Noah Fisher, CFA, Senior Research Analyst

nfisher@haverfordquality.com

The saying ‘sell in May and go away’ is an axiom that suggests the stock market gets most of its gains between November and April. While many of us take it easy in the summer months, that is not always the case for the markets. With 2nd quarter earnings season nearly concluded, investors are curious what insights were gleaned from the companies who reported over the past several weeks and how those reports and market reactions reflect inflationary pressures, jobs, and other economic indicators.

Quarterly earnings allow us to see how economic trends are impacting corporations. At the same time, management teams provide insights that may portend future economic conditions. Headline macroeconomic trends investors were interested in this quarter include inflation, the health of the banking industry, and the corporate growth outlook for the remainder of the year.

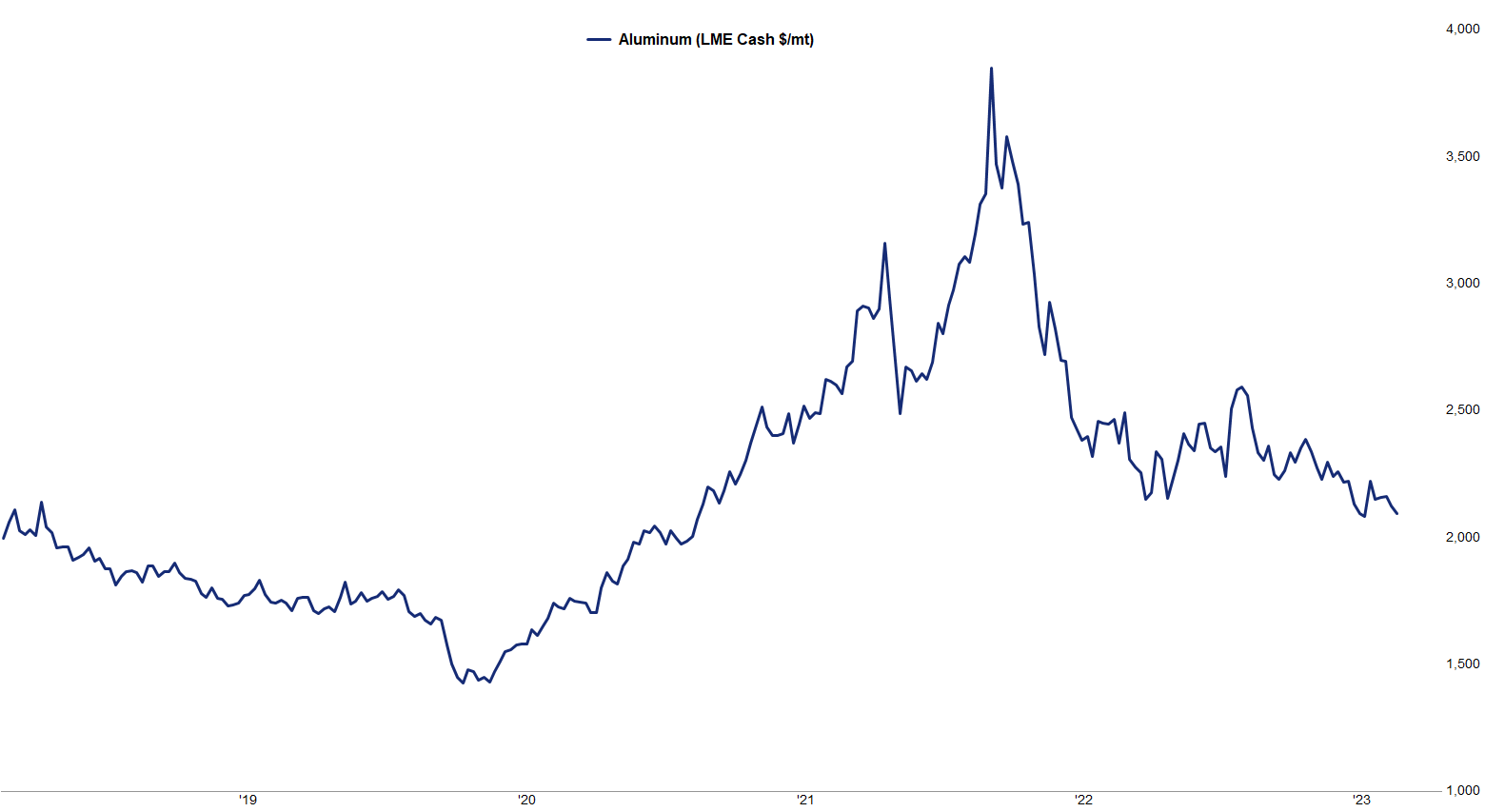

Economic indicators for inflation improved throughout the first half of 2023 as prices of many raw materials stabilized and even decreased. The cost of goods directly impacts not only the consumer, but companies that heavily rely on raw materials. Industries such as chemicals, industrials, and housing have reported improving trends in the cost of materials they use in manufacturing including lumber, metals, and plastics for example. If that continues, it bodes well for improving profit margins in the second half of 2023.

Material Prices Moderate: Aluminum Costs

weekly highlights 081423 7

Source: FactSet Research Systems

It’s hard to forget the banking industry volatility of the first quarter as a few regional banks facing liquidity issues were taken over by the FDIC, then subsequently sold to larger banks. In Q2 investors examined earnings reports from the banking industry, scrutinizing the health of balance sheets, available liquidity, and deposit and lending trends. Overall, investors viewed bank results as “good enough” and not to be signaling distress in the broader economy.

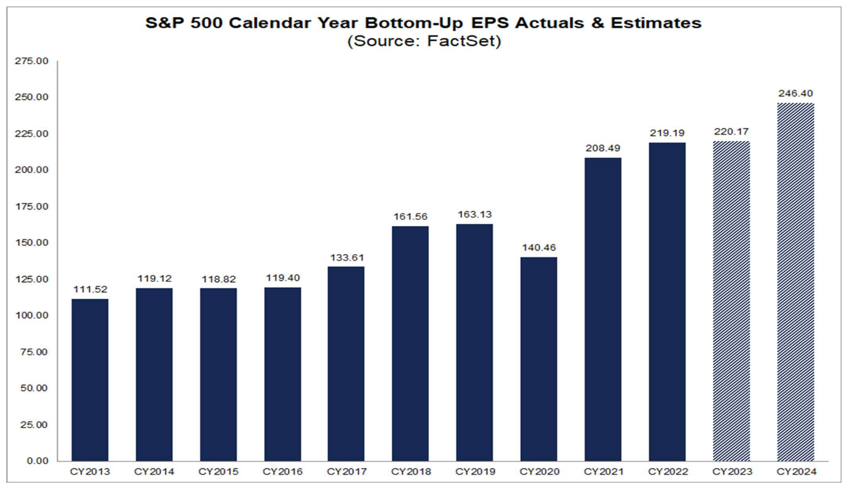

Lastly, investors sought to gauge both company prospects and the strength of the economy. The economic data throughout the second quarter of 2023 had shown a healthy labor market with full employment and good, but slowing, economic growth. Many companies in the technology, consumer discretionary, industrials, and financials sectors reported better than expected results while maintaining or decreasing their guidance for the remainder of the year. This has resulted in a small, but growing, year-over-year increase in S&P 500 earnings estimates for 2023 with potential for earnings to accelerate in 2024.

weekly highlights 081423 6

Source: FactSet Research Systems

Media Inquiries

Veronica McKee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value