The Markets Expect a Fed Pivot

By: Tim Hoyle, CFA, Chief Investment Officer

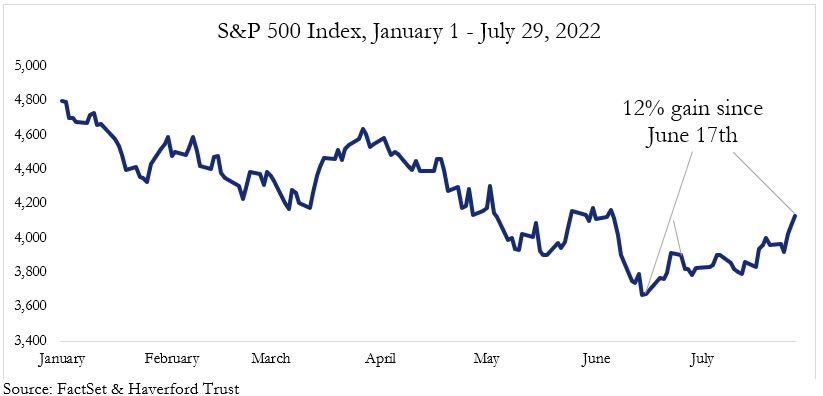

July was the best month of the year so far with the S&P 500 increasing by 9% and the Nasdaq 100 increasing by 12%. This may come as little solace to investors enduring this bear market. Even after July’s gains, the S&P 500 is down 13% year-to-date while the Nasdaq is still off 20%. What last month’s rally highlights is a change in investor sentiment.

Earnings, cash flows, and dividends are long-term drivers of performance. Near-term performance is more often attributable to changes in investors’ attitudes and opinions. There has recently been a marked change in investors’ expectation of a “Fed Pivot.”

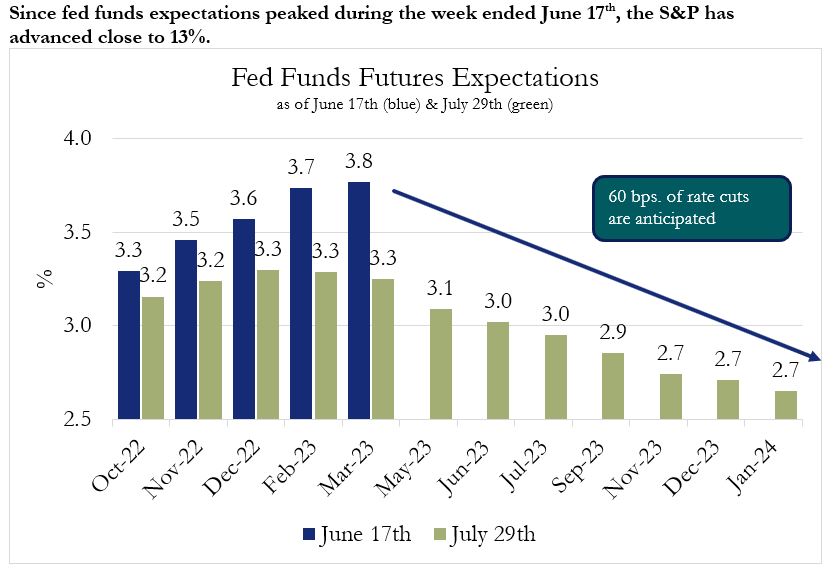

The term “Fed Pivot” encompasses a broad range of opinions that boil down to a belief that the federal funds rate will peak at approximately 3.25% – only 75 basis points above today’s levels – and the Federal Open Market Committee will end up cutting short-term rates by close to 60 basis points during the second half of 2023. Reasons for a Fed Pivot could be cooling inflation, a slower economy, or both. Certainly, lower inflation readings trump recession on the list of reasons why rates will eventually come down. But at this point the market is much more focused on the fact of falling rate expectations, rather than on why they are falling.

All things being equal, which they never are, we believe that the persistence of this market rally will be predicated upon falling inflation numbers that both justify and codify investors’ already reduced rate expectations.

Predicting what the immediate future holds is always difficult, and this is one of the most challenging environments in a long time. It feels like there are far more questions than answers. Not only are there conflicting data points to describe current economic activity, but this economy has been through so much, from lockdowns to unprecedented stimulus, that any economic model will be hard pressed to prove accurate.

On a recent podcast[1] , the co-CEO of Canyon Partners made a statement that resonated with me. To paraphrase, he said “don’t try to predict, but do be prepared.” We write these updates not to predict what will happen, rather to help us prepare for possible outcomes. It is in the preparation of possible outcomes, that we increase our chances of building portfolio success in plans to meet our long-term goals.

[1] Master Class in Credit Investing at Canyon – Capital Allocators with Ted Seides