Thomas Bayer, Jr., CFP®, MT

Senior Wealth Planner

One of the greatest gifts or legacies you can provide to your loved ones is the gift of education. Such a gift not only provides them with the tools to succeed, but you’re also investing in a better future for your heirs.

While seeking a higher education has become commonplace across the globe, a universal question remains, “How do we pay for it?” With student loan debt in the U.S. topping over $1.75 trillion, families are looking for ways to optimize funding for higher education and minimize the debt burden. The following article will cover ways to boost savings for higher education and provide options for those late to the game.

The “Great Debate”:

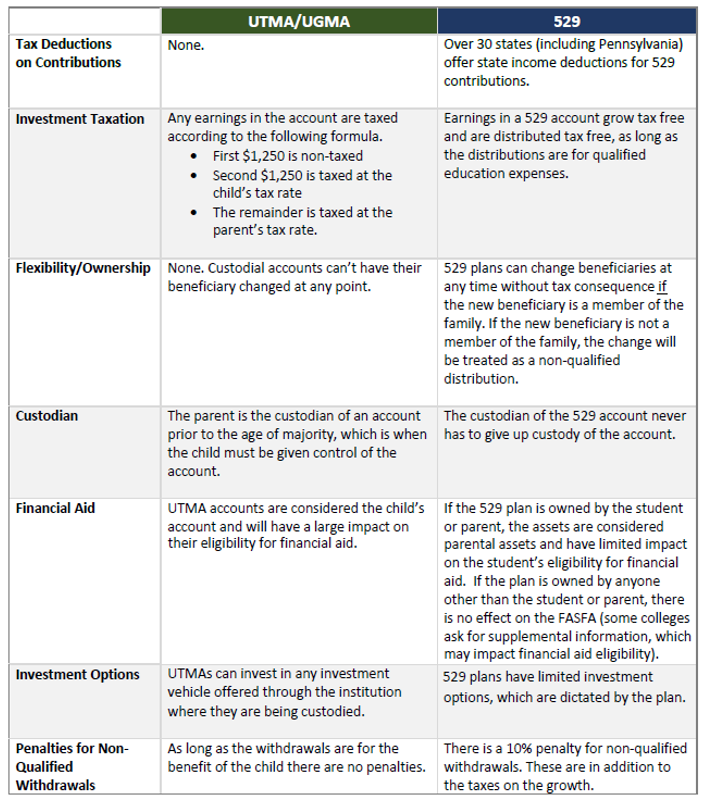

The most common savings vehicles for higher education are 529 plans, UTMA and UGMA Custodial Accounts, and Coverdell Education Savings Accounts (ESA). Although Coverdell ESAs provide tax-free investing and withdrawals for qualified education expenses, it is generally out-of-favor compared to 529 plans and custodial accounts due to the low annual contribution limits and age distribution parameters. The two primary options remaining have sparked a debate, and it is important to compare the features of each vehicle:

Uniform Transfers to Minors Act (UTMA) vs. 529 Plans

Both UTMA and UGMA’s and 529 plans are subject to the same annual funding limits to avoid gift tax return filings. While 529 plans are subject to lifetime funding limits, these accounts can be “front-loaded” with no gift tax consequences. This is an approach where two parents can contribute up to five years’ worth of gifts within one year ($170,000 for 2023) without using any of their lifetime gift exemption. This can be a great strategy to maximize tax-deferred growth. With the chance of a child receiving a scholarship, or deciding not to attend college at all, parents and guardians could be at risk when only saving within a specified education savings vehicle like a 529 plan. However, we believe the flexibility and tax-advantaged nature of 529 plans far out-weigh those of UTMA and UGMA’s.

To demonstrate the flexibility, we have two children whose parents saved the exact same amount in separate 529 plans. The older child, Sam, decides to go to a state school and the younger child, Sally, decides to go to a more expensive private school. Since Sam went to a state school, his respective 529 plan was overfunded, leaving excess funds. Sally, who went to a private school, did not have enough funds in her 529 plan and fell short. Their parents, however, were able to change the beneficiary of Sam’s 529 plan and re-route those funds to Sally. If both Sam and Sally went to state schools, the funds could remain in the account, growing tax-deferred, and eventually used for their children’s education.

Recently enacted legislation under the Setting Every Community Up for Retirement Enhancement Act (SECURE Act), and its successor, SECURE Act 2.0, have provided additional features to 529 plans:

- $10,000 of 529 plan funds can be used to pay down student loans.

- Each year, a child can use $10,000 for private elementary or high school education.

- 529 plans that have been opened for 15 years or more can convert an aggregate $35,000 to a Roth IRA for the 529 plan beneficiary. The beneficiary must have earned income and is subject to the annual IRA contribution limits.

529 plans can also be a great estate planning tool for grandparents who are looking to minimize federal estate and state inheritance taxes. Using our front-loaded 529 method mentioned earlier, two grandparents with five grandchildren can gift $850,000 into their grandchildren’s 529 plans in one year without any gift tax consequences. [1]

Additional Ways to Save:

Outside of the common savings vehicles discussed above, there are many other ways you can prepare for higher education:

- Traditional Savings Accounts and CDs: Parents can save for college in traditional savings accounts or certificates of deposit (CDs) offered by banks. While these options may not offer the same tax advantages and growth potential as specialized college savings plans, they provide liquidity and flexibility.

- Investment Accounts: Parents can consider investing in brokerage accounts, such as individual or joint investment accounts, to potentially grow their savings over time. These accounts offer more flexibility in terms of distributions and investment choices, but it’s important to consider the tax implications and risks associated with investing in the financial markets.

- Permanent Life Insurance Policies: Certain life insurance policies, such as whole life insurance or variable life insurance, may accumulate cash value over time, which parents can use to help fund their child’s college education. Cash value can provide favorable reporting on the Federal Application for Student Aid (FAFSA), however, it’s crucial to carefully evaluate the terms, costs, and benefits of such policies before considering them as a college savings strategy.

- Employer-Sponsored College Savings Plans: Some employers offer college savings benefits as part of their employee benefits package. These programs may provide matching contributions or direct contributions to a 529 plan or other savings accounts. Check with your employer to see if they offer any college savings programs.

- Distribution from retirement accounts: Retirement account distributions for education should be considered as a last resort, if at all. Even though distributions from traditional IRAs, used for education related expenses, can be withdrawn penalty-free, there are still income taxes to be considered. Similarly, funds within a Roth IRA can be distributed, however, only the earnings would be taxed. In both scenarios, leaving the funds within the retirement accounts, growing tax-deferred, is usually the best choice.

I forgot to save, now what?

An old saying asserts, “The best time to plant a tree was 20 years ago, and the second-best time is now.” Likewise, it’s important to start saving for higher education as early as possible to utilize the power of compound growth to maximize savings. However, saving for college can be tough while balancing other financial goals. In the event you were unable to prepare for higher education expenses, let’s review some alternative options:

- Gifts from family members: The annual gift exclusion for 2023 is $17,000 per person ($34,000 per couple). However, when family members pay tuition directly to an accredited institution, there is unlimited gift tax exclusion. Paying the institution directly should always be considered rather than an out-right gift.

- Scholarships: Scholarships are merit-based or need-based financial awards that do not require repayment. They can be offered by universities, private organizations, companies, or government agencies. Search for scholarships that align with academic achievements, skills, talents, or background. Numerous websites and scholarship search engines can help you find opportunities.

- Grants: Grants are typically need-based and provided by the government or educational institutions. The most well-known grant is the Federal Pell Grant, which is awarded based on financial need. Research and apply for grants specific to circumstances and field of study.

- Work-Study Programs and Internships: Many colleges offer work-study programs providing students with part-time employment opportunities on campus. These programs allow you to earn money to cover educational expenses while gaining valuable work experience.

- Employer Tuition Assistance: Some employers offer tuition assistance or reimbursement programs as part of their employee benefits. Check if your employer provides such benefits and inquire about any available educational assistance programs.

- Funding through cashflow: In the absence of a family member with means, or a full ride from scholarships or grants, the next step is to review the sufficiency of your budget to handle the education expenses. Many institutions offer tuition installment plans that allow you to pay your tuition in smaller, more manageable monthly installments rather than a lump sum.

-

- Business Owners: If you own a business, you can hire your child as an employee, provided they have job duties and responsibilities. This not only provides your business with a tax deduction, but it also allows your child to pay education expenses, establish credit, and begin to fund retirement accounts with any excess.

- Borrowing from Family Members: While financial transactions between family members can sometimes cause tension, the use of intra-family loans can be a great way to obtain lower than market interest rates. In some scenarios, this can be set up as a self-cancelling installment note that can be forgiven through annual gifts.

- Federal Student Loans: The U.S. Department of Education offers federal student loans with favorable terms and interest rates. Start by completing the Free Application for Federal Student Aid (FAFSA) to determine your eligibility. Federal loans often have more flexible repayment options compared to private loans. Federal student loans are available for both students (Stafford) and parents (Parent Plus).

- Borrow against real estate: Depending on the interest rate environment, it could make sense to borrow against real estate with a cash-out refinance, second mortgage, or home equity line of credit. The first two options could provide additional tax benefits through Schedule A deductions when itemizing. While the line of credit would not provide any tax benefits, it provides more payment flexibility.

- Private Student Loans: Private loans are provided by banks, credit unions, and other financial institutions. While they can fill the gap when other options are exhausted, it’s important to be cautious with private loans due to potentially higher interest rates and less favorable terms. Compare different lenders and carefully review the terms and conditions before committing to a private loan.

Planning for education is complex and there are many nuances. Whether you have a newborn, a child in private school, or a rising college freshman, there are many options to consider, and it’s important to carefully evaluate the long-term impact of each. If you haven’t already, reach out to your Wealth Planner to determine the optimal strategies based on your individual goals and circumstances; your children, grandchildren, and/or nieces and nephews will be sure to appreciate it.

[1] If the gifting individual passes within five years following the gift, the gift will be prorated based on the annual exclusion and the difference would be factored into the estate tax calculation of the decedent.

The information provided is not intended to be and should not be construed as legal or tax advice. Haverford does not provide legal or tax advice. You should consult with your legal or tax advisor regarding your specific tax situation prior to taking any action based upon this information.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value