Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

What is a Brand Worth?

The top corporate brands in the world are a who’s who of multinational corporations with loyal customers built across years of successful innovation and customer service. Warren Buffet compares a strong brand to a moat around the business, keeping rivals at bay.

The current tariff policy and the uncertainty around its rollout runs the risk of triggering an economic slowdown in the near-term. In the long run an even more detrimental outcome is possible: brand U.S.A. may deteriorate.

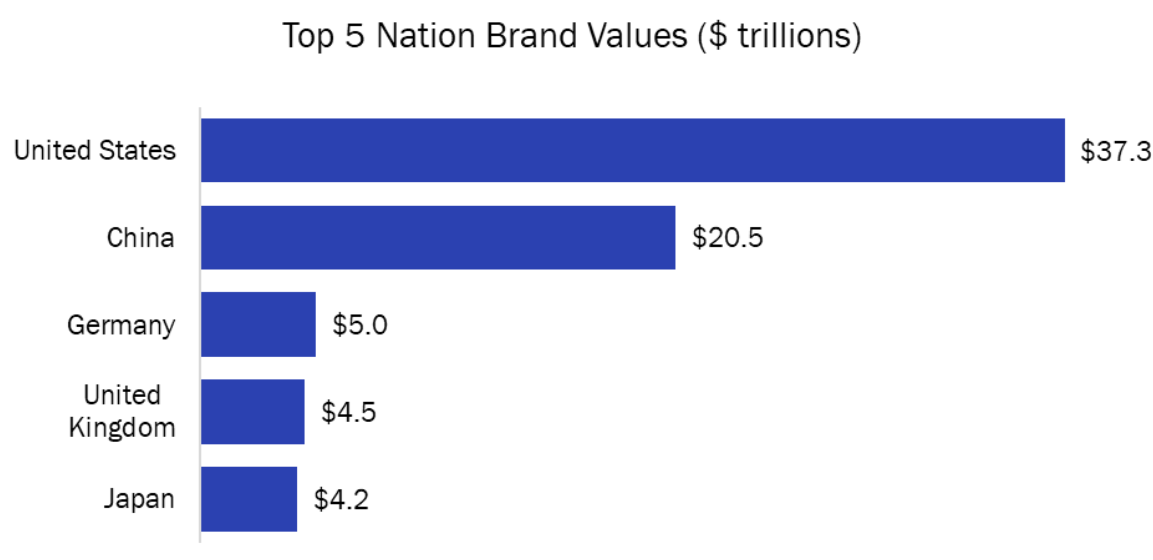

According to Interbrand, in February of 2025, Apple’s $500 billion corporate brand value topped the list as the world’s most valuable brand. Brand Finance estimates the value of the United States brand at $37 trillion, almost double that of China’s $20 trillion.

Top 5 Nations Brand Values

Source: Brand Finance, as of February 2025

A nation’s brand is built on factors such as economic strength, global influence, cultural impact, innovation, and stability. Much like trust, a brand’s value is built over decades but can be eroded much more quickly. While the U.S. brand value has increased consistently over the years, its soft-power ranking has been slowly eroding according to Brand Finance. “There has been a noticeable decline in key pillars that underpin Reputation, particularly Governance…. For the third consecutive year, there has been a decrease in perceptions of ‘political stability and good governance’.”[1] Instability, real or perceived, could begin to weaken the country’s brand in the future.

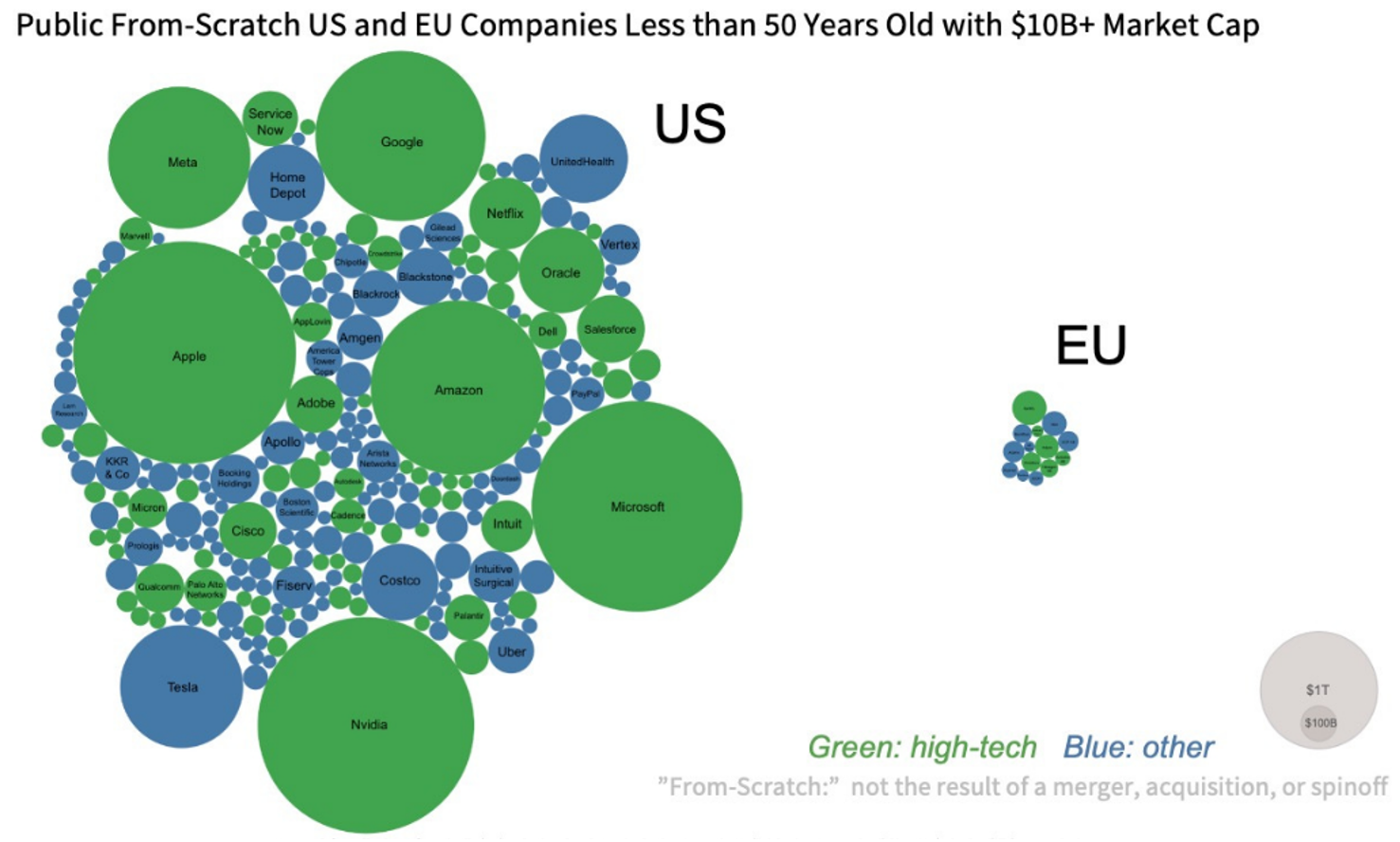

The dominance of the U.S. as a place to do business is most apparent in the accompanying graphic created by MIT professor Andrew McAfee. America is a hotbed of innovation, business formation, and value creation. The value of public American companies founded in the past fifty years was worth close to $30 trillion dollars as of year-end, almost 70 times as much as those created in Europe.[2] The U.S. Dollar is the world’s reserve currency. The U.S. attracts more capital and talented immigrants than any other nation.

U.S. & European Market Cap

Source: Andrew McAfee, MIT

Tariffs and more restrictive trade policy alone are probably not enough to significantly erode our brand equity, however the herky-jerky nature of tariff policy could be. It took seven days, wild equity markets, and a vertiginous rise in treasury yields, before the President walked back the punitive “reciprocal” tariff rates on all trading partners except for China. Where we stand now is a 10% tariff rate on imports from most countries while we aggressively deal with China’s trade practices. It appears that the only bipartisan consensus we can find in Washington is the need to decouple from China.[3]

While broad based tariffs and a China trade war are far from a preferred outcome for free-trade economists, we do not believe these tariffs rise to the level of crippling the U.S. brand. There are more chapters to be written in this tariff saga, but for now we are pleased to see that the administration is moving in the right direction. We both hope and expect to see negotiations with our trading partners further bring down tariff rates.

[1] Global Soft Power Index 2025: The shifting balance of global Soft Power | Brand Finance

[2] A Visualization of Europe’s Non-Bubbly Economy

[3] For the non-consensus view on why we should be wary of divorcing from China, listen to the Ezra Klein Show with Thoman Friedman. Why Trump Could Lose His Trade War With China | The Ezra Klein Show – YouTube

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value