You May Forecast Level or Time, But Not Both

It is the time of year for pajama presents, parties, and prognostications. This week and next, you will hear 2020 predictions from strategists, analysts, and your father-in-law. Despite their confidence, all will likely be wrong or be right for the wrong reasons, yet we continue to predict and listen to others’ predictions. It is human nature to be overconfident.

Soon, you will be receiving Haverford’s 2020 Outlook. Investors often believe they need to make predictions in order to formulate their investing framework and process. We try not to get caught making too many predictions1. The success of our long-term investing framework is thankfully not reliant on near-term predictions. Haverford’s philosophy is built on several long-term predictions (i.e. tenets), which are actually easier to successfully formulate than short-term predictions.

Haverford’s Tenets:

- High-quality, dividend-paying stocks will provide strong risk adjusted returns

- It is time in the market, not timing the market that will generate success

- Appropriate diversification and asset allocation will keep clients invested (e.g. time in the market)

- Intermediate term bonds can offer yields comparable to long bonds with significantly less duration

- Treating every client as if they are the only client, and building strong relationships will generate success

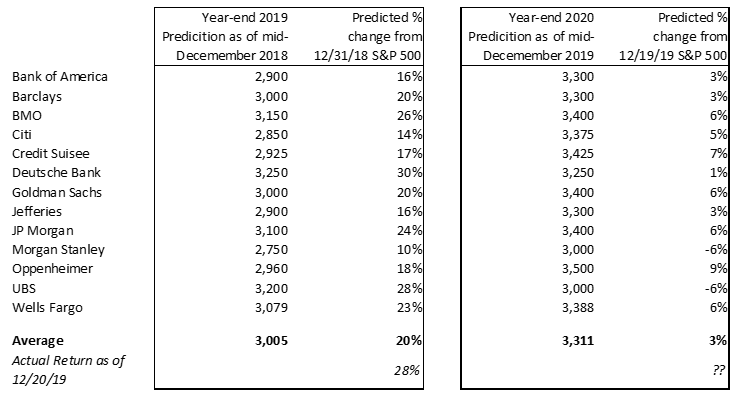

Despite the futility in predictions, it can be an interesting gauge of expectations and sentiment – and plain fun. Below are the results of last year’s predictions by major Wall Street firms for the 2019 year-end level of the S&P 500, as well their current predictions for year-end 2020.

Source: Data compiled by Haverford based on information provided by Yahoo! Finance and Business Insider. Specific date of forecast varies by firm.

1 For 2020, we are predicting a level for the Fed Funds rate: unchanged. We are making that prediction more as a statement that we are taking Jerome Powell and the FOMC at their word, that it will either take a major economic slowdown or upward revision to inflation expectations for move the Fed off the current level of 1.5% to 1.75%