Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

The Room Where It Happens

Leslie Odom as Arron Burr in the musical Hamilton

The Broadway hit Hamilton premiered on the Disney+ streaming service on Friday, July 3rd. That weekend, according to analytics firm Apptopia, there were 752,000 global downloads of the Disney+ app, 74% higher than usual. Even after watching the musical, most people probably still have no idea how influential Alexander Hamilton’s ideas have been throughout America’s history.

“The Room Where It Happens,” one of the best songs in a musical of great songs, provides the account of the Compromise of 1790 through the eyes of Aaron Burr. This dinner-table compromise between Secretary of the Treasury Alexander Hamilton, Secretary of State Thomas Jefferson, and U.S. House of Representatives member James Madison produced a settlement whereby Hamilton won the ability for the newly-formed federal government to assume states’ debts, while Jefferson and Madison were able to relocate the national capital to the banks of the Potomac. Thus, the credit of the United States was established, paving the way for citizens and foreigners alike to finance everything from the $15 million Louisiana Purchase to the $2.3 trillion CARES Act.

Thanks in large part to the CARES Act, about $5 trillion of stimulus was pumped into the U.S. economy during the second quarter, greater than the quarter’s nominal GDP of $4.85 trillion.1 This past week, Congress came to an impasse on an extension of CARES Act benefits, primarily the $600 in federal weekly unemployment benefits. At Haverford, we expect additional unemployment benefits to be extended, but at a rate closer to $400 per week. The CARES Act sequel will be almost as large as the original. We also believe extensive aid will be extended to state and local government in exchange for corporate liability protection in the face of the pandemic. Given the political rancor this weekend, negotiations may force Congress to push back their planned August 10th recess, and unlike recent stimulus bills, we believe this one will have to fail before it can succeed – a failed vote will pave the way for eventual passage. It is times like these that a political duel looks preferable to partisan bickering.

Additional items of note following a week jam-packed with news:

Corporate earnings have been very strong, reinforcing the gap between Main Street and Wall Street. Apple experienced holiday-like sales during the second quarter while Amazon and UPS both blew the doors off expectations. So far, 85% of S&P 500 companies have exceeded consensus EPS expectations by approximately 22%. Adam Crisafulli of Vital Knowledge points out that despite the huge earnings beats, 2021 earnings expectations forecasts have failed to move higher. We still expect to see downside pressure to next year’s earnings estimates. With millions unemployed and massive government stimulus expected to trail off at some point, it is only reasonable that corporate earnings will be hit.

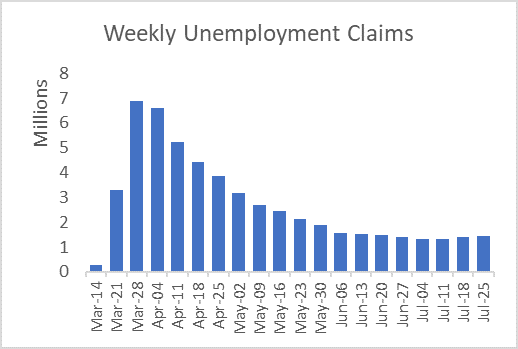

The sharp economic rebound off the depths of the Great Lockdown appears to be plateauing. Jobless claims rose for a second consecutive week. And nearly all the credit card companies have suggested consumer spending improvements are now moderating. The University of Michigan’s reading of consumer confidence also dipped in July. The spike in COVID cases in July is delaying the normalization of economic activity.

Source: Haverford Trust and Federal Reserve Economic Data

During the Federal Open Market Committee’s press conference on Wednesday, Chairman Jerome Powell stated that the central bank would soon conclude a comprehensive review of its policy-making strategy. Most Fed watchers believe that in the future Fed officials may take a more relaxed view of inflation. One way they could do this is by changing their statement of goals to say inflation should average 2% “over time.”

U.S. Dollar weakness has been notable and the source of many news reports, but there was not one question on it for Jerome Powell at last week’s FOMC press conference. The dollar’s decline and gold’s rise could be the market’s response to rising U.S. debt, but more likely is the result of falling domestic interest rates and recent flash economic data suggesting Eurozone economies are demonstrating better growth dynamics vs. the U.S. The Wall Street Journal reported this weekend that the dollar’s weakness could potentially be adding fuel to this year’s surprising stock market rebound.2

There are now less than 100 days until the Presidential election. Markets are shrugging off the potential of a Biden presidency, hoping that a new tone in D.C. will offset the potential earnings hit from higher taxes. As for this week’s potential VP selection, political strategist Dan Clifton believes the markets won’t break stride for anyone but Elizabeth Warren, whose anti-Wall Street policies are well documented. No U.S. president since Calvin Coolidge has won reelection following a recession during the final two years of their term.

1 https://www.thecarsonreport.com/post/biggest-decline-in-nominal-output-income-in-our-lifetime