By: Tim Hoyle, CFA, Chief Investment Officer

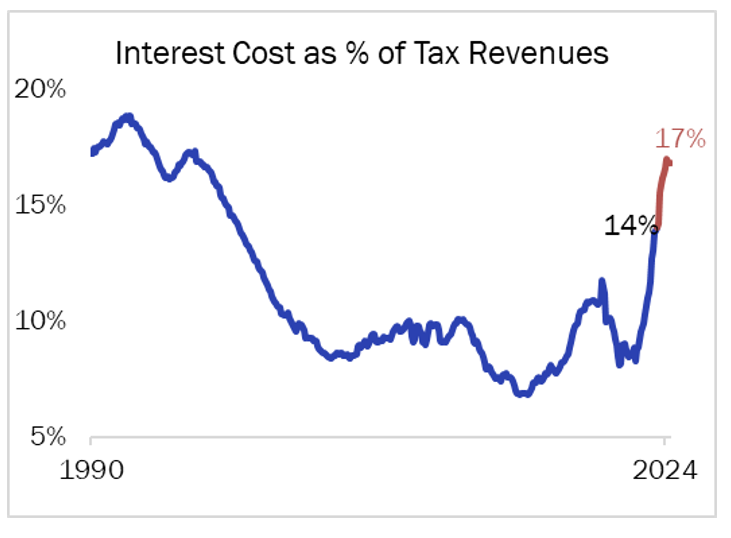

Markets suffered losses in the third quarter as investors navigated a series of incrementally negative economic data points[1] and rising bond market yields. The yield on the benchmark 10-year U.S. Treasury note rose by 80 basis points during the 3rd quarter to yield more than 4.6%, a level not seen since June 2007. Elevated interest rates not only provide an enticing choice for investors and put pressure on equity multiples, but they also have the potential to dampen economic activity and strain budgets. Most notably, higher rates impact the Federal budget where interest costs are expected to rise from 10% of total spending in 2022 to 17% next year. The Congressional Budget Office projects $745 billion interest costs for 2024 compared to $476 billion for 2022 and $345 billion for 2020.

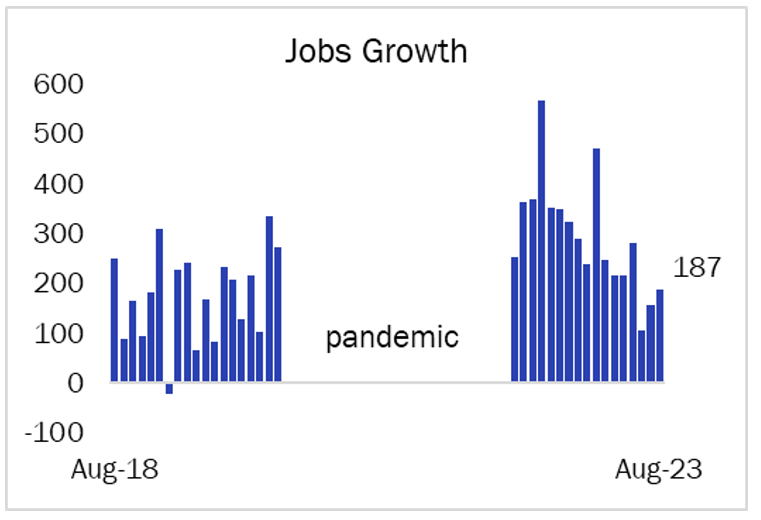

Headwinds such as these have thus far been thwarted by a structurally strong jobs market, where the demand for labor well exceeds supply. The healthy jobs market, combined with the lasting effects of pandemic stimulus, have cushioned the effects of higher rates and confounded expectations of an impending recession. GDP growth in recent quarters has exceeded forecasts, while upward revisions have been made to future projections. During the third quarter, a majority of Wall Street economists tempered their recession expectations. At Haverford, we too adjusted our expectation of a recession within the next 18 months from “likely” to “possible.”

Of course, economic outcomes often defy consensus, and the meteoric rise in interest rates increases economic vulnerability to both unforeseen shocks and underlying imbalances. The longer the economy powers-on with elevated rates and an inverted yield curve, the more likely a potential vulnerability becomes a reality. Unfortunately, levels of uncertainty are rising.

Economy: A structurally strong jobs market stands in the way of multiple headwinds. Inflation has fallen, but long-rates are rising and expected to remain higher for longer.

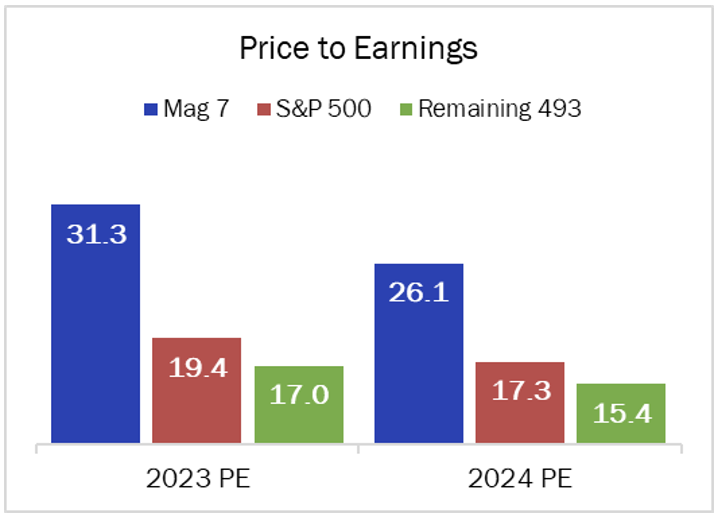

Equities: While the “Magnificent 72” trades at 26x 2024 expected earnings, the rest of the market is priced at just 15x earnings expectations. Stocks are compelling with the average stock trading 12% below 2021 levels.

Bonds: As the Federal Reserve unwinds Quantitative Easing policies, reducing assets on its balance sheet, bond market volatility will move higher.

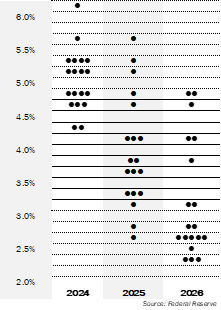

The Fed’s 2025 dot plot echoes economic uncertainty.

This heightened uncertainty is evident in the most recent “dot plot” published by the Federal Reserve. Fed members, guided by their staff economists, routinely project future Fed Funds Rates, and expectations for 2025 are notably disparate. We can’t remember a time when the spread between high and low projections was so high, with no apparent consensus. On the next page, we have provided a series of charts to juxtapose the strong jobs market and positive GDP with less favorable economic data.

As long-term investors focused on keeping Quality at the forefront of everything we do, we know from experience this uncertainty will provide opportunities. So far this year, the strong outperformance of a relatively small handful of stocks has driven the S&P 500 index to significantly outperform the average stock[1]. We don’t own the “average” stock, but seek to invest in high-quality, dividend -paying companies while also lowering portfolio risk. We find tremendous value in our portfolios’ holdings, which continue to appreciate in intrinsic value and now offer a wider margin of safety in the face of future uncertainty.

Uncertainty is not exclusive to stock investors alone. For the first time in 15 years, bond investors are confronted with the real prospect of reinvestment risk. Investors in shorter-maturity bonds, currently yielding well over 5%, may find rates are lower when the bonds mature. Investors wishing to lock in rates for longer must accept lower rates due to the inverted yield curve. The recent ascent of 10-year yields has provided investors with an opportunity to extend portfolio durations at more attractive rates.

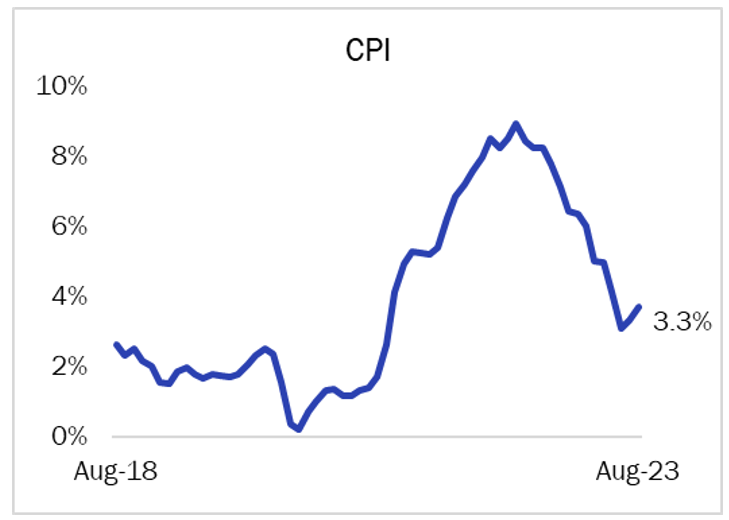

Prices are still increasing, albeit at a slower rate. It has been positive to see inflation rates have come down as fast as they increased. Inflation is still above the Fed’s 2% target.

10-year yields are back to levels not seen since 2007. Monetary conditions are continuing to tighten even if the FOMC is done raising short rates.

Energy prices are a volatile component of inflation pressures and driver of consumer sentiment. After falling post Russia’s invasion, oil prices rose 29% in the 3rd quarter. Price swings have not driven Federal Reserve policy, historically.

The effect of higher rates on the Federal budget is far greater than short-term concerns over budget negotiations. Interest costs, which currently eat up 14% of tax revenues, are expected to rise to 17% in 2024, as shown in the chart below.

The economy is continuing to create jobs at a robust pace. A strong jobs market remains the lynch pin to an economic soft-landing amidst higher interest rates.

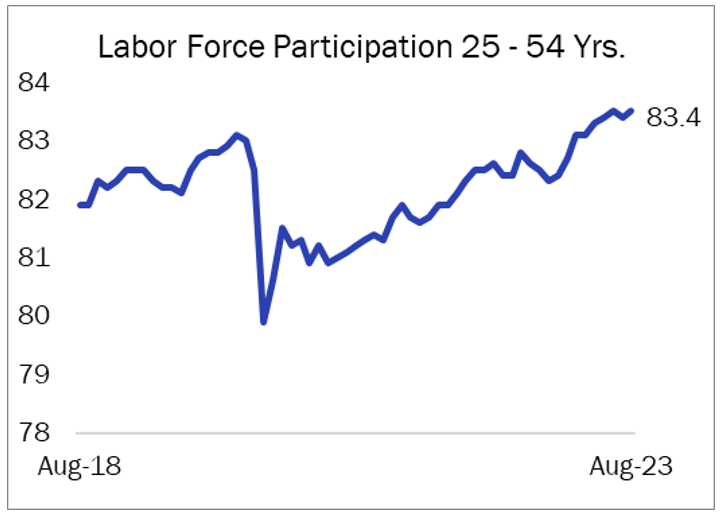

The percentage of “prime” workers (aged 25-54) currently in the workforce is at a 20-year high However, retiring workers are driving a structural labor shortage, which will continue to pressure wage growth higher.

Job growth noted is in the hundreds-thousands.

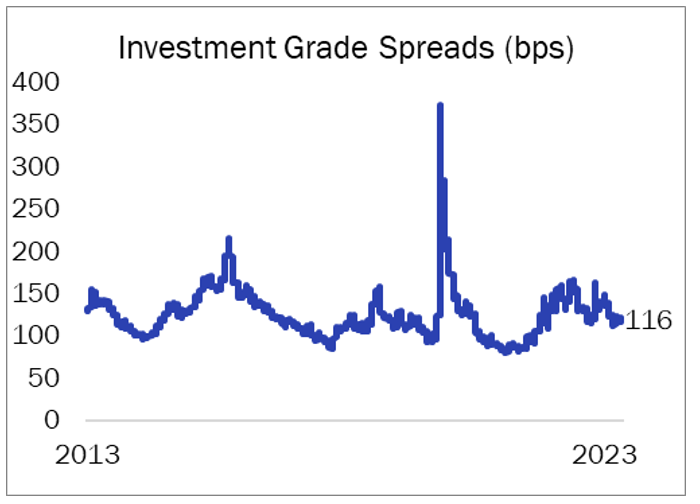

The corporate bond market is not reflecting any credit fears as yield spreads relative to benchmark Treasury yields are close to year-end 2022 levels.

While the largest stocks in the index trade at 26x 2024 expected earnings, the remaining 493 trade at a much more reasonable valuation of 15.4x.

All chart data as of 9/30/2023. Sources: FactSet, Haverford Trust

[1] Incrementally negative data points include higher energy prices, a stretched consumer, labor strikes, possible gov’t shutdown, fiscal deficits and interest costs, slowing global growth, and slowing housing activity with mortgage rates above 7%.

[2] CNBC has coined the seven largest contributors to the S&P 500’s year-to-date return the Magnificent 7. The stocks of Apple, Microsoft, Amazon, Nvidia, Tesla, Alphabet, and Meta account for 84% of the index’s return.