Last Week:

U.S. equities closed higher for the third straight week, with the Standard & Poor’s index (S&P500) hitting all-time highs, while the Dow Jones Industrial Average (Dow) and Nasdaq flirted with fresh new records. Although widely anticipated, the Fed’s signal regarding its openness to a rate cut this year was the main catalyst for the rally this week. On the week, the Dow rose 2.4%, to 26,719. The S&P500 rose 2.2% to 2,950. The Nasdaq closed 3.0% higher at 8,032 while the 10-year Treasury ended the week at 2.07%.

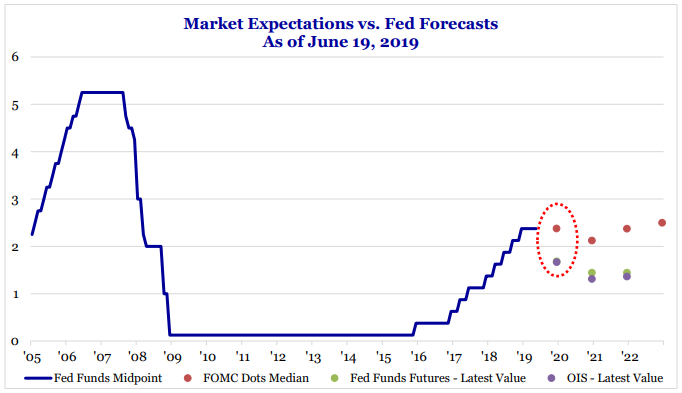

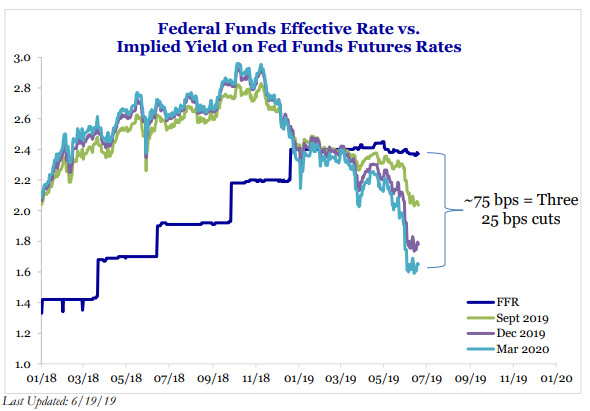

Last week, the Federal Open Market Committee (FOMC) decided to leave the Federal Funds Rate unchanged at 2.25-2.50% in a widely anticipated move, and opened the door to cutting interest rates this year. Investors were already pricing in three rate cuts this year, with the Fed move merely affirming that forecast. The updated dot-plot—which anonymously shows interest rate projections consistent with economic forecasts for each of the 17 Fed officials— showed the median dot for 2019 remain unchanged. Eight of the 17 individual dots moved into “cut” territory (compared to expectations for 4-5), while the mean 2019 dot now calls for a rate cut.

In the accompanying statement, we saw the Fed drop the word “patient” from its language—which previously implied rates will remain unchanged for some time—and instead added a phrase signaling its intent to closely monitor economic data points and act accordingly (“in light of these uncertainties and muted inflation pressures, the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion”). During the press conference, Fed Chair Jerome Powell reiterated the Fed’s intent to sustain the expansion, while citing a number of headwinds, including trade uncertainty, tepid inflation, and softer global economic growth. Powell also commented the market will learn more “in the very near term” regarding the listed issues, suggesting that even the Fed was looking forward to the G20 where President Trump and Xi are expected make some progress towards resolving the trade issues.

The move came with an acknowledgment of moderate economic conditions, including a downward adjustment to inflation expectations. The Fed’s core PCE forecast was down from 1.8% to 1.5%, while GDP was left unchanged at 2%. Over the last several weeks, we’ve seen key economic data points continue to support a strong U.S. economy, albeit at a mature stage in the expansion. Specifically, the bounce back in retail sales and jobless claims sitting well below the 10-year average continue to show a resilient American customer. Even in interest rate sensitive sectors, such as housing, we saw May housing turnover increase for the first time in two months as lower mortgage rates boosted homebuyer demand. With that said, not every part of the economy is flashing green signals. Business investment has been weak as the effects from the tax cuts continue to fade and trade uncertainty continues to hold up investment decisions. These data points will be closely watched over the next few months.

One of the main investor fears has been the likelihood of the Fed making a policy mistake as it embarked on its tightening cycle, potentially driving the economy into a recession. With this change in policy, the Fed may have provided some assurance to the market that it is paying close attention and is willing to adapt to sustain the economic expansion. With investors already pricing in three rate cuts this year, the disconnect between the Fed’s intention and market expectations is likely to drive volatility over the next several months.

Source: Strategas Research Partners

Source: Strategas Research Partners

Look Ahead:

There will be a handful of notable events on the economic front, including home sales and price data, durable goods orders and wholesale inventories, advance goods trade balance, U.S. personal income/spending for May, and Chicago PMI for June. Abroad will see Euro-zone consumer confidence numbers and CPI, German CPI, and China Industrial profits.

Focus earlier in the week will be on the ongoing U.S. China Tariff talks and will culminate with the G20 summit in Japan at the end of the week.