Sticky Inflation Rains on the Market

By: Tim Hoyle, CFA, Chief Investment Officer

“The nicest thing about rain is that it always stops. Eventually.” – Winnie the Pooh

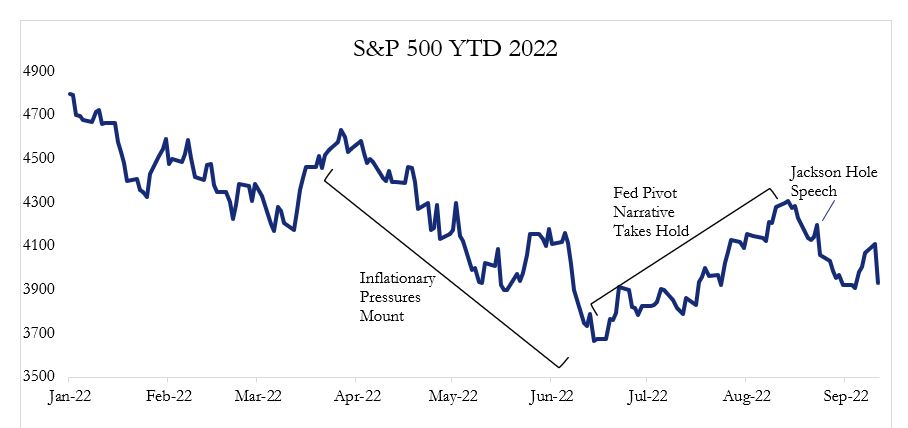

On Tuesday, markets suffered their worst one-day decline in more than two years. The S&P 500 fell 4.3% and the Nasdaq declined 5.2%, while the 2-year Treasury rate hit a cycle high of 3.7%. Following several weeks of benign inflation data, investors and markets had been hoping the all-clear signal was nigh, but inflation, it seems, will not be felled in a single month. Two weeks ago, we cautioned that markets may be underestimating the Fed’s resolve in tackling inflation. We also lamented that many current inflationary pressures are beyond the Fed’s ability alone to contain.

Source: FactSet, bls.gov, Haverford

How is it that one hot inflation headline can wipe out billions, if not trillions of dollars in market value? We all make predictions for the future based on our past experiences. Over the past 15 years investors have, for the most part, experienced V-shaped market recoveries – a market downturn followed somewhat quickly by a sustained recovery. “Buy the dip” seemed a foolproof strategy. For example, the bear market of 2018 lasted but a few months. Even the pandemic-induced bear market of early 2020 saw the markets go from all-time highs to bear market lows in less than a month, before quickly recovering into one the strongest bull markets in a generation.

Source: Haverford, FactSet

So, it’s no wonder that markets and investors continued to expect more of the same. However, yesterday’s price declines on a hotter-than-expected Consumer Price Index report is evidence that this recovery is likely to require more patience than we may be used to. Investors should not confuse news about the potential peak in inflation with an end to inflationary concerns.

Wall Street bulls believe the Federal Open Market Committee (FOMC) will stop raising the Fed Funds Rates just shy of 4%, inflation will steadily decline to below 3% and corporate earnings will prove resilient to macro headwinds. Conversely, bears anticipate that inflation will be stickier, and the Fed Funds Rate will increase to 5% and stay there for a while, and corporate earnings will eventually decline as macro-headwinds mount. Additionally, Quantitative Tightening, the process of reducing the Federal Reserve’s $9 trillion balance sheet, has just begun and could have unintended consequences on market prices.

The ultimate truth will likely be somewhere in between. We are probably entering an environment unlike the past fifteen years. Consumers, businesses, politicians, and policy makers are navigating real inflation; the so-called Fed Put has taken a backseat to more restrictive monetary policy.

It may be natural to assume that a changing environment calls for changing investments. On the margin that is likely true, but it doesn’t require a new process, especially when your investment process starts, ends, and embodies Quality. Haverford’s Quality Investing approach has never been more relevant. In a world of uncertainty, we expect to offer steadiness and continuity. Our investment philosophy and client engagement model seeks to provide our clients with long-term stability, predictability and strength. Haverford’s 5 Star Service model comprises five elements crucial to long-term staying power: Commitment, Competency, Communication, Candor and Consistency.

As we close in on yet another quarter-end, we will be providing our insights into the topics at the heart of the bull/bear debate: inflation, earnings, and interest rates. Our opinions on these topics help to frame, not dictate, our decisions making processes, particularly for equity investors. As Quality equity investors we embrace the long-term and continue to focus on companies with competitive businesses that will provide sustainable and predictable dividend growth through all economic environments. As Piglet once said to Winnie the Pooh, “Difficult Days are so much easier when you know you’ve got someone there for you.” Haverford Trust is here for you during these times.