March 9, 2020

Take a Mulligan

The coronavirus is a classic example of an external shock—an exogenous event that is unforecastable. Coming two months after we penned our 2020 Outlook, COVID-19 has rendered our previous near-term economic expectations void. Therefore, we are taking this opportunity for a mulligan and a revisit of our 2020 themes.

United Airlines (UAL) recently postponed its investor day because, in consideration of the coronavirus, it is not “practical to expect that [United] can have a productive conversation focused on its long-term strategy.” Fortunately, as long-term investors in Quality stocks and bonds, we can and do remain focused on long-term strategy. However, we are empathetic of United’s situation; our own 2020 Outlook has gone up in smoke as the coronavirus spreads.

Market corrections, by their very nature, are unpredictable and are often caused by unexpected events to which collective wisdom thinks there’s no solution. In this case it’s a runaway virus.

Haverford’s time-tested Quality Investing philosophy focuses on owning high quality, financially strong companies and their bonds. We remain confident, as should our clients, in the durability of our process. We design portfolios to help keep clients invested through the full cycle. Volatility is unpleasant, to say the least, but true risk is the permanent loss of capital. We believe our investment philosophy will help clients avoid this ultimate risk. Regardless of the severity and length of the COVID-19 virus and its ultimate impact on the economy, we are confident that the majority of our portfolio holdings will increase their dividends this year— the ultimate statement of confidence—just as they did during the financial crisis, in the years following the dot.com bubble, and after the terrorist attacks on September 11.

U.S. recession probability has increased, but remains below 50%

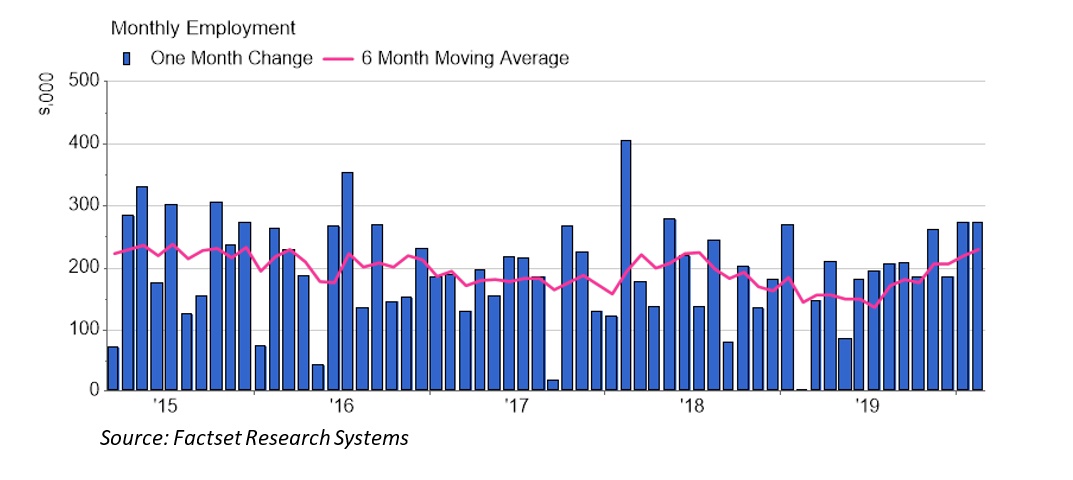

We estimate U.S. GDP growth will slow to below 1% for the first half of 2020. A dramatic slowdown of this magnitude increases the probability of sliding into recession. We believe the economy will not tip into a recession due in large part to its current strength. The February jobs report totaled 273,000 new hires in the month and included upward revisions to the prior month. If not for the virus, this report would have been celebrated. But for now, the financial markets are reacting as if this is the last good jobs report of the year.

The Financial Markets Are Ignoring the Strong February Jobs Report

We believe economic growth will reaccelerate in the second half. This forecast is made with a greater degree of uncertainty than most. The coronavirus has raised the fear level to heights not seen since the financial crisis 11 years ago. Our economic forecast assumes that businesses, consumers, and government will not enact extensive quarantines in the near-term; that in the intermediate-term the virus will peak and begin to fade as often happens in the warmer months; and long-term we will learn enough about the virus to reduce the fear of uncertainty, design better treatment plans, and develop a vaccine. We believe, that in the most likely scenario, the impact on GDP growth will be felt in the first and second quarter, with a rebound in the second half of the year. The key variables are the length and severity (how many people infected) of the virus.

Global economic growth grinds to a halt

We were looking forward to thawing trade tensions providing a much-needed boost to the global economy. Unfortunately, the coronavirus has completely offset whatever economic benefit we anticipated from lessening trade tensions. Supply-chain continuity has become the number one worry of most global companies. According to Bloomberg Economics, Chinese factories were operating at 60%-70% of capacity during the last week of February. The International Monetary Fund assumes that China can orchestrate a V-shaped economic recovery in the second half of the quarter and salvage global growth of 3%, down from previous expectations of 5%. Based on current asset prices, 3% growth would be a significant and welcome surprise to investors.

On the bright side, there is anecdotal evidence that China is already returning to normalcy. Of the companies we follow, supply chain disruptions have yet to materialize. Marvin Ellison, CEO of Lowe’s (LOW), noted that they hadn’t seen much of an interruption from their Chinese suppliers, while Walmart’s (WMT) CFO made similar comments. Meanwhile, companies operating in China are resuming operations, albeit with new safety protocols in place to protect employees and customers. Starbucks (SBUX) issued guidance that the company expects same-store sales growth in China to drop by 50% this quarter, but 90% of its Chinese stores have re-opened, with limited in-store seating, along with increased digital ordering, “contactless” payments, and delivery options. Agricultural company Cargill says all of its facilities in China reopened last week, helping to ease food shortages and price spikes across that country.

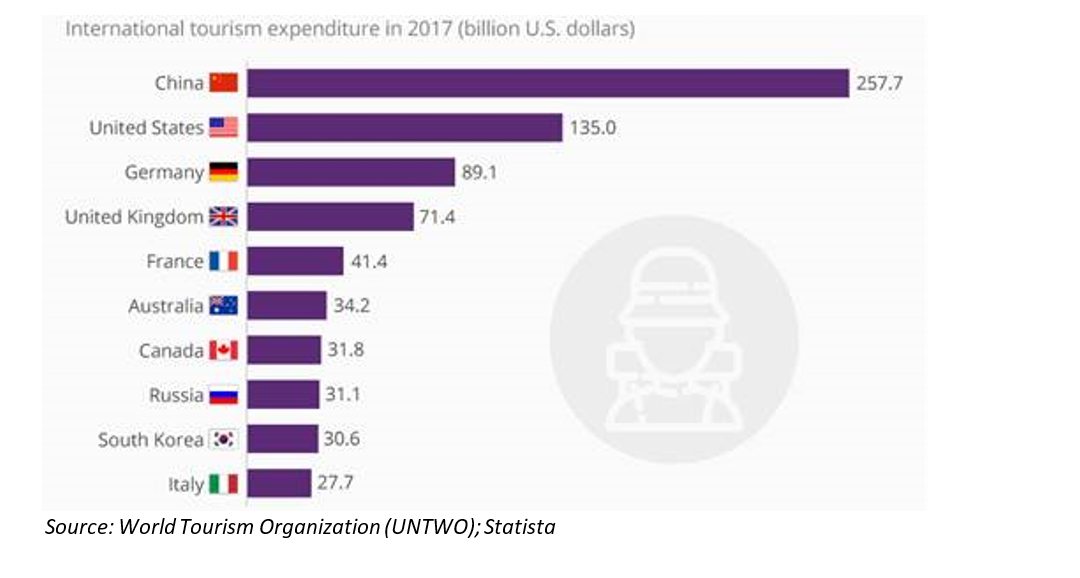

150 Million Chinese Tourists Travel Abroad and Spend Double American Tourists

Globally, economists believe tourism could take as much as a $50 billion hit as a result of government-imposed travel bans and the reduction in corporate travel. The United Nations expects tourism to decline by 1%-3% year-over-year. More than 150 million Chinese citizens traveled abroad in 2019 and spent twice as much as Americans traveling overseas. Travel and leisure companies are experiencing sharp declines in business and stocks. Disney (DIS), for example, has seen its market value drop by twice as much as the overall market this year on fears it will have to close its theme parks.

Equities have priced in a first half slowdown

History teaches us valuable lessons that deserve to be revisited during this period of extreme volatility. First, it is impossible to time the market with consistency. We have never seen empirical evidence of a market-timing strategy that consistently worked. Instead, Haverford believes investors should follow three simple rules to reduce portfolio risk.

- Regularly review portfolio holdings for positioning relative to size, valuation, and sectors.

- Periodically rebalance holdings to their target asset allocation.

- Occasionally shift target allocation to match changing life circumstances.

We believe following a plan of continual review is better than any market-timing strategy.

Investors selling in reaction to bad news are often unlikely to buy back until the news is markedly better. Markets do not bottom on good news. By the time the narrative has changed, and crisis is fading, stocks will likely be much higher than they are today.

In the long run, fundamentals are what matter most. Sell-offs can be indiscriminate, taking everything in their wake. However, long-term stock prices are based on the discounted value of a company’s prospects well into the future. Profits this year may dry up, but companies with solid balance sheets and competitive businesses should ultimately see their profits rebound, we believe as soon as the second half of 2020.

We had modeled aggregate S&P 500 earnings growth of 6.5% for 2020. This conservative estimate now appears to be too optimistic. S&P 500 earnings will likely come in slightly below $165 per share, which equates to only 2% growth. The decline in earnings growth will likely come from mostly cyclical sectors such as banks, energy, industrials, and materials.

The S&P 500 currently trades at 17.8x our revised earnings-per-share (EPS) expectation, almost the precise valuation it traded at in early January when expectations were higher. This news could be interpreted in two ways. Either the market is still too expensive trading at this multiple, or the markets have accurately priced in the first half’s earnings hit and will trade higher as soon as growth is visible again. For investors interested in income growth and protecting the purchasing power of their assets, we believe there is no better alternative to equities.

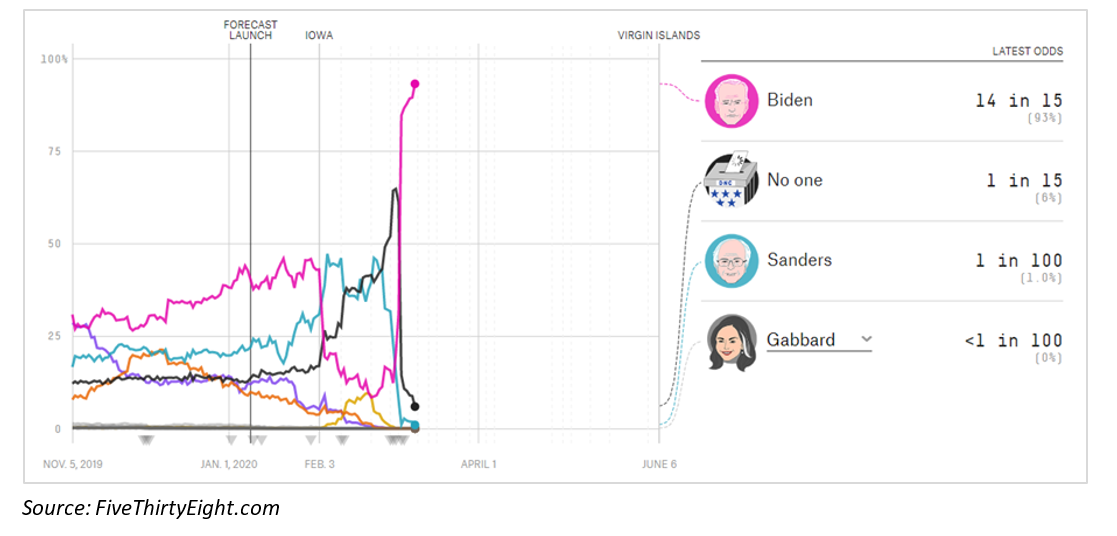

Political landscape becomes more certain

Financial markets enjoy certainty, so the coalescing of Democratic support around Joe Biden this early in the primary calendar has significantly improved political certainty. Vice President Biden is a known commodity to the markets and his views are considered more centrist than most of his primary competition. As the adage states, the market can only focus on one issue at a time. By the time the markets look past the coronavirus, the political landscape will likely be more certain than at the start of the year.

Joe Biden Is Now the Presumptive Democratic Nominee

Low interest rates will support comeback when virus fades

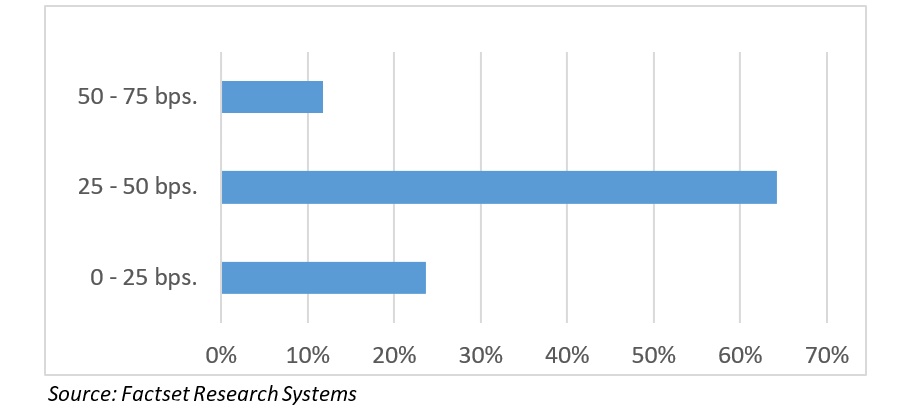

Just two months ago, we thought the Federal Reserve would stand pat throughout all of 2020. We now anticipate the Fed Funds rate will be cut by a total of 100 basis points by summer. By then the election calendar will make it very difficult for them to raise rates, even if the economy is showing greater than expected strength. While the Fed Funds rate is set by policy makers, the 10-year Treasury yield is set by the market. The decline in 10-year yields following the Fed’s surprise move on Tuesday, March 3, is a signal from the bond market on two fronts: first, the Fed’s initial 50 basis point cut was not enough, and second, in uncertain times investors are willing to pay almost anything for the certainty of Treasuries.

The Futures Market Implies a Fed Funds Rate of 25 bps by June

Low rates will not cure the virus or even help avert a recession, if that is where we are ultimately headed, but they will help support an economic and market comeback when the virus finally dissipates. We applaud the Fed for doing what they could and believe they will continue to act decisively to blunt the economic impact of the coronavirus. Monetary policy is much easier to adjust than fiscal policy, which is why the Fed is almost always first to move in an economic crisis, followed by government. Larry Kudlow, senior economic advisor to the President, has stated that large-scale fiscal stimulus is not warranted, but a case can be made for targeted fiscal programs. We expect government assistance will be made available to the travel, leisure, and retail sectors of the economy.

Bonds are benefiting from the safety trade

Market volatility has been extreme on news of increased cases of COVID-19. When considering the benefits of asset allocation, investors typically own fixed income securities as a hedge against equity volatility. Safe-haven bonds are expected to increase in value during times of market stress.

Bonds have reacted just as expected during this time of economic uncertainty. The value of the benchmark 10-year Treasury has increased 8% year-to-date as the yield on the bond dropped from 1.92% to 0.57%. U.S. investors have never had to grapple with rates this low. These rates are reflecting the worst possible news—not just bad news—and for a very extended time.

Corporate bonds have marginally underperformed Treasuries as credit spreads (the difference in yield between Treasuries and other securities) have widened. We anticipated a widening of spreads in our 2020 Outlook, highlighting the correlation benefits of mortgage-backed securities and taxable municipal bonds. We continue to favor the diversifying benefits of these two sectors of the bond market along with their lower volatility, strong fundamentals, cash flows, and underlying high-quality assets.

What will stabilize market sentiment?

Investors have had to endure a tumultuous two-week stretch. The collapse in both oil prices and yields is putting tremendous pressure on energy, industrial, and bank stocks. We believe both will need to stabilize before the stock market can regain its footing. The magnitude of the virus’ spread in the United States is still only speculation. We expect case counts will increase dramatically as test kits are made widely available in the coming week, but this does not mean the markets will react negatively. Gaining clarity on the true magnitude of this crisis, along with the effectiveness of our health system, should go a long way towards stabilizing investor sentiment.

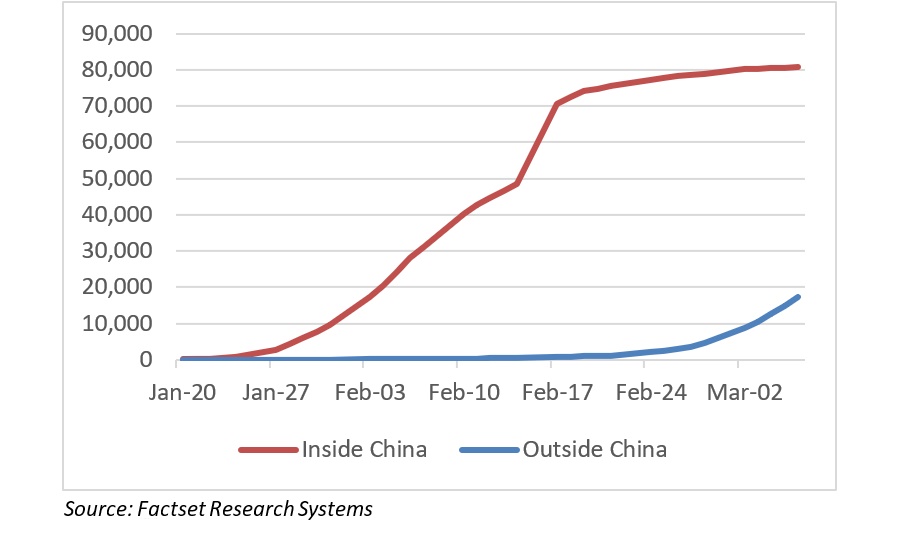

Confirmed COVID-19 Cases

This is the most quickly evolving market environment since the 2008 financial crisis, and while liquidity is not at risk, lives are. We will continue to keep our clients informed and update you more than periodically as events warrant.