The S&P 500 closed the 2nd quarter at all-time highs. Jobs growth remains steady and disinflationary trends resumed during the quarter, contributing to a positive economic outlook. Additionally, Washington stimulus and ongoing enthusiasm for Artificial Intelligence advancements have created a resilient market atmosphere. However, only a select few stocks are driving this remarkable market performance.

Economy & Rates

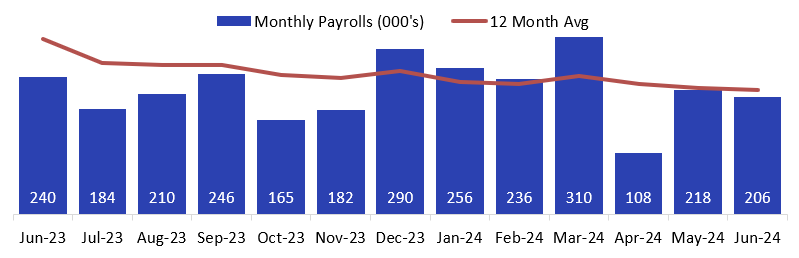

Economic growth is decelerating, but the jobs market remains strong enough to sustain the expansion. We anticipate a slight decline in inflation rates over the summer, giving the Federal Open Market Committee (FOMC) an opportunity to initiate rates cuts by year-end. We do not believe election dynamics will influence the FOMC’s decision and timing. With the Fed currently executing against its dual mandate to maximize employment with stable prices, we foresee no more than a couple rate cuts from current levels.

We believe a 3-month rolling average inflation rate close to 2.5% is necessary to consider a rate cut. While employment growth below 100,000 per month, or a rise in the unemployment rate above 4.25%, will trigger an additional cut. Therefore, one rate cut is likely, with two cuts being a possibility in 2024. Any additional cuts would likely be a response to rapidly deteriorating economic conditions, which currently seem unlikely.

Monthly vs 12-Month Average Payrolls

Source: Factset, Haverford

Politics & Policy

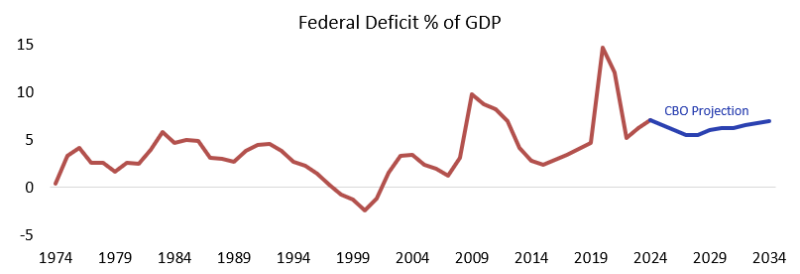

Economies and markets tend to perform well in Presidential election years, in part due to incumbent administrations’ ability to employ measures to sustain economic momentum. In the upcoming term, the President will face a challenging fiscal situation. Interest on the federal debt has exceeded defense spending and accounts for nearly 17% of tax receipts. The Congressional Budget Office (CBO) projects deficits close to 7% of GDP for the next decade.

Although the two leading candidates have significant policy differences, they share a crucial similarity: neither has a plan to address the substantial fiscal deficits. Both are expected to maintain the status quo until an external force necessitates change. A Senate election map favorable to Republicans suggests a high probability that many of the Tax Cut and Jobs Act (TCJA) provisions expected to expire in 2025 will be extended.

Federal Deficit Percentage of GDP

Source: CBO

AI & Markets

AI enthusiasm has driven a narrow bull market. Over the past 30 months, the average stock has been flat, while the cap-weighted index has been up 15%. While profit growth has stagnated in many sectors, companies with exposure to the data center buildout (semiconductors and industrials) have seen rapid profit growth. We expect profit growth to broaden following this period of rapid investment in computer power, presenting an opportunity for underperforming stocks to regain favor.

In a market characterized by narrow growth, diversified managers face challenges in meeting and exceeding benchmark expectations. As Haverford positions portfolios for the future, we are considering several long-term trends.

- Energy transition & grid investment. The shift towards sustainable energy sources alongside increased power consumption continues to provide investment opportunities.

- AI value proposition. AI driven innovations are gradually permeating various sectors, creating widespread opportunities and transformative impacts.

- Consumer Behavior. Stretched consumers are increasingly value-conscious, indicating a trend towards more cost-effective purchasing decisions.

- Bond Market Dynamics. Bond yields will continue to be volatile. Investors in high-quality fixed income can benefit from attractive yields without the risks presented during the period of ultra-low rates.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value