August: In like Bear, out like Bull

Tim Hoyle, Chief Investment Officer

The month of August began with a near market panic before coming to an optimistic end. The S&P 500 declined 5% in just two trading days in response to double digit declines in Japanese markets and fears of an economic recession. However, by month’s end the S&P was back to within 1% of its all-time high. That early-August volatility was driven almost entirely by the unwind of financial positioning and the leveraged Yen carry trade. As we wrote at the time, the evidence out of corporate America is more consistent with a slow-growing economy than a recession. While we are seeing some cracks develop, there are three main fundamental forces supporting equity values:

Goldilocks economic data. Inflation data has remained tame for several consecutive months while the economy continues on a modest growth trajectory. Most recently, the PCE deflator showed a 2.5% increase in prices year-over year, the tenth straight month of readings below 3%. The Federal Reserve Bank of Atlanta’s GDPNow tracker’s most current estimate shows the economy growing at a 2.5% annual rate.

Fed easing expectations. In the clearest possible terms, Federal Reserve Chair Powell signaled a rate cut in September. “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks. We will do everything we can to support a strong labor market as we make further progress toward price stability.”

The FOMC’s focus has clearly shifted from inflation to labor markets, where the most obvious economic cracks appear to be developing. Unemployment has ticked up, which historically tends to rise very slowly before exploding higher at the onset of an economic downturn. Weekly jobless claims, which provide the timeliest measure of the labor market, recently came in at 231,000, only slightly higher than the average of 219,000 since the beginning of 2022.

Source: Haverford, FactSet

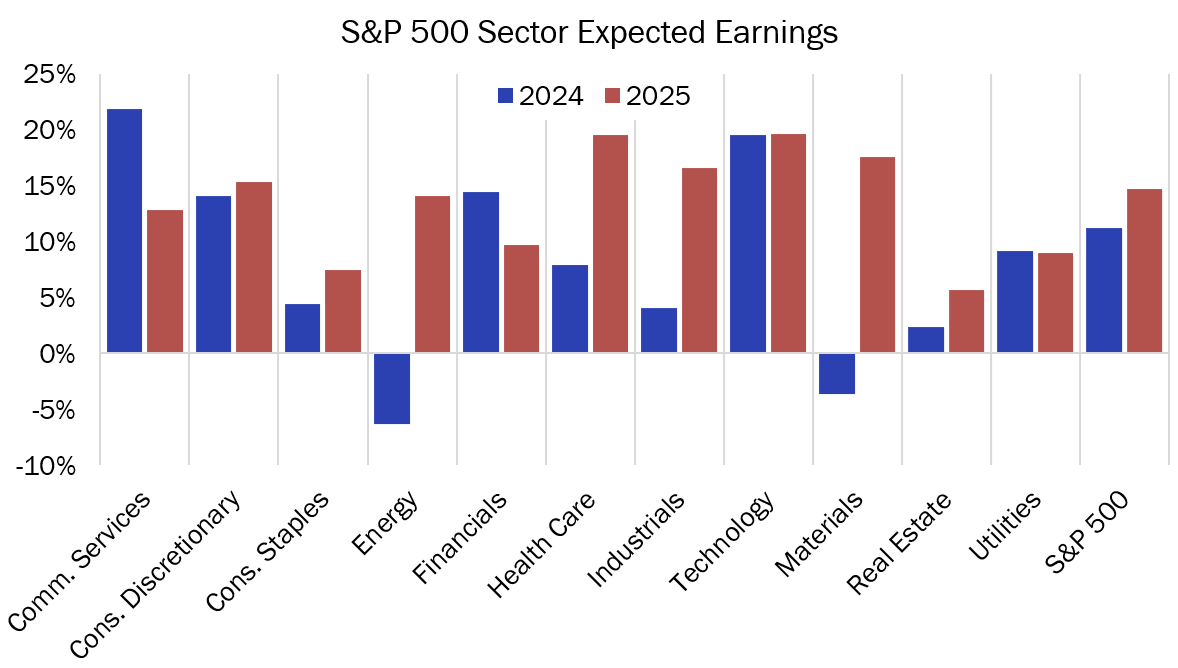

Corporate earnings. Expectations for robust earnings have not abated, with a broadening out of the beneficiaries of earning growth expected to occur in 2025. S&P 500 earnings are expected to grow by close to 11% this year, and 15% next year. Eight out of the S&P’s 11 sectors are expected to post double digit profit growth next year.

Source: Haverford, FactSet

We concur with Chairman Powell; a degradation in economic growth – no longer inflation – presently poses the greatest risk to markets. Valuations are by no means cheap and must be supported by continued earnings growth. This month we will see one monthly jobs report and two weekly unemployment claims before the Fed decides how much to move rates on September 18th. Anything more than 25 basis points may portend that growth is decelerating too quickly, that earnings expectations could be too optimistic, and the markets’ ability to trade at current multiples is called into question.