The Great Recalibration of Monetary Policy

By Tim Hoyle, CFA, Chief Investment Officer

The S&P 500 fell close to 3% last week as several Federal Reserve officials updated their interest rate expectations. St. Louis Fed President Jim Bullard put a 75 basis point hike on the table, while Chairman Jerome Powell all but guaranteed a 50 basis point[1] hike on May 4. To close the week, Cleveland Fed President Loretta Mester appeared on CNBC’s Closing Bell to discuss the need for a “great recalibration of monetary policy” and her wish to get the Fed Funds rate to 250 basis points by year-end. The futures market was already pricing in the almost certainty of a 50-bps hike on both May 4 and June 15. President Mester’s views were incrementally more hawkish; getting to a 2.5% rate by year-end implies the need for four 50 bps hikes.

The S&P 500 is now off more than 11% year-to-date, while the Nasdaq is close to 20% off its highs. While we believe the “great recalibration” poses the greatest risk to markets, the threats posed to the global food supply from Russia’s war, and to the greater supply chain in general from new lock-downs of Chinese cities, cannot be dismissed. A large number of investors today have yet to live through an inflationary environment, and we expect a heightened level of volatility to persist.

Volatility goes both ways – up and down. So in a week where sentiment is dour, we would like to point out three more positive highlights.

1. Earnings season is underway and overall corporate commentary has been positive, notwithstanding Netflix’s high-profile blow-up. Overall earnings expectations have risen slightly as the quarter has progressed, with aggregate first quarter earnings per share (EPS) expected to be 11.1% and the calendar 2022 EPS expected to rise 10.9%.[2]

2. Dividend hikes continue to outpace inflation. Of the high-quality, dividend-paying companies we follow, the median announced dividend increase so far this year has been 9%.

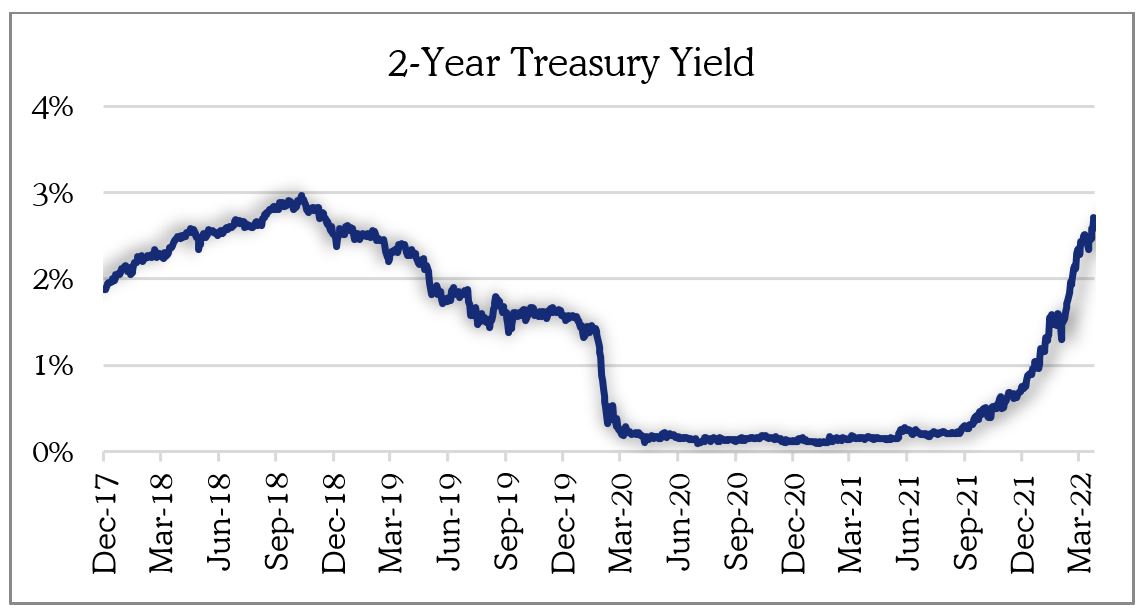

3. The Fed’s jawboning is proving successful in achieving its goal of higher interest rates and tighter monetary conditions. The 2-Year Treasury note now yields 2.7%, up from 0.7% to start the year. We believe 2-Year yields are likely to trade within a range of 2.5% to 3% for the time being, giving the economy and markets time to adjust to the “great recalibration.”

Source: FactSet

[1] A basis point (“bps”) is 1/100 of a percent

[2] FactSet Earnings Insight, April 22, 2022