Even the most stoic investors might have suffered heartburn yesterday. On Monday, August 5th the Dow Jones Industrial Average declined more than 1000 points (-2.6%), while the S&P 500 and NASDAQ fell by 3.0% and 3.4%, respectively. The decline in U.S. markets pales in comparison to the 13% decline in Japan’s Nikkei 225, which started a domino effect of selling across global markets. Investors in Japan have been caught off-sides following a recent hike in Japanese interest rates that led to massive reversal currency markets as the Yen strengthened. The single-day correction in the Nikkei gave U.S. traders who were already spooked by recession fears another reason to consider selling stocks.

The U.S. jobs report on Friday showed that the economy added only 114,000 jobs versus the forecasted 175,000, while the unemployment rate rose to 4.3% and triggered the “Sahm Rule[1].” This weaker than expected jobs report is just one data point and while it fits with the pattern of a weakening economy, it does not signal an imminent recession. Economic data is not precise and oftentimes is just plain messy. Monday’s ISM Report on Business, which measures the health of services businesses, came in above expectations providing evidence that a recession is not a foregone conclusion. While the markets are apt to overreact to a single data point, the Fed is not. Federal Reserve Chair Powell recently stated, “We will be data dependent but not data-point dependent, so it will not be a question of responding specifically to one or two data releases.”

Fed-bashing has become the favored past-time of many market commentators, but we are hesitant to throw stones. While it may have been nice if the Fed cut rates last week, we don’t believe a 25-basis point cut at the end of July versus a 50-basis point cut in September would have drastically changed the trajectory of the economy if it truly is headed towards a recession. We continue to believe the jobs market is strong enough to keep the economy growing and the recent commentary from corporate America is more consistent with a slow-growing economy, not a recession.

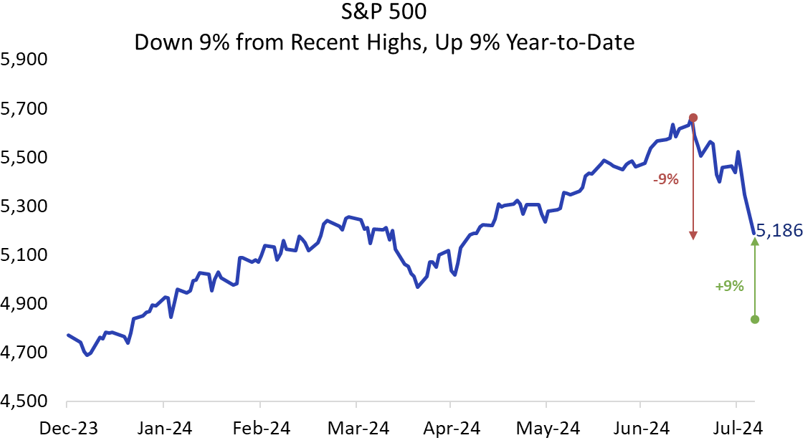

Source: The Haverford Trust Company

As of Monday’s close, the S&P 500 is down 9% from recent highs, but still up 9% for the year. August and September are historically weak months for market returns. Layering geopolitical and political risks onto economic uncertainties will probably lead to more volatile days, both up and down. That means the S&P 500 could fall into correction territory, which last occurred in October 2023 and is almost always an annual occurrence. However, after a brief period of weakness and volatility, we anticipate better days ahead as fundamentals and earnings growth drive intrinsic value.

Haverford’s Quality Investing approach is designed to weather market uncertainty with less volatility. We have seen volatile markets before and believe our portfolios are well suited to navigate such conditions. If you have any questions, please reach out to your Haverford team.

[1] The Sahm Rule, which has historically been a reliable recession predictor was triggered by a 50 bps increase in the trailing 3-month unemployment rate.