Last Week:

U.S. equities finished negative for the week: On the week, the Dow Jones Industrial Average (Dow) fell 3.0%, to 24,815. The Standard & Poor’s (S&P500) index fell 2.6% to 2,752. The Nasdaq closed 2.4% lower at 7,453 while the 10-year Treasury ended the week at 2.13%.

Haverford was wrong when we predicted the economy was experiencing “peak tariff” in our annual Outlook for 2019. Last week’s announcement of a 5%—rising to 25%—tariff on Mexican goods caught everyone by surprise. The market declined over 1% on Friday following Thursday night’s tweet by the President. The market probably would have sold off more if traders truly expected the full 25% tariff to come to fruition. We are not alone in trying to discern if the President views tariffs as a negotiating tactic or the end goal of his policies. According to Factset, S&P 500 companies are expected to earn $186 per share in 2020. With the S&P trading at 2752, this represents a multiple of only 14.8 times earnings, but everyone including Haverford is mentally writing down expectations as we contemplate the ramifications of tariffs on multiple trading partners.

In a change of strategy, China escalated the stakes of the trade war by announcing they will create an “unreliable entity list” of (U.S.) companies that damage the rights and interests of Chinese companies. FedEx is most likely to find itself at the top of this list of dissidents. Last week the company had to apologize for mis-routing to the United States several Huawei packages originating in Japan and destined for China. FedEx was down 4% on the week.

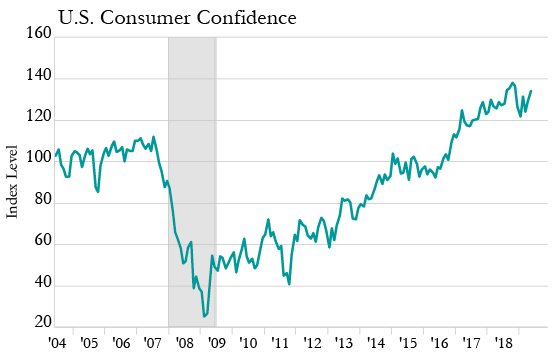

It isn’t surprising to us that the consumer remains impervious to the geopolitical tit-for-tat trade war. So far, tariffs have not had an adverse effect on prices. The latest reading of same store sales showed an increase of 5.7% and the May reading of the Consumer Confidence Index rose to 134.

As of today, two of the four pillars we believe are needed for a bullish market remain intact: the Fed is on pause as seen as likely to cut rates while the consumer is strong on the back of job gains. The pillars of rising earnings expectations and alleviating trade tensions are cracked. As it stands now, we will have to wait until the end of June to see if the G20 meeting provides a backdrop for Trump and Xi to reengage in positive trade negotiations.

Source: FactSet, June 2019

Look Ahead:

- The corporate calendar will be busy this week as first quarter earnings season continues. Notable reporters include McCormick, Cronos Group, Lululemon, Paychex, and Accenture, among others. There will also be a number of broker conferences and investor meetings during the week.

- On the economic calendar, we will see the Institute for Supply Management and Purchasing Managers Index (PMI) data, Factory Orders data, U.S. Vehicle Sales, and the May Jobs report to end the week.