Last Week:

- U.S. equities finished positive for the week: Last week, the Dow Jones Industrial Average (Dow) gained 569 points, or rose 2.34%, to 24,831. The Standard & Poor’s (S&P500) index gained 64 points, or rose 2.41%, to 2,728. The Nasdaq closed 2.68% higher at 7,403, while the 10-year Treasury ended the week at 2.97%.

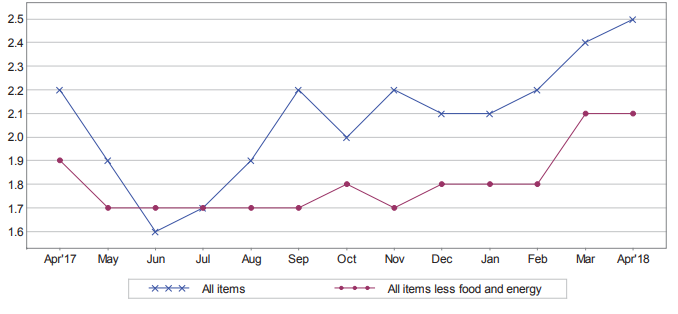

- Inflation/Fed: Last week, The Bureau of Labor Statistics reported inflation (as measured by the Consumer Price Index – CPI) rose +0.2% during the month of April, coming in below expectations of +0.3%. Although gasoline and rental accommodation costs rose during the month, a moderation in healthcare prices helped restrain the April numbers. This week’s inflation miss follows the previous week (5/4) where we saw the Fed’s preferred inflation measure, core PCE (Personal Consumption Expenditures – less food and energy), also come in below expectations. Nonetheless, directionally, the expectation is for inflation to keep firming and investors will continue to monitor it closely.

12-Month % Change in CPI for All Urban Consumers, not seasonally adjusted

Source: Bureau of Labor Statistics

Look Ahead:

- First quarter earnings season continues to wrap up with notable reports from, Home Depot, Macy’s, Cisco, J.C. Penney’s, and Campbell Soup Co. among others. On the economic calendar, the week will be relatively slow with retail sales data on Monday, May Empire State Manufacturing Survey on Tues, U.S. Housing Starts on Wednesday, and The Conference Board’s index of Leading Economic Indicators on Thursday.