Markets at All Time High Thanks to Five Catalysts

Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

The markets closed out the second quarter on a high note, despite unprecedented levels of uncertainty and geopolitical risk. The market’s resilience can be attributed to five key areas where investors hold an optimistic outlook: strong economic data, pro-growth policies, moderate tariffs, continued earnings growth, and advancements in artificial intelligence. This environment is largely driven by these factors, setting the stage for what could be another strong quarter ahead if the headlines and trade negotiations remain positive.

Economic Policy Uncertainty Index

Source: FactSet, Jun 30 2025. The US Economic Policy Uncertainty Index measures the frequency of articles in major newspapers that contain terms related to the economy, policy, and uncertainty, the number of federal tax codes set to expire, and the dispersion in economic forecasts in the Federal Reserve Bank of Philadelphia Survey of Professional Forecasters. The index is used to track uncertainty over time. Higher values of the index indicate greater uncertainty, which can affect investment, employment, and overall economic performance.

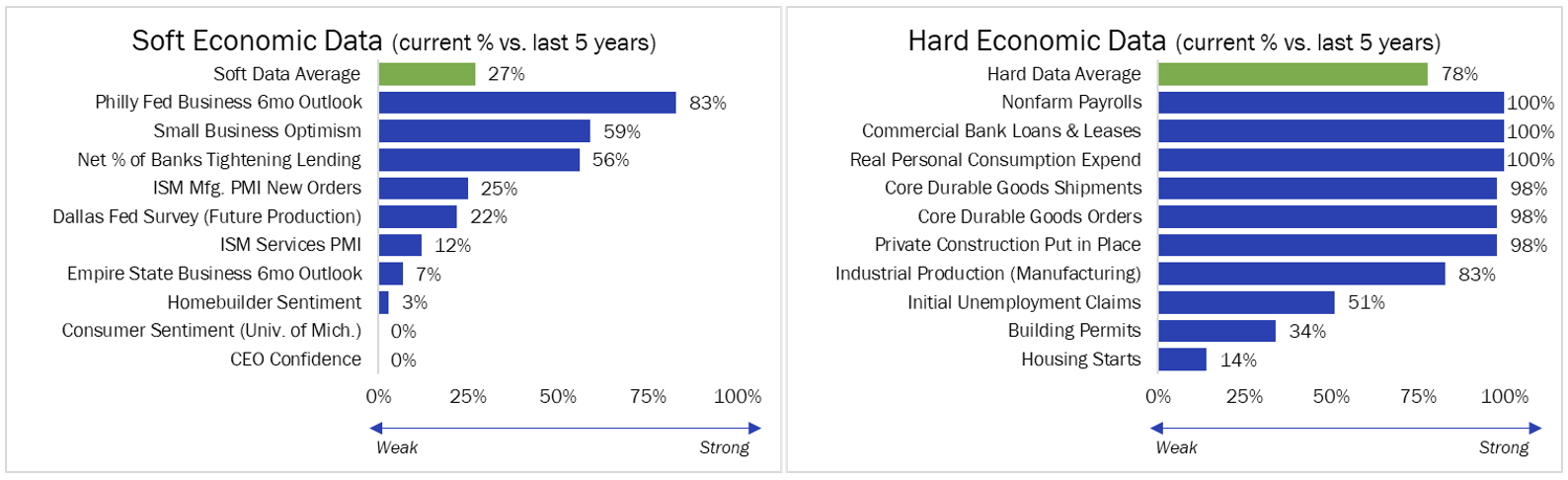

1. The Hard Economic Data Remains Strong

The contrast between hard data (quantifiable metrics like employment numbers and industrial production) and soft data (survey-based indicators like consumer and business sentiment) has been a defining theme this quarter. While most survey data plummeted in the wake of April 2nd tariff proposals, hard data continues to signal economic growth, albeit slower growth.

Payroll growth has softened, averaging 145,000 jobs per month compared to 185,000 jobs per month this time last year, yet it continues to support overall economic momentum. Meanwhile, goods orders and industrial production remains robust, inflation is trending lower, with the Consumer Price Index rising just 2.4% year-over-year. In contrast, the housing market continues to struggle—existing home sales are tepid, primarily due to persistently high mortgage rates and limited inventory. The ongoing weakness in the housing market could eventually spill over into other facets of the economy.

We believe slower job growth and continued tame inflation, will allow the Federal Open Market Committee (FOMC) to lower interest rates once in the third quarter, followed by another rate cut later in the year. We expect to continue to see the soft survey data improving as the additional themes below play out.

Soft and Hard Economic Data

Source: As of 5/15/2025. Understanding the Difference Between Soft and Hard Economic Data | Baker Boyer Bank

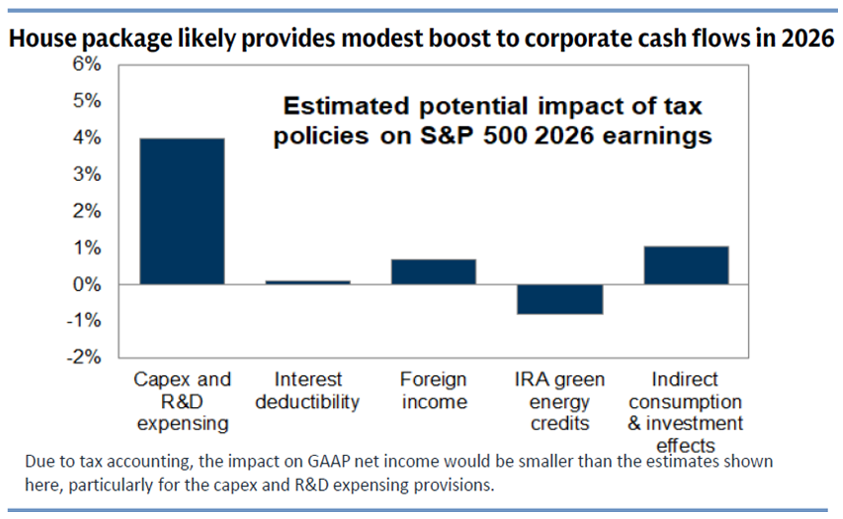

2. The Budget Bill Provides Pro-Growth Policies

The passage of a comprehensive Big Beautiful Bill (BBB) will likely be the cornerstone of the President’s term and inject a fresh wave of corporate-specific fiscal stimulus into the economy. Without its passage, all taxpayers will see their taxes increase, and an economic contraction would likely commence; both are outcomes neither party desires. The bill is set to mostly maintain current individual tax policy while providing robust incentives for businesses to invest domestically and drive more onshore manufacturing. These provisions include: 1) Allowing companies to write off 100% of their capital equipment purchases; 2) Allowing research and development (R&D) costs to be immediately expensed; 3) Expanding the amount of interest expense that can be deducted. These tax provisions would provide a “carrot” to compliment the tariff “stick.”

We believe the consequences of not passing this bill would be catastrophic, as it would usher in the biggest tax increase in history. The timetable for the passage of the BBB appears to be late July, before Congress’ August recess.

House Package – Modest Boost to Corporate Cash Flows in 2026

Source: Goldman Sachs

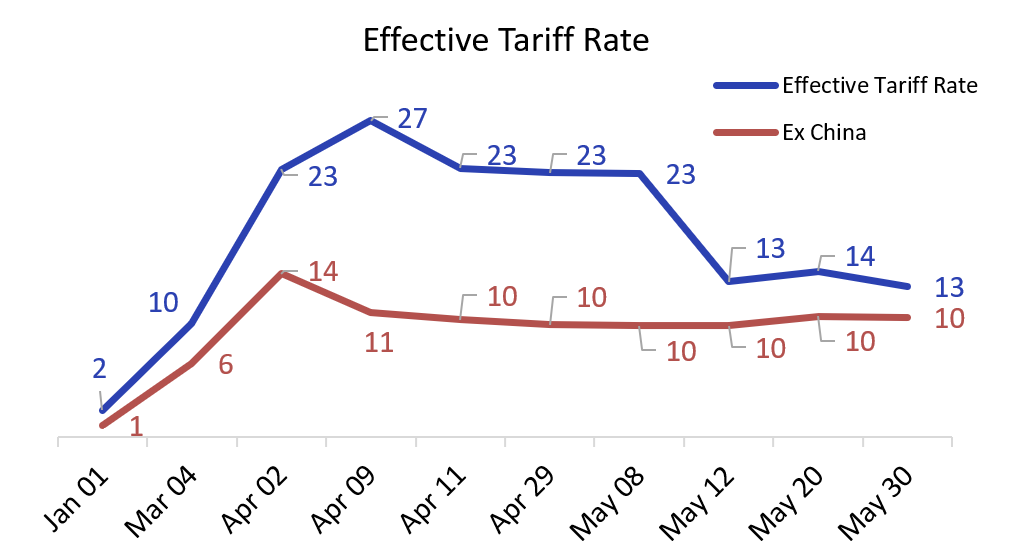

3. Trade Negotiations Result in Moderate Tariffs

Markets are looking beyond the current seesaw of tariff policy. According to J.P. Morgan, there have been at least 50 tariff announcements since Inauguration Day. The President’s use of bombastic, and chaotic, rhetoric as a tool to achieve his goals is a style that some find tiresome. However, he does seem to have success with it. NATO’s recent commitment that member states would raise defense spending to 5% of GDP is one such example.

The announcements of April 2nd set the reference point for tariffs so high that an eventual 10% average tariff won’t seem so bad. A 10% tariff on $3 trillion in imported goods will still amount to a $300 billion tax to be borne by consumers and businesses. That equates to almost 9% of corporate profits; however, most companies are proactively mitigating the tariff policies such that the final impact should be much lower. So far, these potential risks have not yet been manifested in the economy. Inflation hasn’t ticked up, nor has consumer spending trailed off. The markets are going to look through the tariff chaos as long as expectations for baseline tariffs remain near 10% and more antagonistic tariff advocates such as Peter Navarro don’t regain influence over negotiations.

Effective Tariff Rate

Source: Haverford, JP Morgan

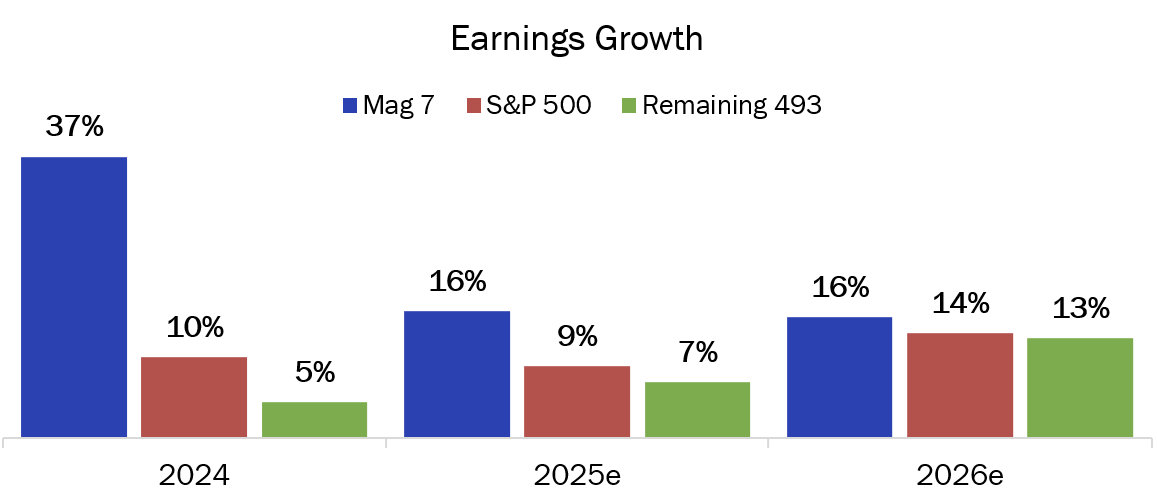

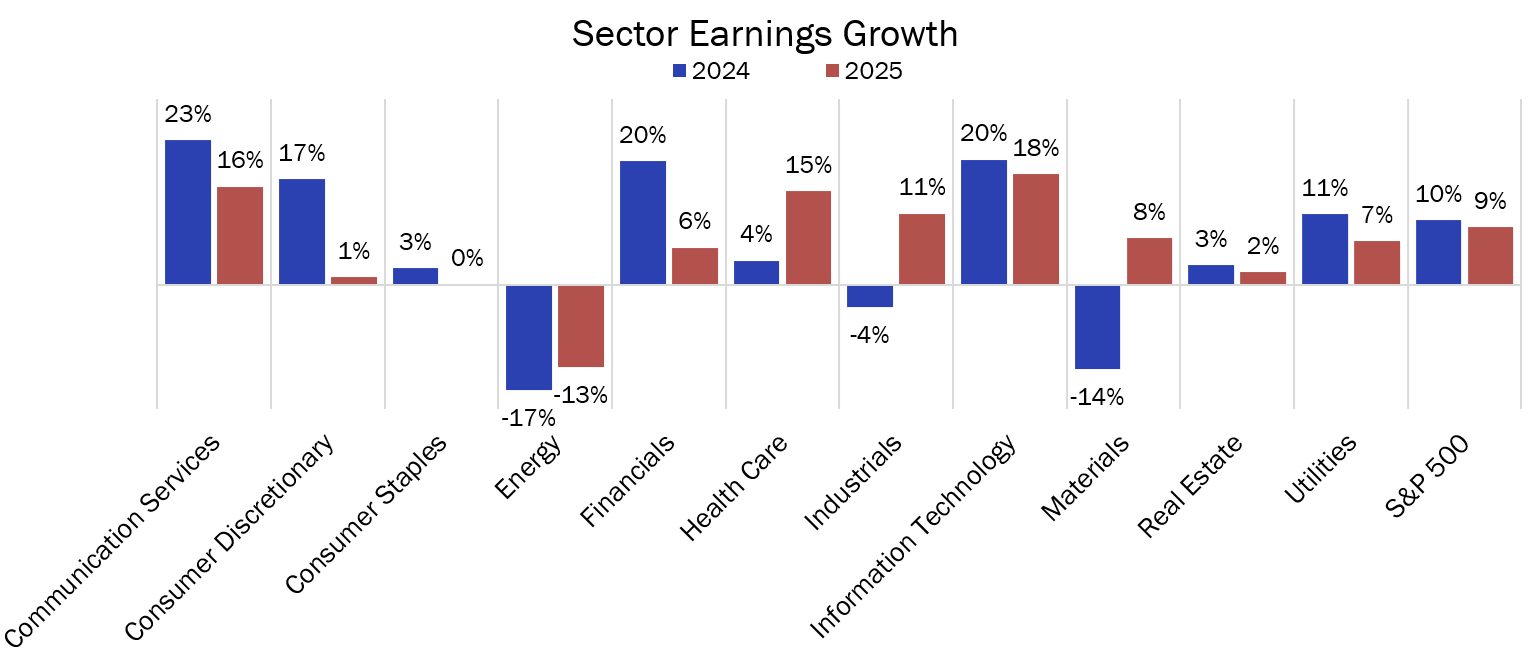

4. Earnings Growth is Set to Continue

Overall first quarter S&P 500 earnings grew 13% year-over-year while full year 2025 earnings are expected to grow 9%. Tech giants continue to lead the growth charge with robust revenue growth driving profits. Microsoft’s earnings stood out as exceptional for the quarter, where earnings accelerated 18% on 13% revenue growth. Remarkably, Microsoft has posted mid-teens revenue growth in six of the past seven years.

Earnings Growth

Source: Haverford, Factset

While technology is leading, other sectors are set to see a resurgence of earnings growth in 2025. Following several years of lackluster growth post the pandemic highs, healthcare is expected to see mid-teens earnings growth this year. In addition, industrial stocks, buoyed by defense spending and data center construction, are also on the path to double digit earnings growth this year.

Sector Earnings Growth

Source: Haverford, Factset

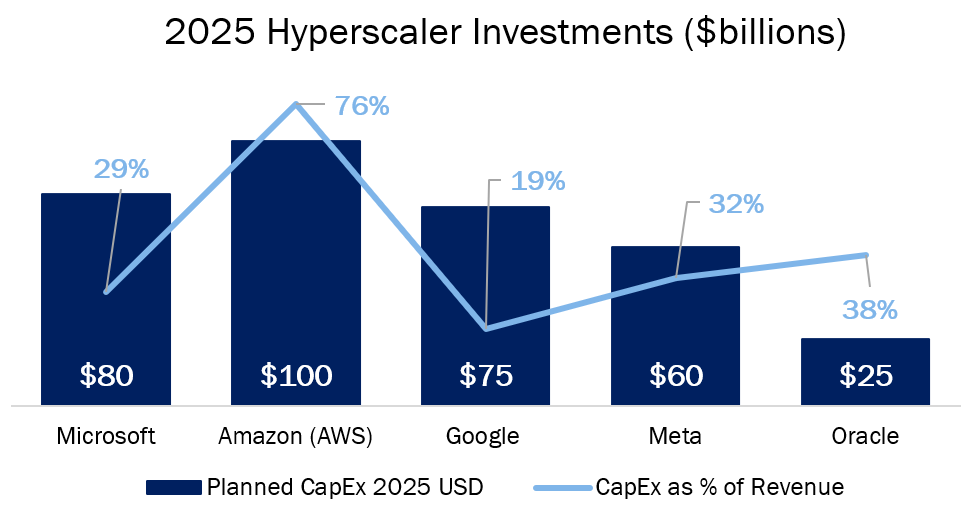

5. Still in the Early Stages of Artificial Intelligence Productivity Gains

Artificial Intelligence (AI) will continue to be a transformative force reshaping the way businesses operate. The investments required to fuel this AI revolution are extraordinary. According to Columbia ThreadNeedle, capital expenditures for the four largest hyperscalers (Alphabet, Amazon, Meta, and Microsoft) is expected to rise to $395 billion in 2027 from $150 billion in 2023. Capital expenditure relative to revenue is at never-before-seen levels for large-cap companies. Oracle is currently on pace to spend over 35% of their revenues on capital investment in 2025.

2025 Hyperscaler Investments

Source: Haverford, Factset

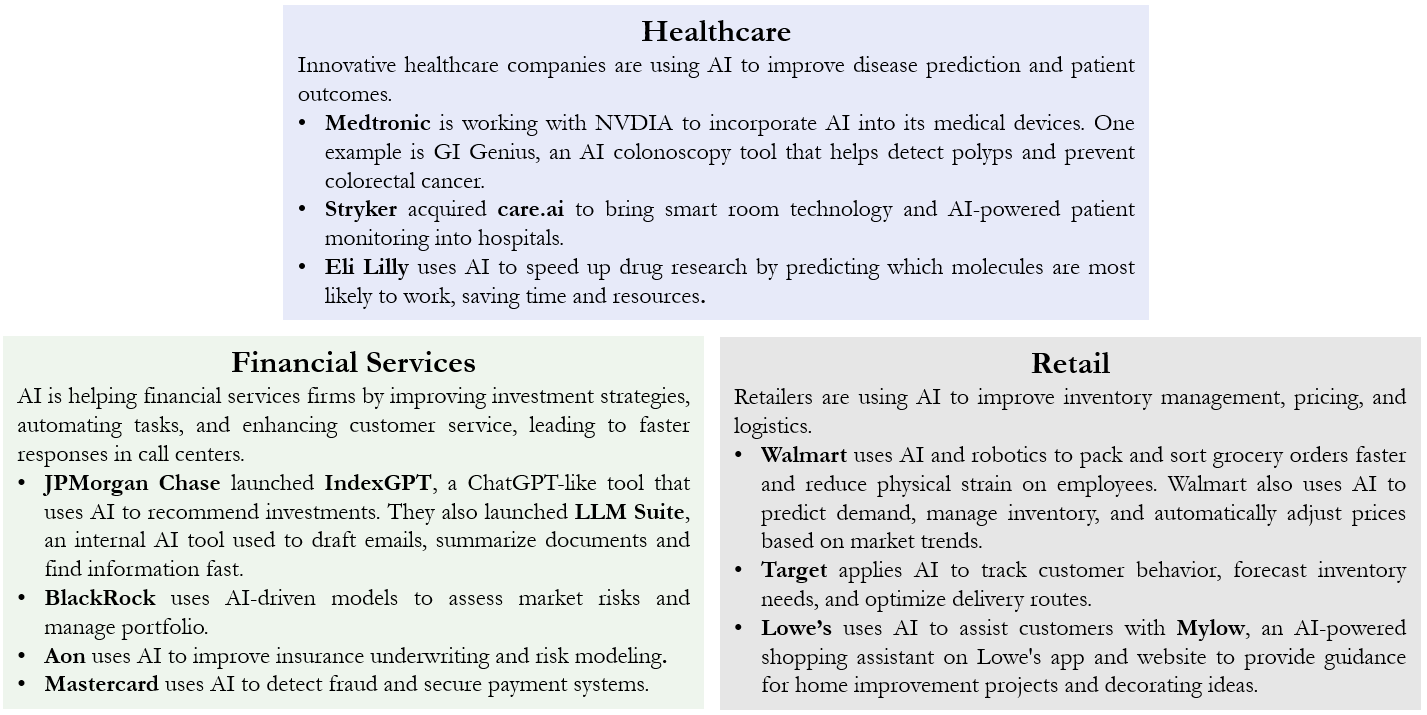

It’s easy to see where technology firms are integrating machine learning and data analytics to enhance their product offerings. Other industries are starting to show benefits as well. Healthcare and financials are using AI applications to improve diagnostics, risk assessment, and customer service. The ripple effects of AI are far-reaching, and its integration into business models is likely to prove to be a significant value driver for the equity markets for years to come.

A.I. Use in Market Sectors

Source: Haverford

Looking Ahead

As we head into the second half of the year, the catalysts that have propelled markets during Q2 are likely to remain in place during the third quarter. The interplay between hard and soft data will continue to shape the economic narrative, while the budget bill provides structural support for sustained growth, as long as the tariff narrative remains benign. Earnings momentum, coupled with the productivity potential of AI, could position equity markets for further gains.

However, investors should remain vigilant, keeping an eye on evolving risks such as geopolitical tensions, the slowing jobs market, and the effects of tariffs on spending and inflation. Diversification and a focus on quality investments will be key strategies for navigating the market landscape.

Media Inquiries

Veronica McKee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value