Reports of the Dollar’s Demise are Greatly Exaggerated

By: Tim Hoyle, CFA, Chief Investment Officer

Saudi Arabia and China have recently accelerated yearslong negotiations to price oil contracts in Chinese yuan. These plans are consistent with China’s long-term goals to internationalize the yuan and chip away the U.S. dollar’s economic hegemony. Combined with crypto currency, China/Taiwan tensions, fearmongering in the debt ceiling debate, inflation, and seemingly ineffectual sanctions against Russia, it’s no wonder the dollar’s place in the world is being questioned.

We are confident the dollar’s dominance will not be waning anytime soon for several reasons, chief among them:

- The U.S. system values the rule of law, with strong property rights. Contrast our treatment of billionaire entrepreneurs (which may err too far towards idol worship) with China’s approach to Alibaba’s founder, Jack Ma.

- The U.S. has the world’s most vibrant and diverse economy, which attracts both investors and human capital, and most importantly, allows that capital to flow freely. Thus, the dollar is trusted and widely accepted for the vast majority of international trade and transactions. In a recent commentary, Marc Chandler of Bannockburn Global Forex, wrote:

“Focusing on how oil transactions are denominated confuses the key to the dollar’s role in the world economy. It also misunderstands what has happened over the past 40 years. Put simply, if crudely, the market for money outstrips the market for goods by magnitudes.

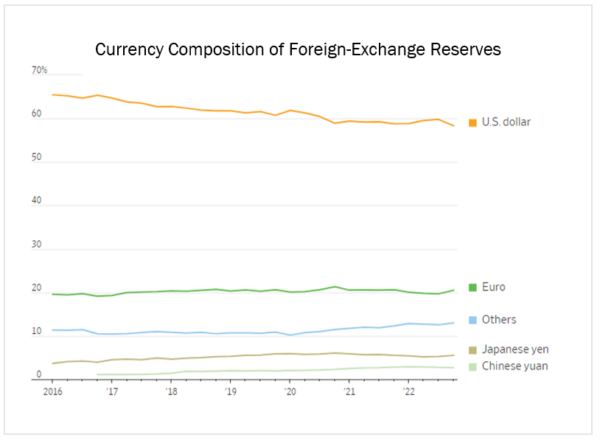

The Bank for International Settlements estimates that the daily turnover in the foreign-exchange market is $7.5 trillion. Global trade for all of last year was about $32 trillion. The dollar is on one side of 88% of currency trades, little changed from 1989 (when the dollar was one part of 90% of currency trades). China may be the most important trade partner for more countries than the U.S., but the dollar’s role remains paramount[1].”

Source: FactSet

There is no question that China wishes to challenge the dollar and become the world’s preeminent power. However, that stands almost no chance of happening as long as China maintains the yuan’s floating peg against the dollar. The Saudi riyal is also pegged against the dollar.

The biggest threat to the dollar’s status comes from within. Winston Churchill aptly stated in a 1944 speech, “The foundation of a sound currency is sound public finance, and behind that lie national effort and national unity. But the elements of our financial strength are many; they include a balanced budget, a strong bank system, sound and stable monetary institutions, wise public investments, and a faith that the resources of the country can be developed and applied to the fullest extent in the national interest.” Thus, the U.S. dollar will remain the reserve currency for as long our elected officials and policy makers make the necessary prudent decisions.

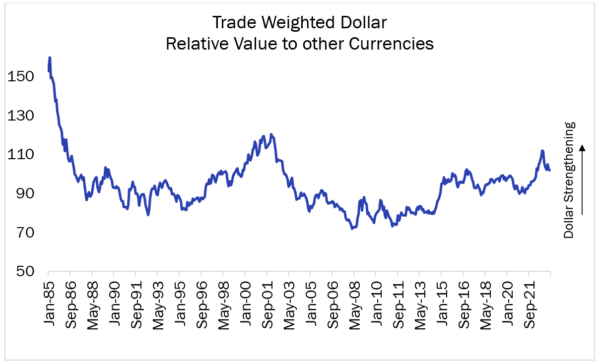

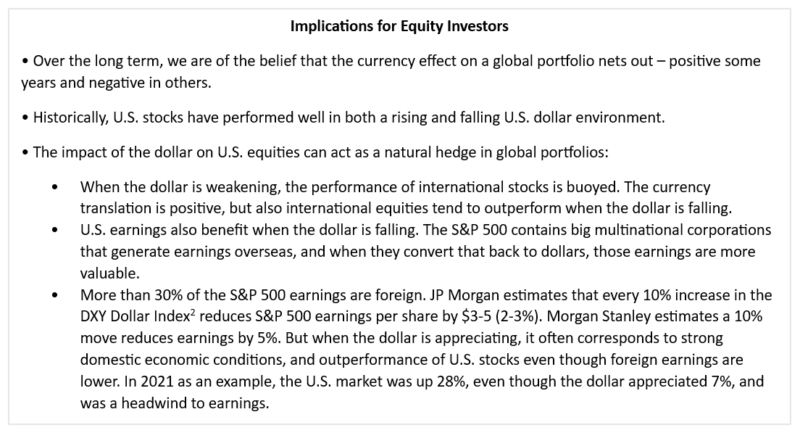

The dollar’s dominance as a reserve currency should not be confused with its relative value. A key factor of the dollar’s appeal is its free-floating nature. Being a reserve currency comes with many benefits, but it also comes with notable curses. A reserve currency must be able to be held by other nations in “reserve,” which means the U.S. has to run current account deficits, something we are very good at! It also allows for budget deficits with little or no near-term consequence. These deficits ultimately undermine the currency’s value, creating something of a dilemma.

Source: International Monetary Fund

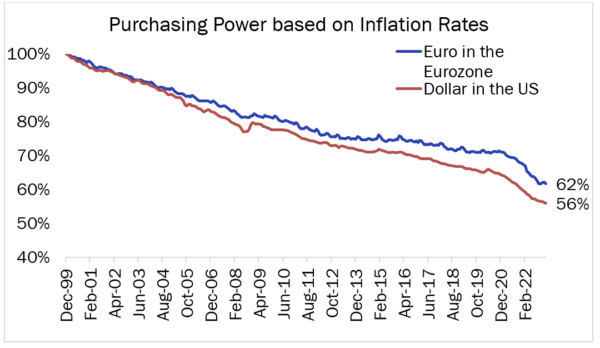

Inflation will also continue to diminish the dollar’s purchasing power, which is why long-term investors seek out assets with pricing power. And the dollar will continue to fluctuate in relative terms against the world’s other free-floating currencies. Foreign exchange values are always relative and revert to long-term means, which is why there are no currency investors, just traders.

*One unit of currency purchases 56% of the goods and services relative to 1999

Source: FactSet

[1] China’s Yuan Is Globalizing. But Only Washington Can Dethrone the Dollar. | Barron’s (barrons.com)

[2] Index of the value of the United States dollar relative to a basket of foreign currencies.