Fall Market Outlook: What’s Driving the Markets?

By: Tim Hoyle, CFA, Chief Investment Officer

The stock and bond markets have been propelled along their current course by rapidly rising interest rates, inflation, and falling economic expectations. Below we address how we expect these important market drivers will develop in the coming months.

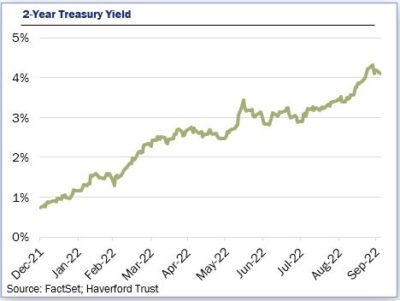

U.S. equity prices have been constrained by the 2-year treasury yield. As 2-year yields have risen, equity markets come under price pressure; and when yields fell, the equity markets rallied in relief. We believe we are closer to the end of the 2-year’s meteoric rise than we are to its beginning. This is not a very bold prediction when one realizes that the yield was only 0.26% a year ago and it hit a peak of 4.36% last week. While this significant headwind to equity prices is set to alleviate, we believe the yield on the 10-year will rise to near 4.5% in the future.

2-year yields have risen in lockstep with the Fed Funds target rate, which is the main weapon in the Federal Open Market committee’s (FOMC) arsenal against inflation. We anticipate that disinflationary forces will continue to bring down headline inflation, but core levels of inflation between 4.5 and 5.0% will persist for at least the next six months. We expect that the Fed wants to see the Fed Funds rate at or above core inflation before they will consider pausing.

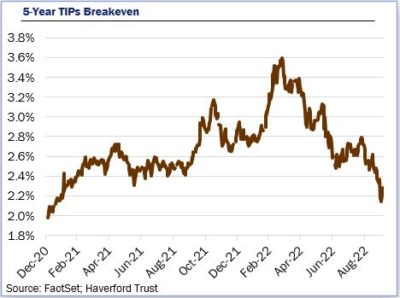

Expectations regarding future inflation have come down sharply. The 5-year Treasury Inflation Protected Securities (TIPS) breakeven has fallen from 3.6% in March to 2.25%, very near the average over the past five years. While we do think inflation will drop from its recent peaks, the TIPS’ expectation is likely too optimistic.

Jerome Powell has told the markets to anticipate that economic growth and job creation will be a casualty of the Fed’s war on inflation. Therefore, corporate earnings, which are a key driver of equity values are also at risk. A slowdown in economic activity, the dollars’ extraordinary rise, and higher costs will likely strain earnings in 2023. Corporate earnings excluding the energy sector were flat in 2022 compared to 2021. We anticipate another flat-to-down year in 2023. Based on these expectations, the market currently trades at 16-17x next year’s EPS, slightly above long-term average multiple.