Last Week:

- U.S. equities finished mixed for the week: In the holiday-shortened week, healthcare stocks remained under pressure as they reacted to increasing political headlines relating to Medicare for All. Meanwhile, better than expected topline and earnings growth drove healthy gains in industrial stocks, helped by improving manufacturing data out of China. During the week, the Dow Jones Industrial Average (Dow) gained 147 points, or rose 0.56%, to 26,560. The Standard & Poor’s (S&P500) index decreased 2 points, or fell 0.08% to 2,905. The Nasdaq closed 0.17% higher at 7,998 while the 10-year Treasury ended the week at 2.56%.

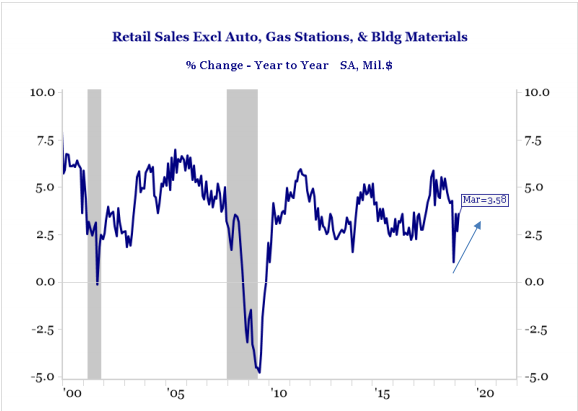

- Economic Data Recap: Last week, the U.S. Census Bureau reported retail sales for the month of March rose +1.6% from February, marking the strongest gain since September 2017. Considering the December decline and weak start to the year, the March retail sales number is particularly encouraging and aligns with the healthy U.S. job market and consumer confidence relating to the state of the economy. Spending at gas stations rose +3.5%, while spending at auto dealers rose +3.1%. Excluding auto-related and gasoline spend, with gas prices up recently, retail sales still increased a solid +0.9%, above economists’ expectations. The government shutdown and the delay in processing tax refunds may have delayed spending and exacerbated the distortion in the retail sales numbers we have seen so far this year. However, as we enter the second quarter, expectations are for a stronger recovery as consumer confidence remains high, with a consistently strong job market and rising wages.

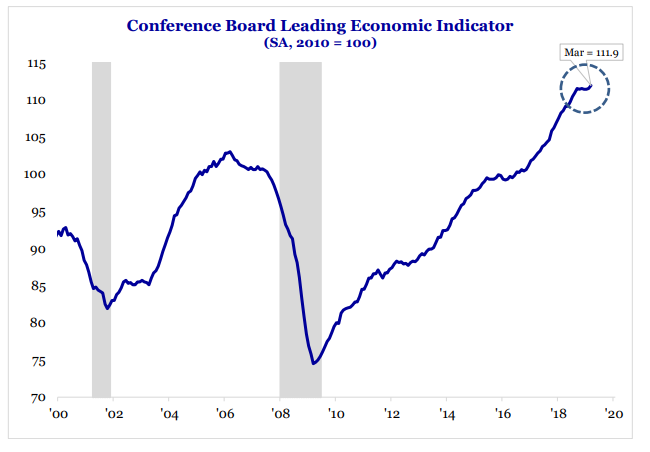

- During the week, we also saw the Conference Board’s Leading Economic Indicators Index for the United States, which increased +0.4% in March, following a +0.1% increase in February and no change in January. The March gain brought the growth of the index over the last 12 months to +3.1%, up modestly from February’s reading. All ten components rose during the month, with strength in labor market components, consumers’ outlook, and stock prices all solid contributors. The Board’s Coincident Economic Index (CEI), a measure of current economic activity, increased +0.1%, with the Lagging Economic Index also increasing +0.1% during the month. Bottom-line, although the coincident data appears weak, the leading indicator data is better.

Source: The Census Bureau, Strategas Research Partners

Source: The Conference Board, Strategas Research Partners

Look Ahead:

- The corporate calendar will be very busy this week as first quarter earnings season kicks into full gear. Notable reporters include Kimberly-Clark, Coca-Cola, United Technologies, Verizon, Air Products and Chemicals, Microsoft, Baxter International, Comcast Corp, Altria, Starbucks, Chevron, and Exxon Mobil, among others. There will also be a number of broker conferences and investor meetings during the week.

- On the economic calendar, we will see Existing Home Sales, The Chicago Fed National Activity Index, New Home Sales, Durable Goods Orders, Personal Consumption Expenditures, Gross Domestic Product (GDP), and the University of Michigan Consumer Sentiment to end the week.