Erich Hickey, CFA, Director of OCIO Services

ehickey@haverfordquality.com

Climbing the Wall of Worry

The S&P 500 hit another all-time high Friday amidst what most investors would argue as a volatile political and economic environment. The list of macroeconomic factors we have discussed with clients during recent meetings include fears of a bubble in highflying technology companies, concerns over the duration of inflationary pressures, the effect of deficit spending on long-term rates, the Delta variant, Chinese regulation, and how Afghanistan could affect the proposed stimulus and reconciliatory packages.

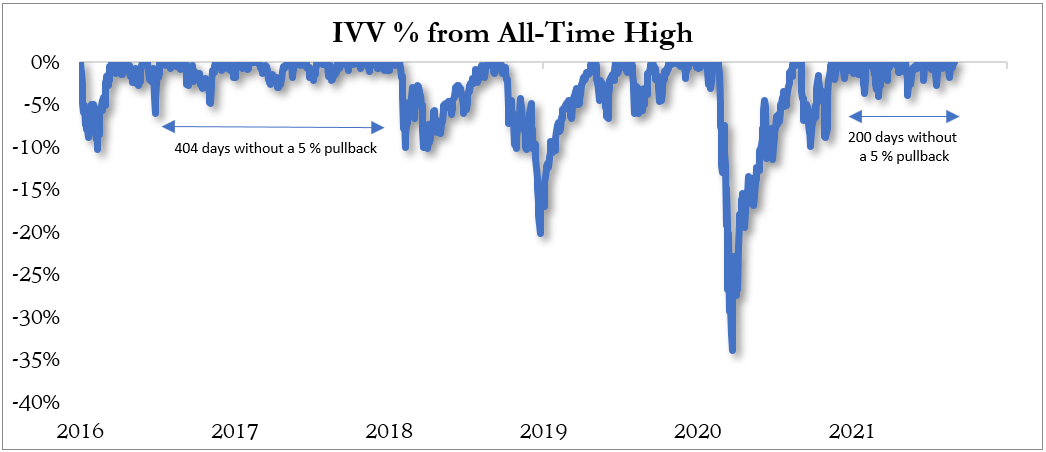

Not only have domestic equities ground higher, ignoring virtually all headlines and events, but their path upward has been remarkably steady and persistent. The S&P 500 has fallen only 6 days in August and the index has not corrected more than 5% from its peak since November 4, 2020, a period of well over 200 days. As you can see in the table below, a 200-day streak is not unprecedented, but it is also not very common. So does the macro backdrop matter right now or should we ignore it?

Source: Haverford; FactSet; IVV Composite Stock Price Index is a capitalization-weighted index of 500 stocks intended to be a representative sample of leading companies in leading industries within the U.S. economy. Index returns are provided for illustrative purposes only. Indices are unmanaged, do not incur fees or expenses and cannot be invested in directly. Past performance is not a guarantee of future results.

At Haverford, our time is spent reviewing both macro and micro data releases. The former allows us to understand where economic growth is headed, the timing of central bank actions, and potential risks that could influence our portfolio positioning. The latter is comprised of company specific data; how are firms performing individually and in aggregate. Both are valuable, but macroeconomic analysis and forecasting tends to be more subjective, biased, and downright difficult.

Howard Marks, founder of OakTree Capital Management, commented in his most recent investor letter, “Thinking About Macro” that macro forecasters consistently get it wrong. So what is best when uncertainty is high? He states, “It may be hard to admit – to yourself or to others – that you don’t know what the macro future holds, but in areas entailing great uncertainty, agnosticism is probably wiser than self-delusion.”

We agree with Howard, and in our investment process, we concentrate on what we do know and rarely make decisions solely based on macro forecasts. Currently, our convictions lie with our portfolio holdings and their ability to generate predictable long-term earnings growth. This is why we advocate remaining invested in equities despite the storm of negative headlines. While we don’t ignore macro events, we remain “macro aware” and humble in our ability to forecast the future. Recent and future data releases and events will certainly matter to both broad markets and individual companies, but it is likely these impacts will be short term and virtually impossible to predict.

As long-term investors, we strive to ignore most of this macro “noise”, focus on the facts, and remove behavioral biases and emotions from our decision making. We impart this same advice to our clients, but admittedly, it is difficult to do and can feel very uncomfortable. We look forward to discussing both the macro and micro in our upcoming Fall Outlook, and we leave you with a Mark Twain quote cited in Howard Marks’ letter that resonates both in life and investing.

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” – Mark Twain.