Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

Looking Ahead to Earnings Season

As of Tuesday morning, July 15th, second quarter 2025 earnings reporting season is off to a solid start with several high-profile financial stocks announcing results that exceeded expectations. S&P 500 second quarter earnings are expected to grow 4.5% year-over-year, with earnings growth accelerating into the second half of 2025. Overall, investors expect corporate earnings to grow 9% in 2025, and 14% in 2026, on top of last year’s 11% earnings growth. This positive earnings forecast is one of many supporting factors propelling markets to all-time highs.

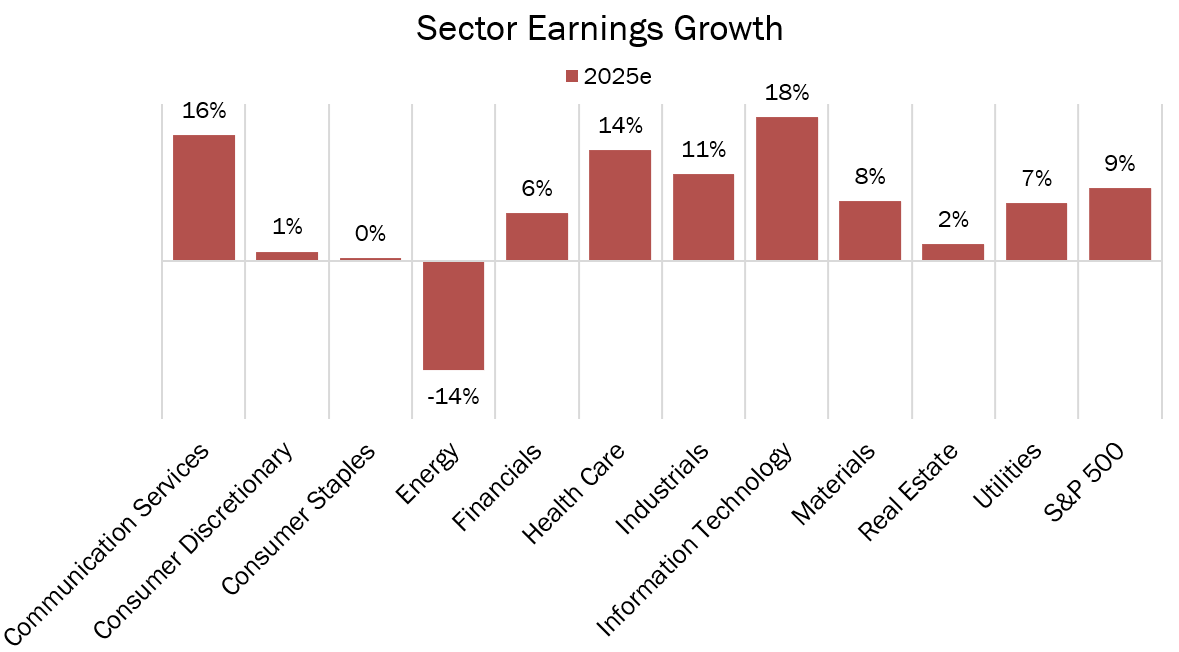

Sector Earnings Growth

Source: Haverford

Similar to last year, earnings growth is being driven by the technology sector and companies adjacent to the boom in AI capital expenditures. The Mag 7 stocks, a good proxy for AI plays, are expected to grow earnings by 17% this year while the rest of the market grows corporate earnings by 7%. Moving forward the spread between this small group of stocks and the other 493 in the S&P 500 is expected to continue to narrow next year, but the disparity will likely remain. Earnings growth is the ultimate driver of stock prices. As long as earnings remain healthy, investors feel they can remain optimistic for the year ahead.

Annual Earnings Growth

Source: Haverford

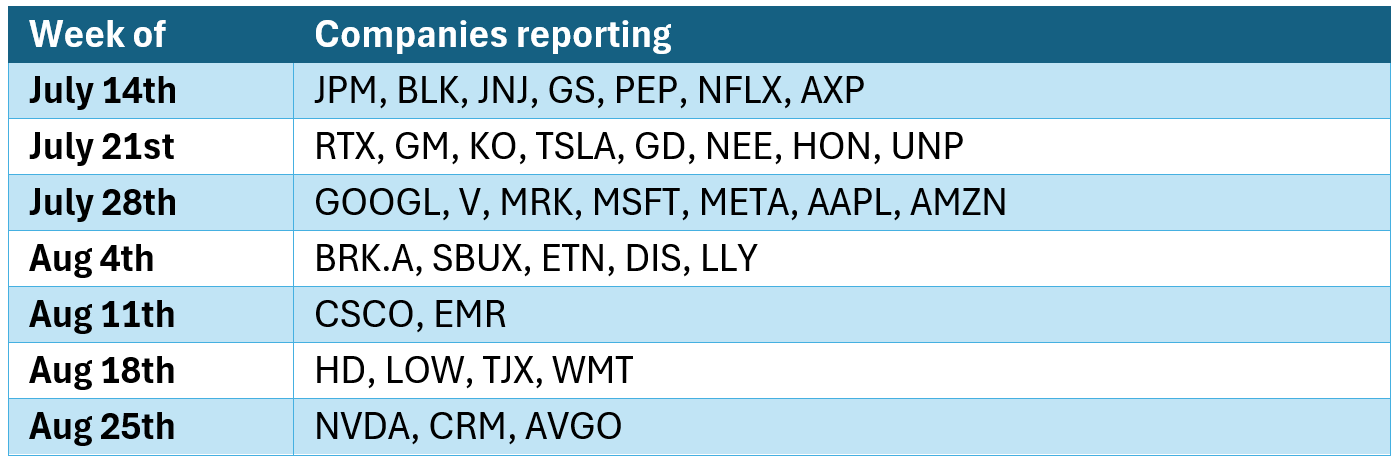

Calendar of notable companies Q2 2025 Report Dates

Earnings Reports

Source: Haverford

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value