Quality Fixed Income Portfolios

The Haverford Quality Fixed Income strategy maintains that high quality, intermediate term bonds provide the most attractive risk-adjusted returns.

Our portfolios provide customized investment solutions for a broad range of investors. We employ an active management style that seeks to provide clients with attractive after-tax risk-adjusted returns while preserving capital and income. Haverford serves its clients’ needs, ranging from cash reserve assets to core bond portfolios, by offering both taxable and tax-exempt portfolio management.

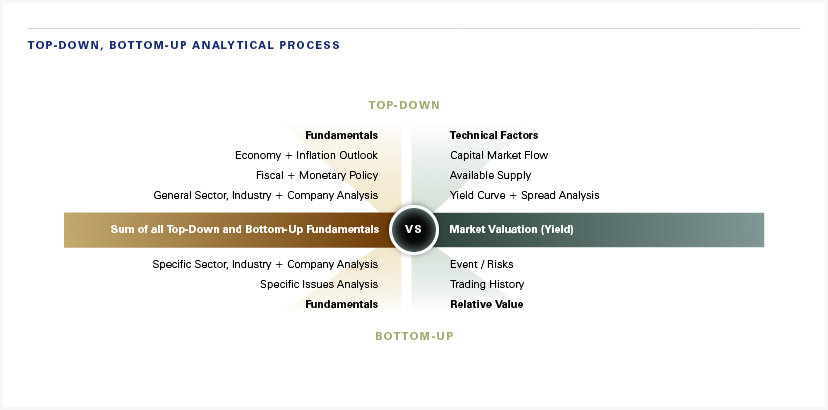

Haverford examines the inherent risk factors in each security and then evaluates the compensation paid to investors to ensure our clients feel adequately rewarded for taking any given level of risk. The analysis of allocation decisions is made across sectors and industries, with careful consideration paid to the selection of individual securities. Our emphasis on Quality Investing focuses on market valuation and the sum of top-down and bottom-up risks to achieve lower volatility.

Investments in securities are not FDIC insured, not bank guaranteed and may lose value.