Are you nearsighted or farsighted?

By: John H. Donaldson, CFA, Vice President & Director of Fixed Income

The global economy has proven much stronger than most believed possible over the past several months, despite negative headlines and rumors of an impending recession. Strong U.S. jobs creation has supported consumer spending. Mild weather and reduced natural gas prices have buoyed the European economy, while China’s about-face has added support to the global economy.

However, none of this positive data has had much effect on confidence. The monthly survey of U.S. consumer sentiment regarding financial prospects, known as the Consumer Confidence Index or CCI, has been a must-read for more people ever since the Federal Reserve began raising rates to combat inflation in 2022. A quick glance at the CCI release for January looked mediocre.

A current CCI above 100 means that consumers are more optimistic, with levels above 125 being strong. A CCI below 100 shows a more pessimistic consumer with weakness indicated at figures below 75. The January CCI numbers came in at 107.1. That is a solidly positive confidence level, although it doesn’t come near to the recent peak from 2018 or the all-time high at the end of the Dot Com boom.

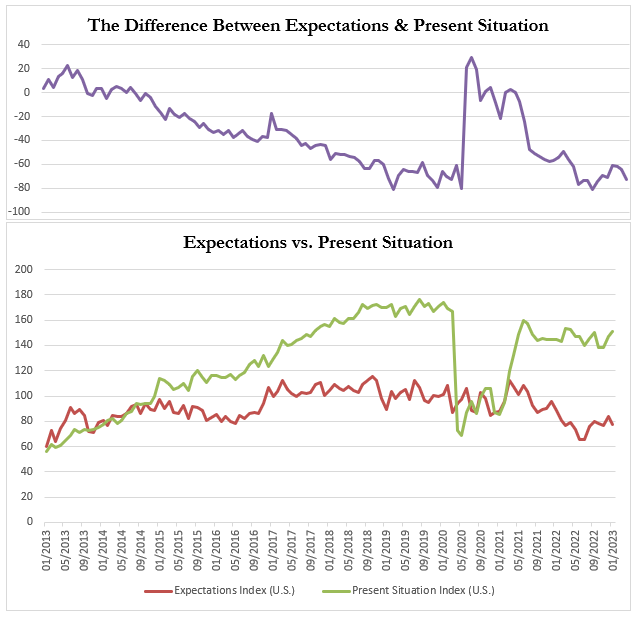

When you look at the individual constituents of the survey you can achieve a better view on how respondents are perceiving the economy. The survey regarding the Present Situation came in at a very robust at 150.9 in January. What everyone can see right in front of them looks very positive and promising. However, the survey for Expectations tells a different story. That number came back at a weak 77.8, down from the previous month. That gap between what you see today and what apprehensions you have about tomorrow is unusually wide. This spread sits 1.55x standard deviation from the median over the past 20 years.

Source: FactSet

The human response to glum headlines of job layoffs, inflation, and predicted recessions overshadows the optimistic factors, including low unemployment, high availability of jobs, and lessening supply chain problems. Our conclusion is to encourage investors to weigh all the positives we can see directly in front of us more heavily than the possible “maybes” out on the distant horizon.

While we still believe the chances of a near-term recession are elevated, the probabilities have been declining, and the odds of it being shallow and benign have increased. The trick now is to not “expect” our way into one.