The S&P 500 posted a 10.6% advance in the first quarter of 2024, marking the index’s strongest start of the year since 2019. The quarter also saw 22 record-high closes, a feat not seen since 1998. While the capitalization-weighted return continued to outpace the returns of the equal-weighted average stock (11% vs. 8%). Stock prices were also undaunted by rising Treasury yields. The broadening out of market participation and tightening corporate bond spreads signal a positive outlook for future returns.

The following are the key drivers of the market’s strong first quarter performance:

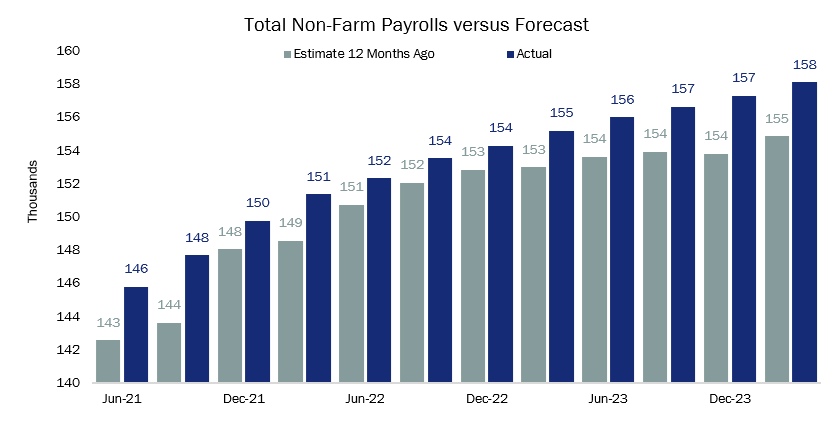

The exceptionally strong jobs market continues to consistently surpass expectations, fueling both the economy and stock market growth. The April 5th jobs report showed jobs growth exceeding expectations for the fifth straight month, and today’s employment levels far outpace economists’ expectations from a year ago. Underestimating the strength of the jobs market has been the trend for the past three years.

040924 1

Source: Factset, Haverford Trust

Despite full employment, government spending is expected to drive a 7% budget deficit in 2024. Public concern over debt levels remains low. A recent Gallup poll shows that only 3% of respondents claim it is the most vital issue facing the country. The willingness and ability of the government to continue to run high deficits will continue to drive the economy and markets, until it doesn’t.

After marginal growth in 2023, corporate earnings are projected to grow by 11% in 2024 with further acceleration expected in 2025. Possibly more meaningful than the market’s overall growth rate, the number of contributors to that growth is expected to meaningfully broadening the coming quarters. As we enter earnings reporting season, we expect to hear more evidence of this broadening out.

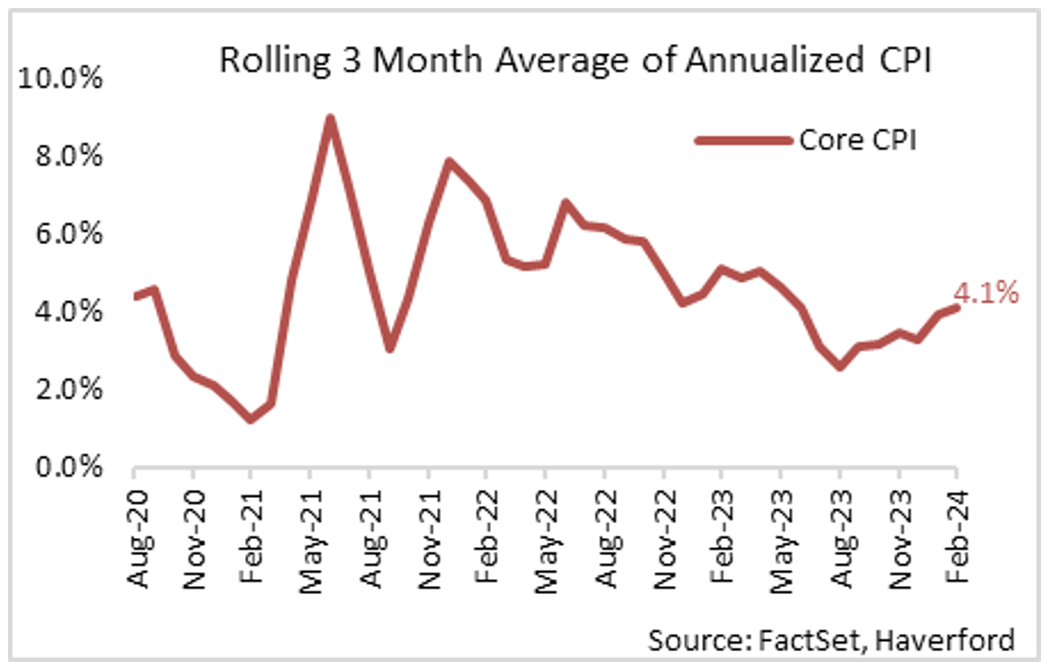

Inflation rates, which have stalled above 3%, will remain a key area of investor concern. Expectations for Federal Reserve rate cuts have abated. As of the first week in April, only two to three rate cuts are priced in by market participants, down from a high of six expected rate cuts at the start the year.

040924 2

Source: Factset, Haverford Trust

In a recent letter to JP Morgan shareholders, Jamie Dimon highlighted several reasons future inflation rates may be higher than currently expected. “It is important to note that the economy is being fueled by large amounts of government deficit spending and past stimulus. There is also a growing need for increased spending as we continue transitioning to a greener economy, restructuring global supply chains, boosting military expenditure and battling rising healthcare costs. This may lead to stickier inflation and higher rates than markets expect.”

We take Fed officials at their word, that “the job is not done” and “there’s still no rush” to cut rates. Market forecasted rates are now close to where we were to start the year: there will likely be 2-3 cuts in 2024. Higher rates have yet to put major dents in the economy. The economy’s resilience, combined with government stimulus and a broadening out of earnings growth should continue to support stock prices in the year ahead. We will remain vigilant of the ever-changing market dynamics and will always seek to align portfolios with our goals of preserving your capital, growing your portfolio, and reducing your risks.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value