Passing a Debt Ceiling Deal May be the Easy Part

Jeff Bagley, CFA, Vice President, Senior Research Analyst, & Portfolio Manager

jbagley@haverfordquality.com

Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

President Biden and Congressional leadership met yesterday for a second round of talks on a plan to raise the debt limit. Although it appears both sides are still far apart, there was progress and an agreement was reached for direct one-to-one negotiations between representatives of Speaker McCarthy and President Biden. Although the political process isn’t often enjoyable to watch, especially when there is a fair amount of brinksmanship involved, we believe a deal to raise the debt ceiling is not only the practical outcome, but the inevitable one as well.

Both sides have a vested interest in avoiding default. It’s difficult to envision either side of the aisle benefiting from what would be an extremely disruptive event for both the financial markets and the general electorate. Even the staunchest fiscal conservatives in the Republican-controlled House eventually compromised to ensure passage of their bill. Meanwhile, it’s become apparent that Democrats, who have long favored an increase in the debt ceiling with no strings attached, are actively working on a compromise as well.

The financial markets seem to agree with this assessment. Unlike what we experienced in 2011 when we had a similar political showdown regarding the statutory debt limit, both equity and fixed-income markets have not been nearly as volatile. In fact, stock and bond prices have been fairly resilient this time around. We recognize that public-opinion surveys signal a great deal of pessimism. That pessimism, however, has not yet found its way into asset prices.

We acknowledge that things can change quickly. Although we believe that a compromise is inevitable, we also believe that the real test for markets will be in the details of the deal as well as budget negotiations slated to take place later this year. Given decades-high inflation and interest rates, most of us are by now well aware of the negative consequences of excessive fiscal and monetary stimulus. It’s become much more difficult to afford the basic essentials, and the cost of financing durable goods such as automobiles and housing has risen dramatically with the increase in financing costs.

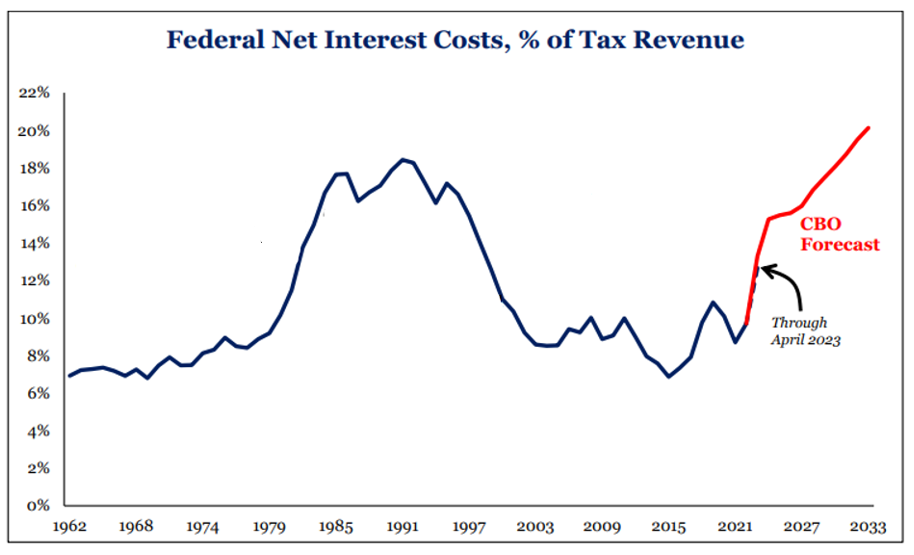

What’s more, the cost of financing the public debt has risen greatly (now approximately 13% of tax revenues), and similar to the 1980s, is expected to become a much larger portion of the U.S. Federal budget. The Congressional Budget Office projects interest payments to grow to 20% of tax revenues over the next ten years.

Source: Strategas Research Partners

Left unchecked, this could become a vicious cycle. As a higher percentage of tax revenues are directed to paying interest rather than paying down the deficit, it is likely other budget items will be squeezed and interest rates remain elevated as the government issues more and more debt. This, in turn, would likely result in more calls for higher taxes and more spending cuts, both unpopular depending on which side of the political spectrum you reside. Renowned investor Stanley Druckenmiller recently gave a keynote address on this topic to the USC Marshall Center for Investment Studies that we encourage you to read.

On a positive note, it is helpful to point out that this is not the first time we have been faced with these difficulties. Problems that once seemed intractable become solved, and the fear du jour often fades to optimism as U.S. companies again and again prove to be resilient and flexible enough to react and adapt to changes in the economic and political landscape.

Our philosophy of building diversified portfolios with a focus on the highest quality companies has served us well over the years, and we believe the future should be no different. We have taken many steps since the pandemic began to position our portfolios well for a period of higher inflation and slower economic growth. If recent earnings reports and forward guidance are any indication, our focus on companies that have strong pricing power and market positions has paid off. We have faith they will continue to adapt through future economic environments as well.