Tim Hoyle, Chief Investment Officer

Thoyle@haverfordquality.com

Entering 2026 with Economic Momentum

We are seeing some “just right” Goldilocks data as we approach the end of 2025; however, as is often the case, this welcome news is accompanied by a few caveats. Current consensus estimates call for GDP growth of 1.9% in 2026, well below the long-term average of around 3.15%. But recent data suggests the economy may be gaining firmer footing as Q3 2025 GDP growth accelerated to a 4.3% annualized rate as the headline inflation rate cooled to 2.7%. Net exports rose significantly while imports fell. The Consumer Price Index data was noisier than usual as the month-long government shutdown forced the Bureau of Labor Statistics to report a two-month price change from September to November. The jobs market remained tepid, adding just 64,000 jobs in November and the unemployment rate rose to 4.6%, the highest since 2021.

Economic momentum can be added to the list of reasons for optimism in 2026. Tariff wars are receding further into the past while the effects of 2025’s One Big Beautiful Bill Act tax reforms begin taking effect. Corporate provisions in the OBBBA are expected to add to earnings while boosting domestic capital expenditures. Reduced taxes on tips and overtime should be felt in 2026 with larger than average tax refunds expected for many working families, seniors, and certain middle and upper-middle-income households.

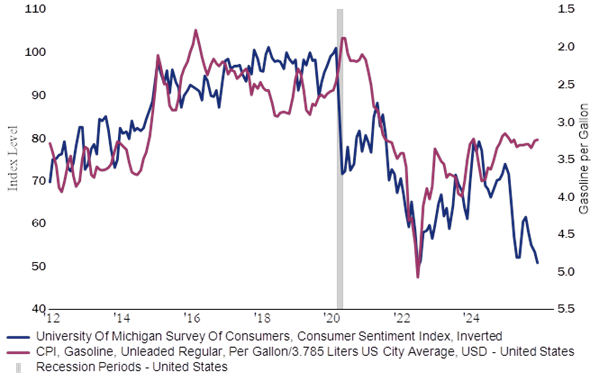

Despite this healthier macro mix, consumers remain wary. The slowing job market, especially for new college graduates, is weighing on already pessimistic sentiment and affordability concerns. The University of Michigan’s Consumer Sentiment index ticked up slightly in December but still sits nearly 30% below last year. Gasoline prices, once the most important data point for sentiment, have fallen to their lowest level in four years but have failed to put a dent in the affordability narrative.

The 2026 midterm elections will likely center on the affordability issue. In a recent interview with Politico, President Trump said, “It’ll be about pricing.” Typically, midterms bring greater market volatility. We believe this year will be no different.

Our base case for 2026 is that the economy will likely outperform current expectations without meaningful improvement in consumer sentiment. AI and data center capital spending will continue, but stand to become politically charged, adding to the politics-induced volatility. Overall, strong earnings growth should support the equity market, but a correction is highly likely before the midterms, which presents a buying opportunity for investors. As always, we will adjust positioning as the year evolves and remain focused on balancing opportunity with prudent risk management.

Before we turn the page on 2025, we want to extend our sincere gratitude to all our clients for their continued trust and partnership. We wish you all a bright and prosperous 2026 filled with growth, success, and happiness.

MC Dec. 30

12/29/2025 - The relationship between gasoline prices (inverted) and consumer sentiment has broken down in recent years.

Media Inquiries

Veronica McKee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value