Christmas in July

Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

I first remember hearing “Christmas in July” in Sunday School, when we would collect and send presents with ample time for the missionaries to receive them in December. According to Wikipedia, this tradition started in a Baptist church in Philadelphia in the early 1940’s.

A series of positive economic surprises this July brought Christmas for the markets, with the economy seemingly headed towards a soft landing . The Dow Jones Industrial Average enjoyed its longest winning streak since 1987, rallying nearly 2000 points over 13 consecutive days, and is now just 3% from its all-time high.

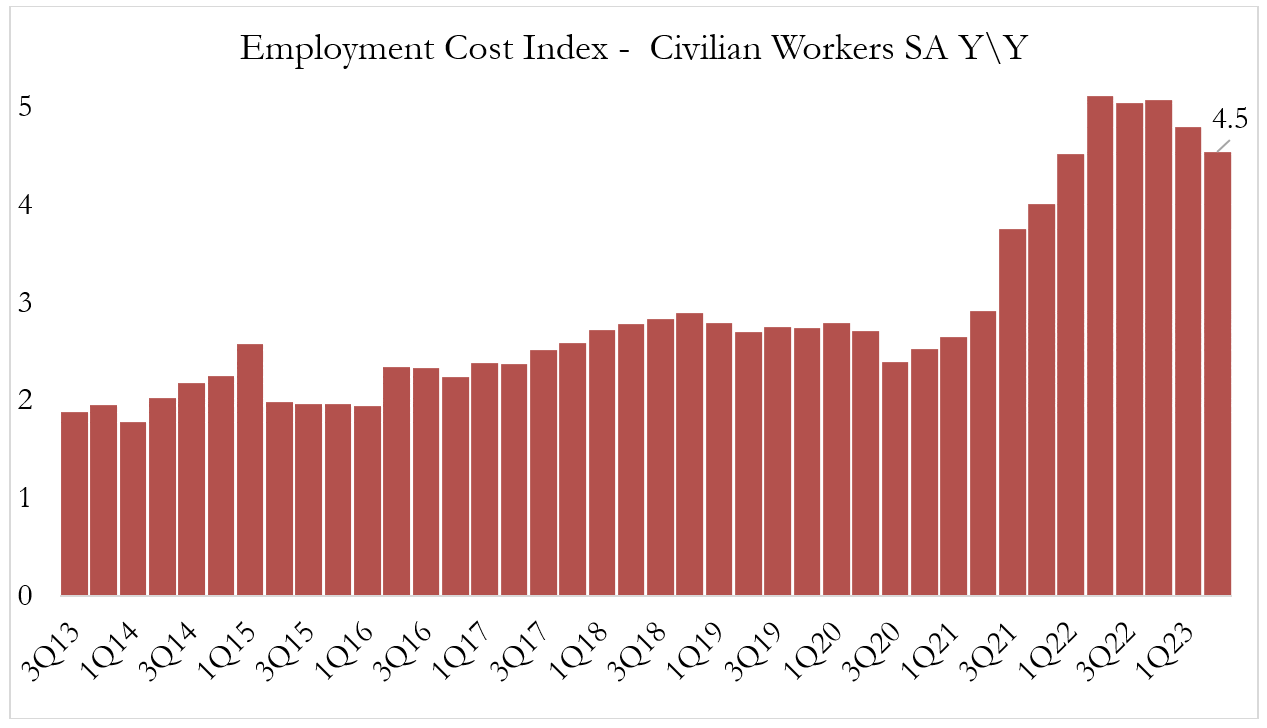

The employment cost index (ECI) stands out as one of the key data points surpassing expectations last month. Although published only quarterly, the ECI is a preferred measure of economists because it is not distorted by shifts in the composition and employment among industries and occupations. The ECI shows that quarter-over-quarter wage growth stands at 1%, while year-over year employment costs increased 4.5%, marking the slowest pace of growth since Q1 2022. This ECI reading confirms other indicators showing wage growth and overall inflation are continuing to fall.

ECI 080123

Source: FactSet

Christmas in July 2023 also brought good tidings of an anticipated soft landing. Many economists have withdrawn their recession forecasts. Goldman Sachs’ David Mericle now believes the U.S. economy is on track for a soft landing despite the likelihood the Federal Reserve will continue to raise interest rates. Former chief economist at the Department of Labor, Heidi Shierholz said, “I am optimistic that we are getting a soft landing – that we are already seeing inflation moderate dramatically and we will continue to see inflation moderate and not see a big rise in unemployment.” Jay Powell and the Federal Open Marketing Committee (FOMC) added to the optimism on Wednesday, stating that FOMC staffers had withdrawn their forecast for a U.S. recession.

At Haverford, we too have modified our outlook. Our base case has gone from, “a mild recession is likely, but not inevitable,” to “a soft landing looks achievable, but a mild recession in 2024 can’t be ruled out.”

The jobs market will continue as the crucial indicator for a successful soft landing. Labor demand (job openings) must continue to moderate alongside slowing wage growth. The yield curve remains steeply inverted and policymakers are likely to keep short-term rates high until the labor market normalizes. Eliminating job openings without destroying jobs will truly be the Christmas miracle we have all hoped for.

Earnings Update

So much attention is focused on the macroeconomic outlook that often the micro analysis is ignored. However, earnings are the lifeblood of the markets and deserve just as much attention as interest and inflation rates. With close to 50% of companies reporting, year-over-year S&P 500 earnings growth is tracking for a decline of 6%, but this is better than expected as companies are proving they have continued pricing power and are able to cut costs. Next week we will provide more insight into how the second quarter earnings season has played out so far.

Media Inquiries

Veronica McKee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value