The FOMC Plays Grinch

By: Tim Hoyle, CFA, Chief Investment Officer

It appears that the Grinch stole the much hoped for Santa Claus rally in the wake of the Federal Open Market Committee (FOMC) meeting last week. Historically, the months of November and December bring strong equity returns, with the weeks around Christmas being notably strong enough to earn the metaphor of being gifts from Santa. However, the Fed’s continued hawkish tone seems to have crushed the market’s holiday spirit.

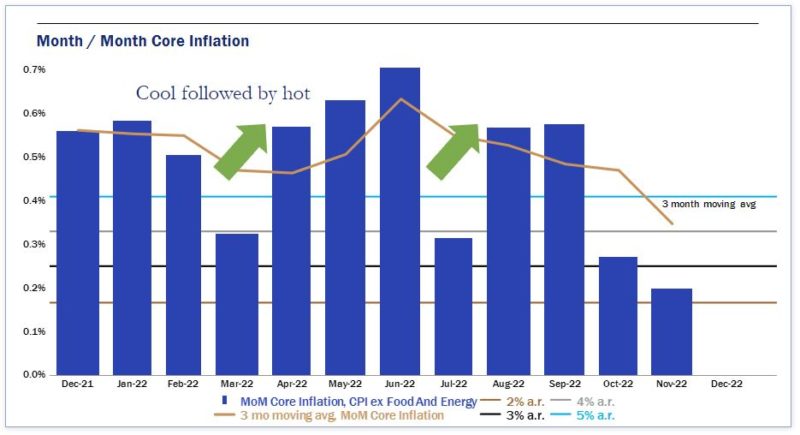

Following last Tuesday’s benign inflation reading, the markets were hoping Jerome Powell and company would sound a more conciliatory note. Instead, the FOMC raised their 2023 inflation expectations and continued to express a “higher for longer” message in reference to the Federal Funds Rate. Most FOMC members expect short term rates to go to 5% and stay there through the entirety of 2023.

At Haverford, we anticipate a similar path for 2023. It has paid to take the Fed at their word, and we don’t see a reason to stop doing so now. On the other hand, the futures market continues to forecast close to 75 basis points (i.e., three quarters of one percent) of rate cuts in 2023 and market participants remain highly focused on “how high” while not fully considering “for how long” rates will remain at or above current levels. However, we also know that the Fed is not always the best forecaster, even of their own decisions.

The Fed will ultimately respond to the data, although which data, and how much, is the ultimate question. While almost every measure of inflation over the past two months has shown moderation, the economy continues to grow and wage growth is showing no signs of abating. If forward inflation readings remain consistent with these last two months, we see no reason rates would have to exceed 5%.

Source: FactSet

We also don’t expect the Fed to loosen monetary policy until they see a meaningful deceleration in the overall economy and wages. After incorrectly describing inflation as “transitory,” we expect the Fed to need a lot of evidence before shifting policy stance.

As we look forward to 2023, our Outlook can be summed up in several broad themes:

- Powell won’t be fooled twice. As stated above, the FOMC is going to require substantial evidence before changing course.

- From inflation-scare to growth-scare. Inflation appears to have peaked, and that’s very good. But markets and investors may shift their worrying from rising prices to falling profits. So far, earnings have remained resilient, but there is a possibility that corporate earnings fall in 2023.

- The most predicted recession may be a benign recession. It is safe to say that “everyone” expects a recession in 2023, but as our own Maxine Cuffe pointed out last week, there are reasons to believe that a recession may be short and shallow.

- Product, Profit, Pricing Power. Companies with real profits, real products, and pricing power did relatively well in 2022. We expect this trend to continue in the New Year.

We look forward to expanding on these themes as we meet with clients in the coming year.

On behalf of Haverford Trust, I would like to wish everyone a Happy Chanukkah, Merry Christmas, and a prosperous New Year. I also want to thank all my colleagues, and especially my team, who have worked so hard in 2022 to ensure that we are able to deliver the insights and guidance that our clients have earned. We look forward to working with you all in 2023 and beyond.