Last Week:

- U.S. equities finished positive for the week: Last week, the Dow Jones Industrial Average (Dow) gained 103 points, or rose 0.42%, to 24,463. The Standard & Poor’s (S&P500) index gained 14 points, or rose 0.52%, to 2,670. The Nasdaq closed 0.56% higher at 7,146, while the 10-year Treasury ended the week at 2.949%.

- Solid first quarter earnings season expected: According to Bloomberg, out of the 87 S&P500 companies that have reported earnings so far, 83% beat EPS estimates by an average of 7%, while 67% came in ahead of topline expectations by 2%. For the quarter, analyst expectations are for earnings to grow 18%, which would mark the highest growth rate since the first quarter of 2011.

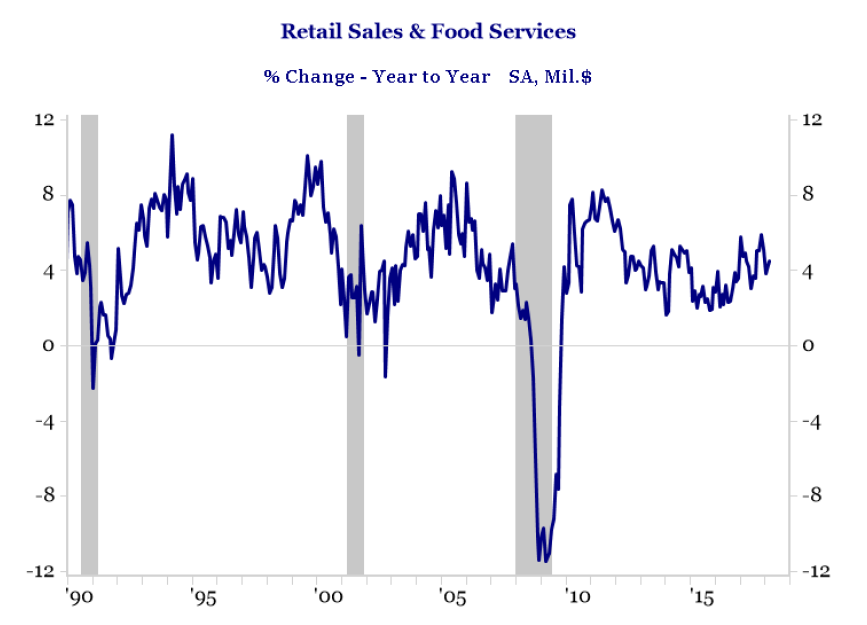

- Improving retail sales: After a weak start to the year, U.S. retail sales finally increased +0.6% from the previous month and +4.5% above March 2017. With consumer spending accounting for about 70% of the U.S. economy, this is yet another sign that despite the uncertainty from rising inflation, tariffs and Syria among others, the U.S. economy remains healthy.

Source: Strategas Research Partners, Census Bureau

Look Ahead:

- First quarter earnings season will continue as we enter the largest volume week of the reporting period. Notable reporters include, Kimberly-Clark, Alphabet, Coca-Cola, United Technologies, Comcast, Verizon, Pepsi, Amazon, Microsoft, Chevron and Starbucks among others. On the economic calendar, the week will be relatively slow with Flash PMI for U.S. and Euro-zone on Monday morning, and U.S. consumer confidence on Tuesday. On Thursday, the European Central Bank (ECB) will hold its policy decision, and on Friday, we will see the Bank of Japan (BoJ) policy rate decision, as well as a first look at U.S. first quarter Gross Domestic Product (GDP) estimates.