Dividend Payers Have Delivered During a Volatile 2022

By: Tim Hoyle, CFA, Chief Investment Officer

Markets continue their volatile path towards the New Year. If you feel like markets (not just equities, but fixed income and currency markets as well) have become increasingly volatile, you are correct. A recent publication from AQR Capital Management highlights the increase in volatility in 2022 across multiple sets of markets. According to their research, the number of volatile days, where the market moves vary by more than 1.5 x the norm, has nearly doubled relative to market history going back to 1980. They also find that volatility follows volatility, or said another way, significant volatility tends to persist.[1]

As investors, we cheer volatility on the upside, but dread it on the downside. Thankfully, recent market moves have been in the investors’ favor. Since we published our top ten reasons to be optimistic on October 5th, the S&P 500 has advanced over 7% and the Bloomberg Aggregate bond index is up 4%, while the trade weighted Dollar is down close to 6%. We hope November’s rally reaches all the way through Santa’s adventures and into the New Year, but portfolios can’t be built on hope. We must always keep the downside in mind: protect on the downside and the upside will take care of itself.

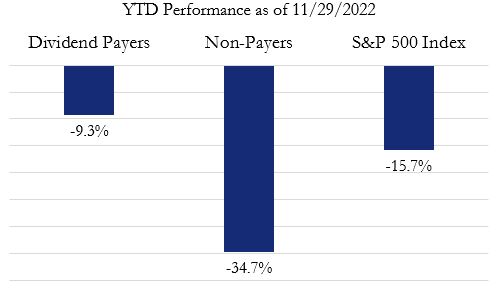

Our Quality Investing philosophy was developed to achieve three goals: Preserve Capital, Reduce Risk, and Grow. It is not a coincidence that two of the three goals are written with the downside in mind. One of our primary tools to help us accomplish this mission is our focus on dividend paying companies. We expect dividend payers to shine during times of economic stress and market volatility. So far in 2022, dividend payers within the S&P 500 index have far outpaced their non-dividend paying counterparts. Wolf Research recently published a note stating that investors should consider buying up dividend ‘aristocrats’ to brace portfolios for potential volatility in 2023.

“Dividend aristocrats have a long track record of raising dividends. What’s more, these stocks typically outpace the broader market heading into and out of a recession, according to Wolfe Research.”[2]

When the economy is in late deceleration, as it is now, dividend aristocrats typically outperform the S&P 500. During periods of retrenchment, that outperformance has historically done even better. Haverford’s focus on Quality Dividend payers as the cornerstone of any portfolio gives us confidence that no matter what 2023 brings, Haverford is well positioned to deliver on our goals. Our commitment to investing in dividend paying companies may have attracted you to Haverford Trust and we appreciate your continued confidence as we follow our own guidance and philosophy with your best interests in mind.