By: Maxine Cuffe, CFA, Vice President & Director of Global Strategies

Periods of economic slowdown are a regular part of the business cycle. There are several reasons why this recession might be more “garden-variety” than the “Great Recession” of 2008, which is the only recession that many people reading this are old enough to remember. Recessions do not have to mean economic catastrophe.

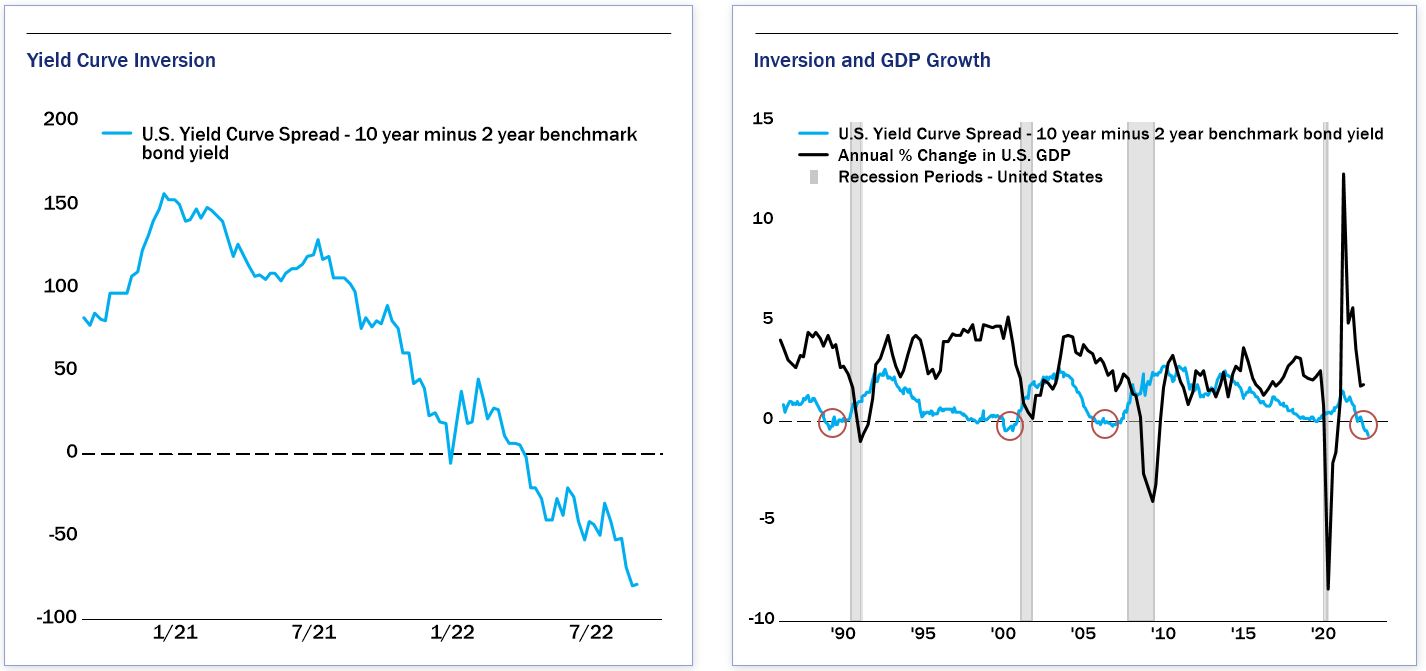

The bond market is sending a clear message to investors that a recession is coming. The yield curve, the difference between short- and long-term interest rates, is deeply negative. An inverted yield curve doesn’t always predict a recession, but it has a pretty good track record. Every recession in the past 60 years has been preceded by an inverted curve. The current spread of negative 80 bps is the largest inversion in decades. The last time the curve was this inverted, Paul Volcker was ramping up rates to fight 1970’s inflation. Naturally, investors are questioning what this means for the economy this time around.

As mentioned in this Wall Street Journal article[1], there’s still the possibility that the Federal Reserve can orchestrate an elusive “soft landing” although Haverford believes a potentially mild recession is likely in 2023. Over the past 12 months, the market has experienced one of the fastest tightening cycles in history, as the Fed does “whatever it takes” to calm inflation. It is highly probable that higher rates will slow the economy and most probably cause GDP to contract at some point in the next 6-12 months.

Unofficially, a recession is when GDP growth turns negative for two consecutive quarters; it’s very possible this happens and yet is too subtle for most consumers to notice. For most, a recession starts to bite when people are losing their jobs. Job insecurity is what makes consumers lose confidence and start to rein in their spending. The job market is what ultimately will determine the depth and duration of a recession in 2023.

In recent weeks, some of the world’s largest employers have announced layoffs and hiring freezes. Yet despite the doom and gloom headlines, most businesses are still complaining about not being able to find workers. The unemployment rate of 3.7% is near record lows – an unprecedented level for the beginning of a recession. There is a chronic shortage of labor, driven by changing demographics and immigration patterns, that is unlikely to resolve any time soon. Businesses have struggled to find and retain workers over the past two years. Surveys show that businesses are loath to let people go, knowing they will need workers once the economy starts to accelerate again.

Furthermore, we’re unlikely to experience a “balance sheet” recession, where debt-burdened consumers are forced to cut back because of a sharp rise in interest rates. Over the past decade, homeowners have had ample opportunity to lock-in mortgage rates at attractive levels. The percentage of income that homeowners are spending on mortgage interest has fallen to historical lows, while home equity levels hit all-time highs. Naturally, as mortgage rates spike, affordability becomes an issue and transactions are slumping. While it feels unavoidable that home prices will correct in the coming quarters after rising 40% during the pandemic, homeowners are in good shape. We’re unlikely to see the foreclosures and forced sellers of the 2008 era.

Another difference between today and 2008: the financial system. In the Great Recession, banks were at the epicenter. Today U.S. banks are adequately capitalized and subject to much tighter regulatory oversight. All this gives Haverford confidence that if we do have a recession in 2023, it is likely to be short and shallow.