.”

It’s not often a wealth manager gets emergency calls. Still, when they serve as trusted advisors, a wealth manager can — and should — be the first person an investor calls in some situations. A wealth manager takes the burden of managing money off a client’s shoulders.

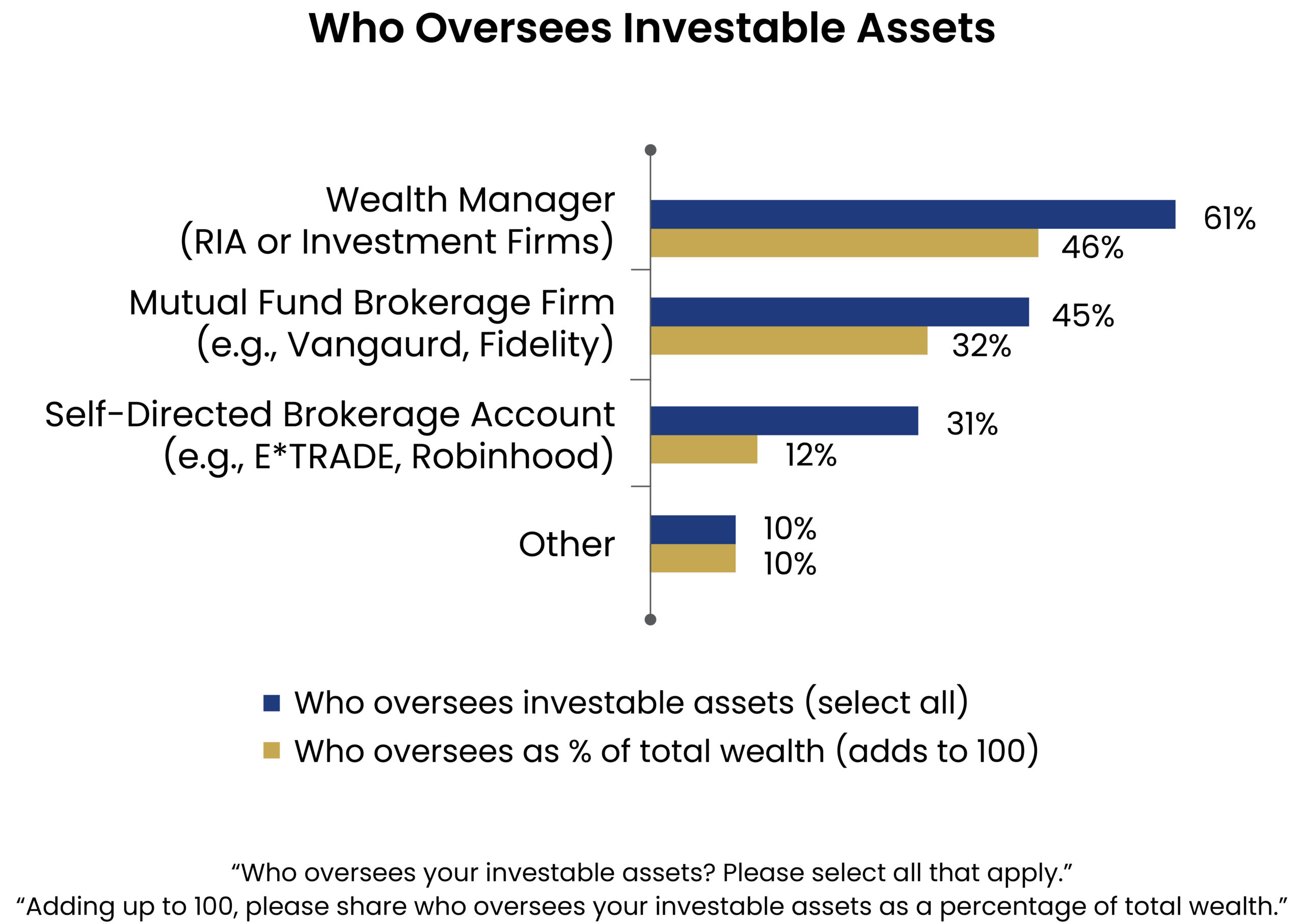

Many investors are operating without this assistance choosing to go it alone or shoulder more of the decision-making burden. Just six of 10 investors said they work with a wealth manager, according to a recent Philadelphia Business Journal survey, commissioned by Radnor-based investment management and wealth strategies firm The Haverford Trust Company.

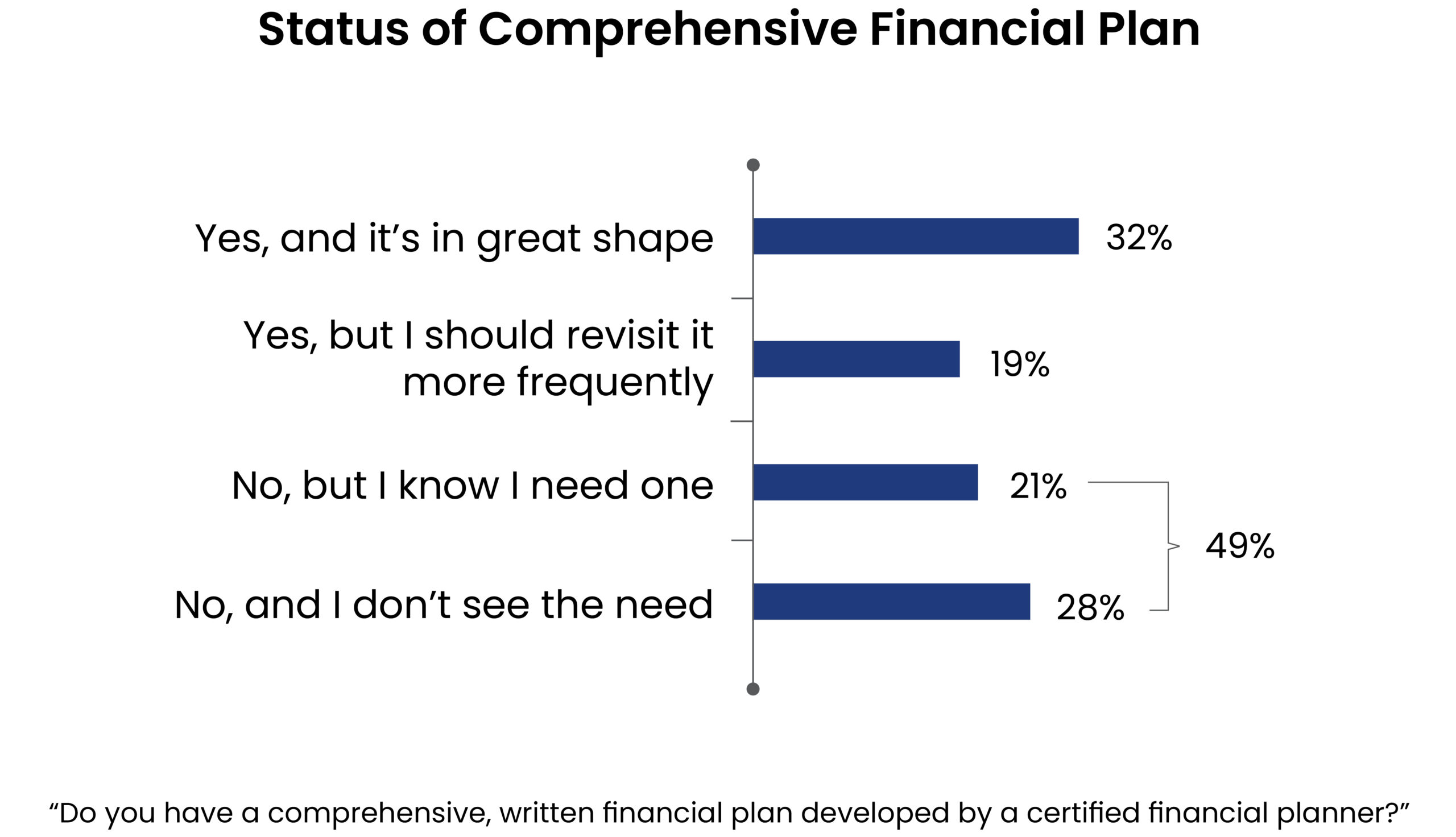

Half said they don’t have a comprehensive financial plan or wealth strategy developed by a professional, leaving them exposed to emotional stimulus and working harder to make each decision.

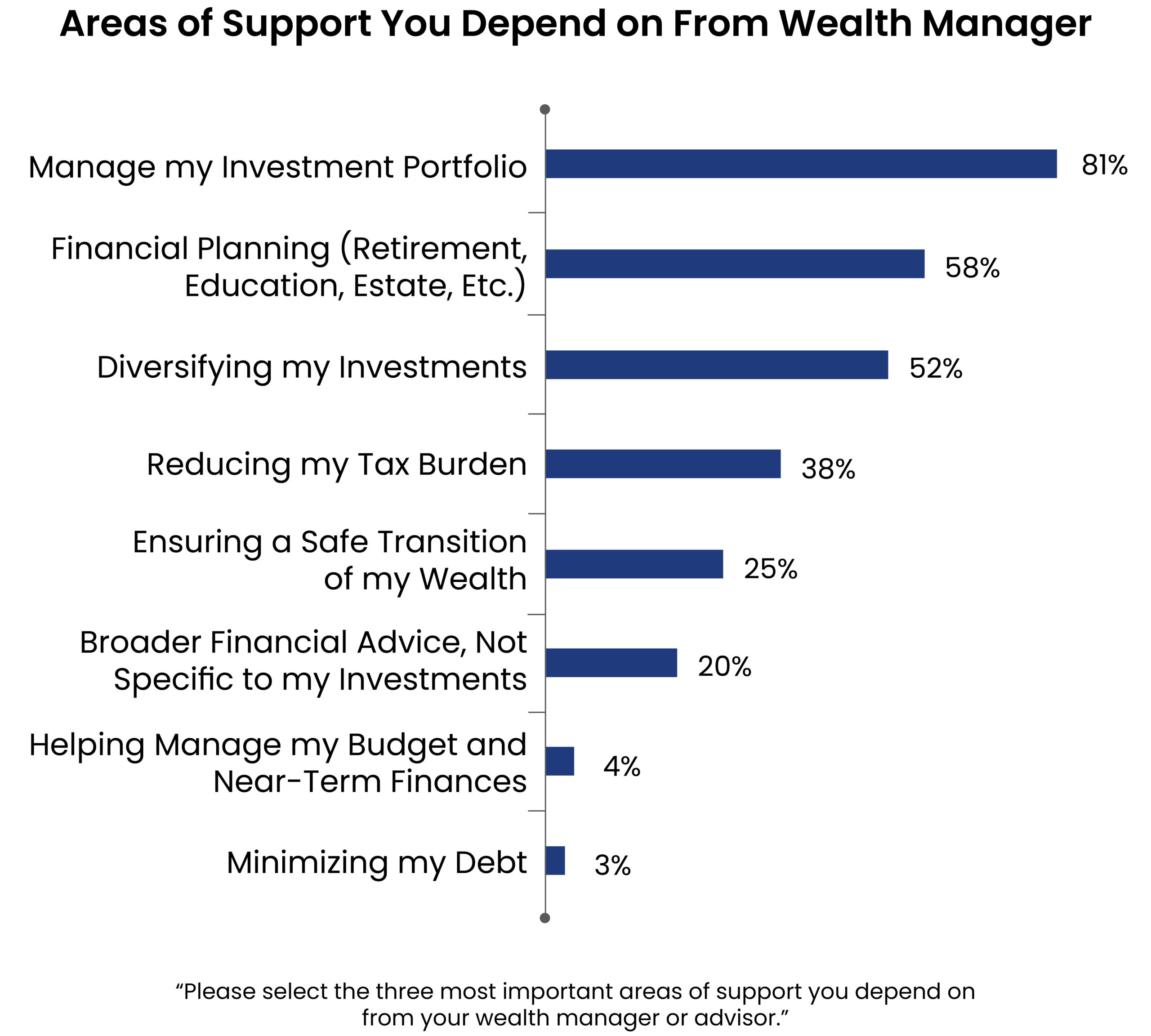

Wealth managers provide a wide range of services to the investors polled. The most frequently used, according to the survey, are portfolio management, financial planning and diversifying investments.

Finding the right wealth manager means choosing a firm whose team takes the time to understand your goals and needs, said Joseph McLaughlin, Haverford’s CEO. Investors also want a partner who connects managing their investment portfolio with strategies to help achieve their overall financial plan. That way, they can be part of a well-defined process and adjust as needed.

“Like any great relationship, it’s all built on communication and trust over time,” McLaughlin said. “It’s so important when life changes, you have those types of conversations with your advisors so they can help you factor that into the plan and your future goals.”

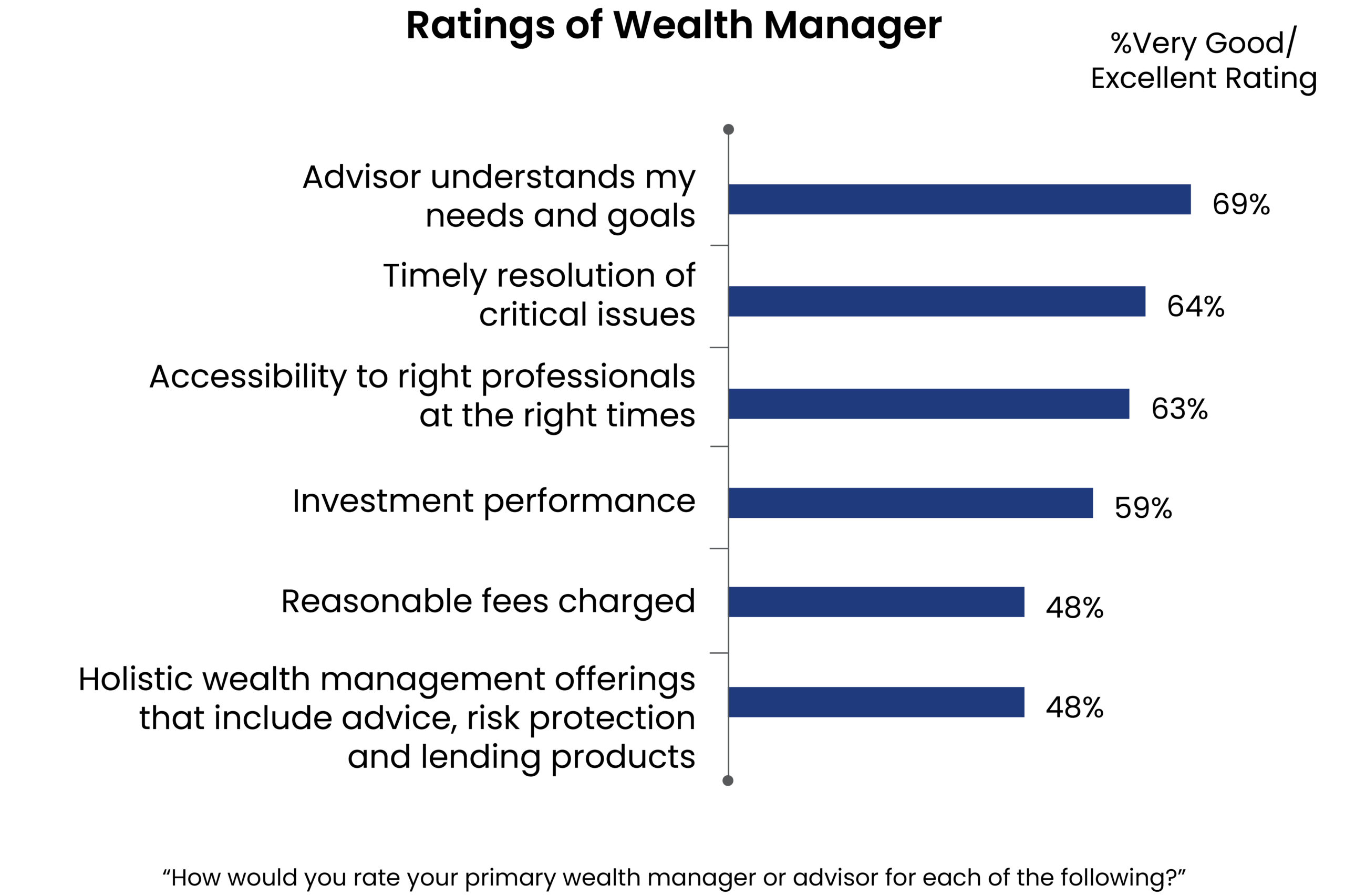

Most investors in the survey gave their wealth manager positive ratings when it comes to understanding their needs and goals, resolving critical issues in a timely manner and accessibility.

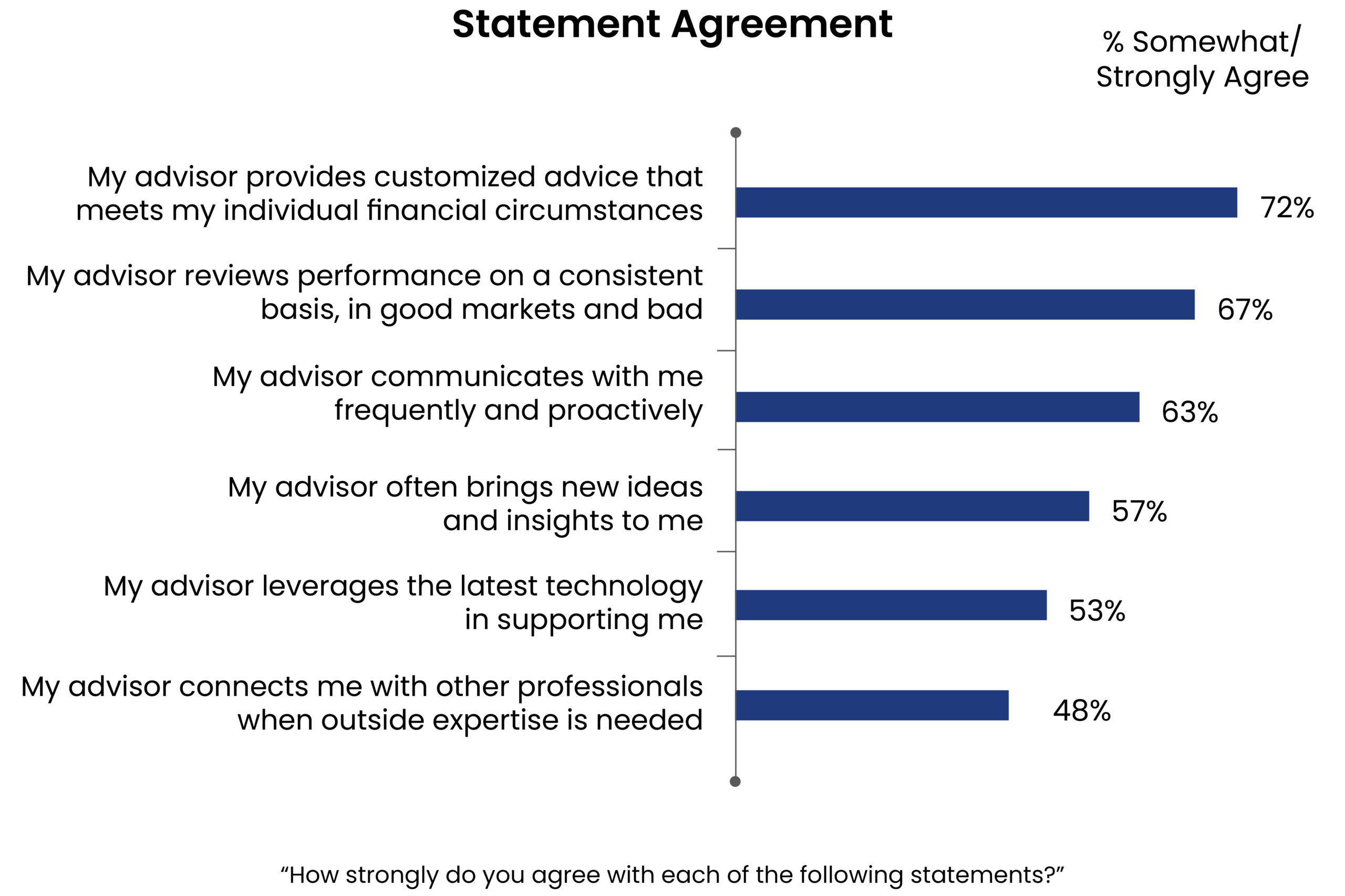

The survey respondents also said their advisor provides customized advice, reviews performance on a consistent basis and communicates frequently and proactively.

Those attributes are particularly important for successfully managing a portfolio over a long period, McLaughlin said.

“When you go through bumpy periods like we’ve been through in the second quarter this year or what we went through in 2008 and 2009, it’s important to have somebody who is going to be by your side when you need it,” McLaughlin said. “You want professionals who have been through many market cycles.” During market corrections, individuals tend to realize how much time and energy it takes to be your own advisor, and how broad and impersonal the advice on the internet is.

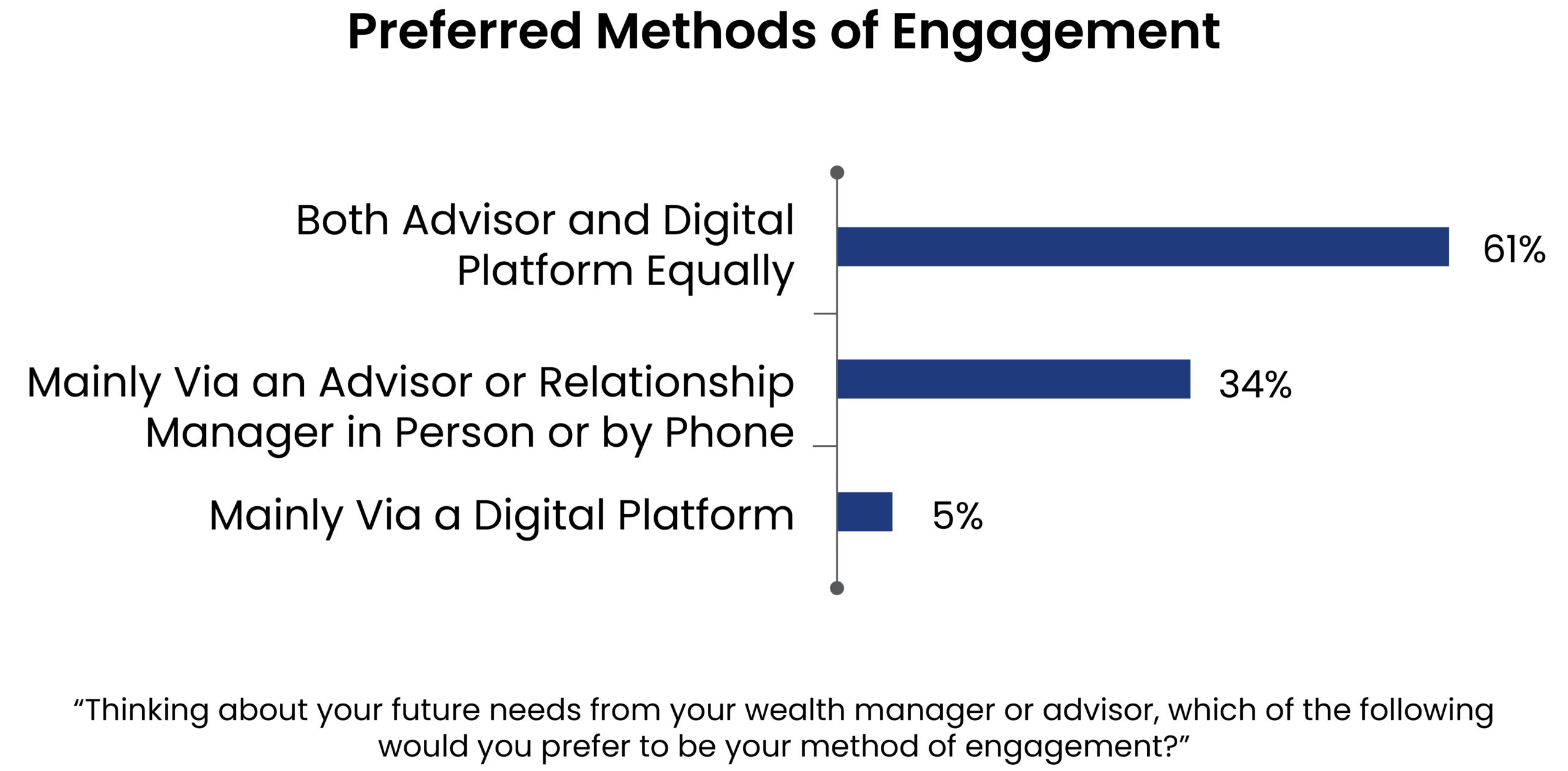

Investors also noted benefits from wealth managers who embrace technology. The majority of investors surveyed — as shown in the previous charts — said their advisors bring new ideas and insight to them and leverage the latest technology for support. Meanwhile, responses indicate that investors prefer an even blend of digital and personal communication.

Ideally, your wealth manager will coordinate with your larger professional services team, especially your accountant and lawyer. That way, Wietlisbach said, everyone on your financial team is working on the same page.

“It’s amazing what a difference that makes,” Wietlisbach said. “I think about two families in particular where we had a good relationship with their accountant and lawyer. In both cases, when the head of the family passed away, the estate settlement went smoothly. That is such a gift to the people who are left behind. It cannot be overappreciated.”

This content was published in partnership with Philadelphia Business Journal. To see the original article, click here.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value